The Budget’s macroeconomic view is not mindful of my recent paper on fiscal policy. That paper predicts that, with most COVID restrictions on consumer spending now lifted, the excessive fiscal stimulus introduced in 2020 and 2021 will lead in 2022-23 to an upsurge in consumer spending triggering an outbreak of inflation. Less expansionary fiscal and monetary policy are needed now to limit this outbreak.

Contrary to this, the Budget forecast that inflation would be contained and it even added more fiscal stimulus. The Reserve Bank is similarly optimistic on inflation and is yet to raise the cash rate from the basement level of 0.1 per cent.

Pre-Budget, my paper forecast consumer price inflation of 5.75 per cent to the June quarter 2023, compared to the Budget forecast of 3.0 per cent and the most recent Reserve Bank forecast of 2.75 per cent. I can’t recall such a striking difference in forecasts between the government and me in over thirty years of forecasting. In due course, it will become clear which inflation forecast is closer to the mark.

In the meantime, here I explain my analysis of fiscal policy and inflation and show that the government’s more optimistic inflation forecasts rely on two unrealistic assumptions.

The COVID recession and compensation

In March 2020, COVID-19 reached Australia, causing ill-health. The government introduced restrictions to limit the spread of COVID-19 to and within Australia. Besides these mandatory restrictions, individuals also voluntarily restricted their activities. The three developments together had economic effects, referred to here as the COVID effects.

Australian Bureau of Statistics (ABS) data shows that COVID had highly uneven effects on employment across industries. The largest percentage falls were in the accommodation & food services and the arts & recreation, while employment prospered in financial & insurance services and public administration & safety.

The income losses in the restricted industries could have led the affected households to reduce their consumption, causing the weakness in economic activity to spread to the unrestricted industries. Further, it would have been inequitable to expect participants in the restricted industries to carry more than their share of the economic burden in slowing the spread of COVID. So, in the interests of macroeconomic stability and equity, it was good policy to compensate participants in the restricted industries for their COVID income losses.

The COVID fiscal stimulus of 2020 and 2021

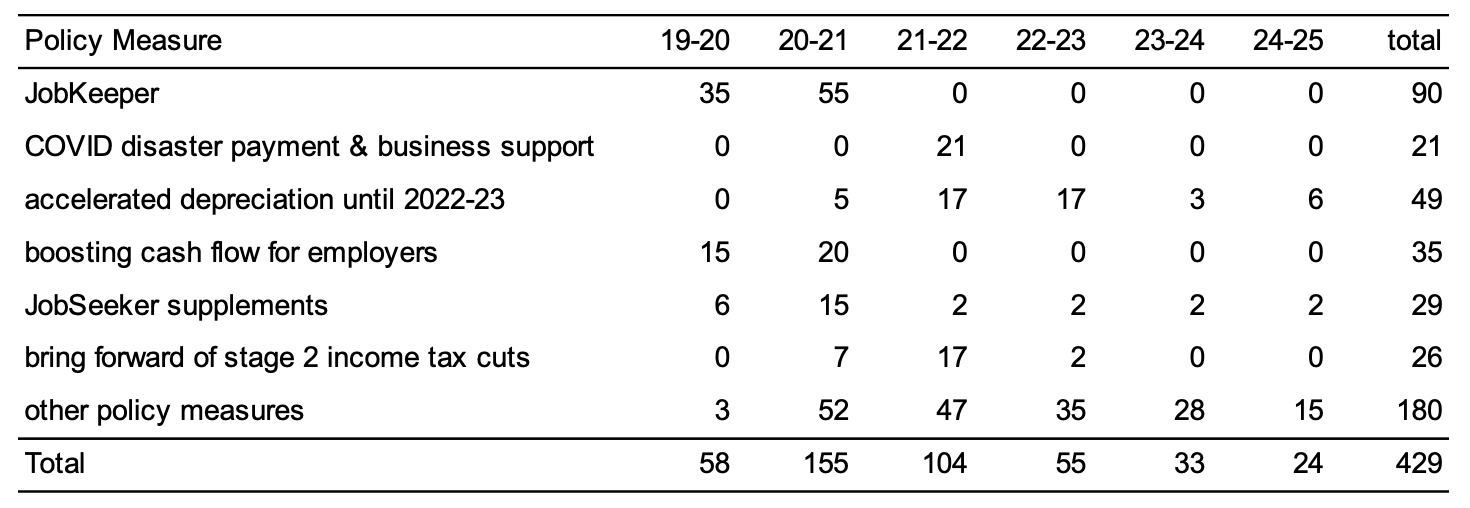

The COVID-era fiscal policy measures announced in 2020 and 2021 did more than compensate for these income losses, they over-compensated. These measures had a massive total budget cost of $429 billion, as seen in Table 1. This is the equivalent of 20.8 per cent of last year’s GDP. Of this total amount, the 2021-22 MYEFO identifies $337 billion as being specifically related to COVID, there being $92 billion in non-COVID measures.

Table 1. Budget Cost of COVID-era Fiscal Policy Measures ($ billion)

Sources: Australian Government (2020, 2021a, 2021b).

JobKeeper

The largest COVID measure, JobKeeper, provided payments per employee to businesses who experienced, or expected to experience, a loss of turnover of at least a specified minimum percentage. These payments were made with respect to stood down employees as compensation for lost wages, and with respect to active employees as compensation to business owners for lost profits.

As the name suggests, the first objective of the JobKeeper program was to keep workers in an unbroken relationship with the businesses who employ them, and Treasury (2020) provides evidence of success in that area. Compensating for COVID income losses was the third objective and my paper shows that this compensation was highly uneven.

There were three different forms of over-compensation. First, originally most part-time workers were over-compensated. Second, JobKeeper payments to businesses often continued for about three months after their operations had recovered. Third, businesses operating just under the JobKeeper turnover eligibility ceiling were often more profitable than under normal operations.

Besides the clear inequities, this over-compensation had disincentive effects. But the main point for present purposes is that JobKeeper, in combination with the other policy measures in Table 1, led to over-compensation in aggregate, with macroeconomic consequences.

Modelling scenarios

To analyse the fiscal policy response to COVID, my paper modelled three scenarios. Relative to the comparable models used at the Treasury and the Reserve Bank, the model used here is better suited to this task because it contains more industry detail to capture how COVID impacted unevenly across the economy and it possesses more fiscal detail to differentiate the economic effects of the fiscal policy measures in Table 1.

The modelling shows that, with no fiscal response (other than the usual automatic stabilisers), the private sector would have lost $119 billion in real income (at 2019-20 prices) to the COVID economic effects in 2020 and 2021. However, the actual fiscal response provided, directly and indirectly, $265 billion in compensation. That is, the fiscal response conferred the private sector with over $2 in compensation for every $1 of income lost to the COVID economic effects. Comparing the three scenarios below will show, not surprisingly, that properly calibrating the level of fiscal compensation to the potential income loss during COVID would have led to greater macroeconomic stability post-COVID.

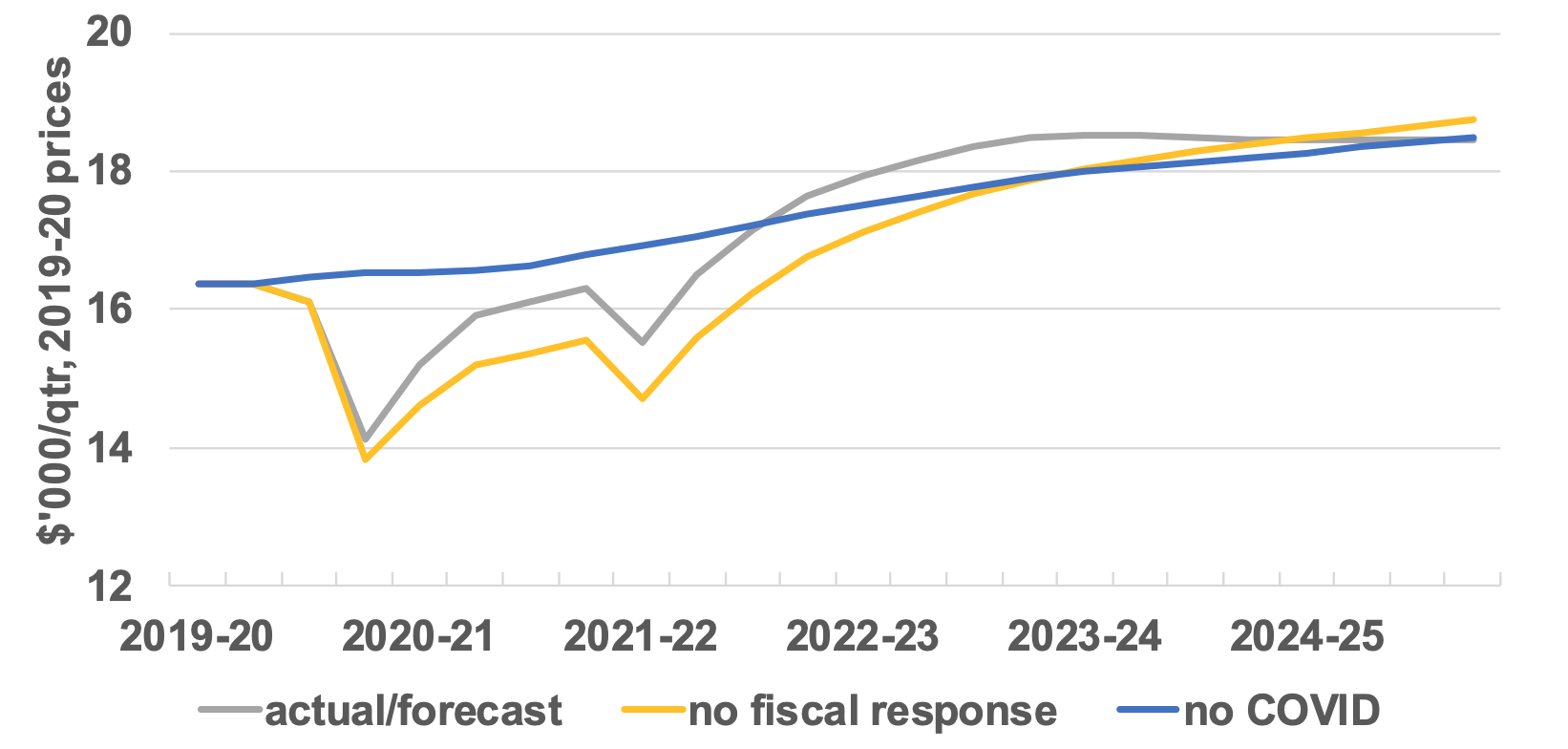

COVID suppressed some areas of household consumption (Figure 1). With no fiscal response, consumption would have been 9 per cent lower in 2020-21 (yellow line) than with no COVID (blue line). The actual fiscal response limited the loss in consumption in 2020-21 to 5 per cent, but the lifting of restrictions results in consumption surging to be 3 per cent higher in 2022-23 (grey line) than with no COVID. This surge is unsustainable.

Figure 1. Real household consumption per head of population aged 15-64

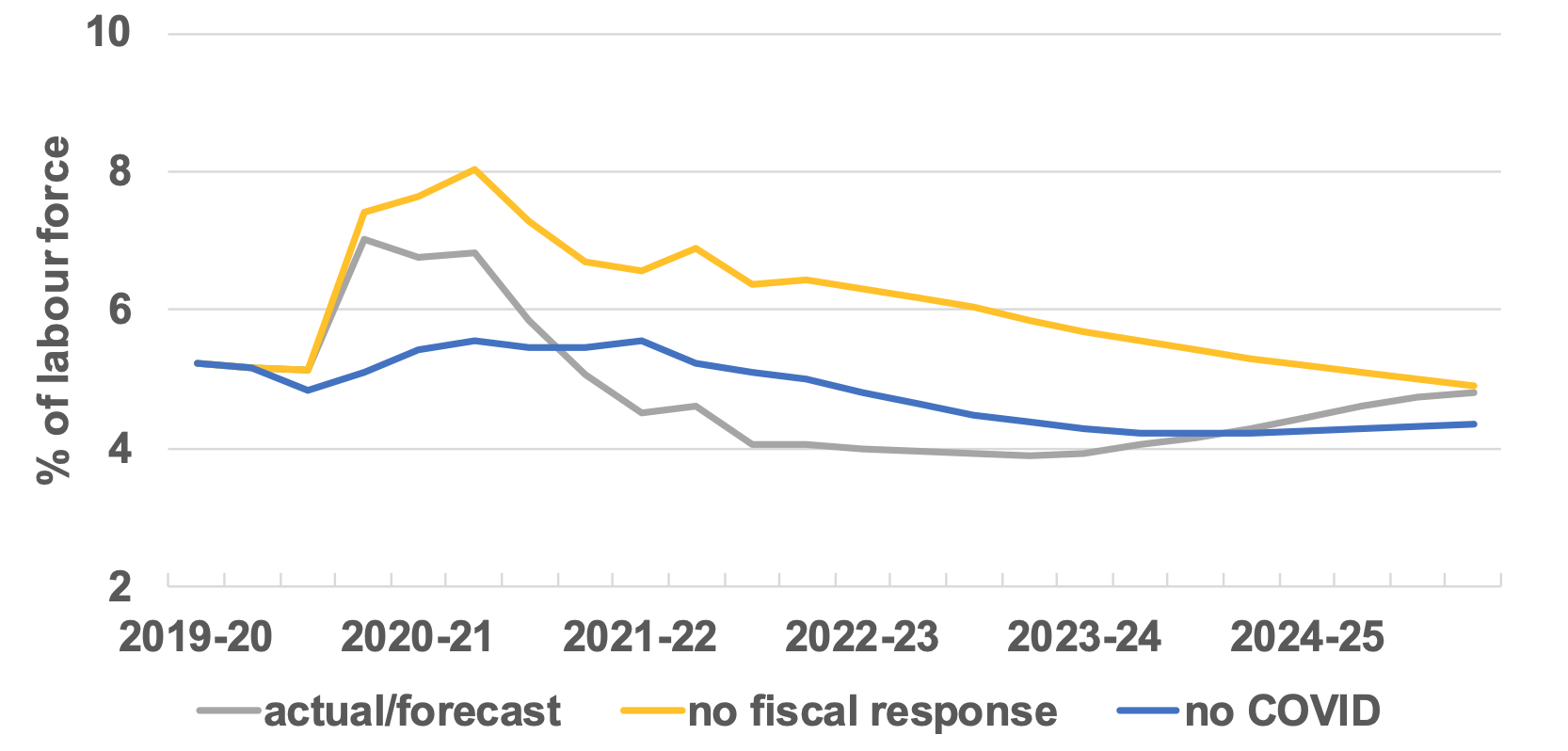

These COVID effects on consumption are the main driver of the COVID effects on unemployment (Figure 2). With no COVID, unemployment would have stabilised near 4.3 per cent from 2022-23 onwards (blue line). Under COVID, with no fiscal response, unemployment would have reached a peak of 8 per cent (yellow line), and then would have only gradually subsided. The actual fiscal response limited the rise in unemployment, but unemployment is unsustainably low at 4 per cent through 2022 and 2023 (grey line).

Figure 2. Unemployment rate

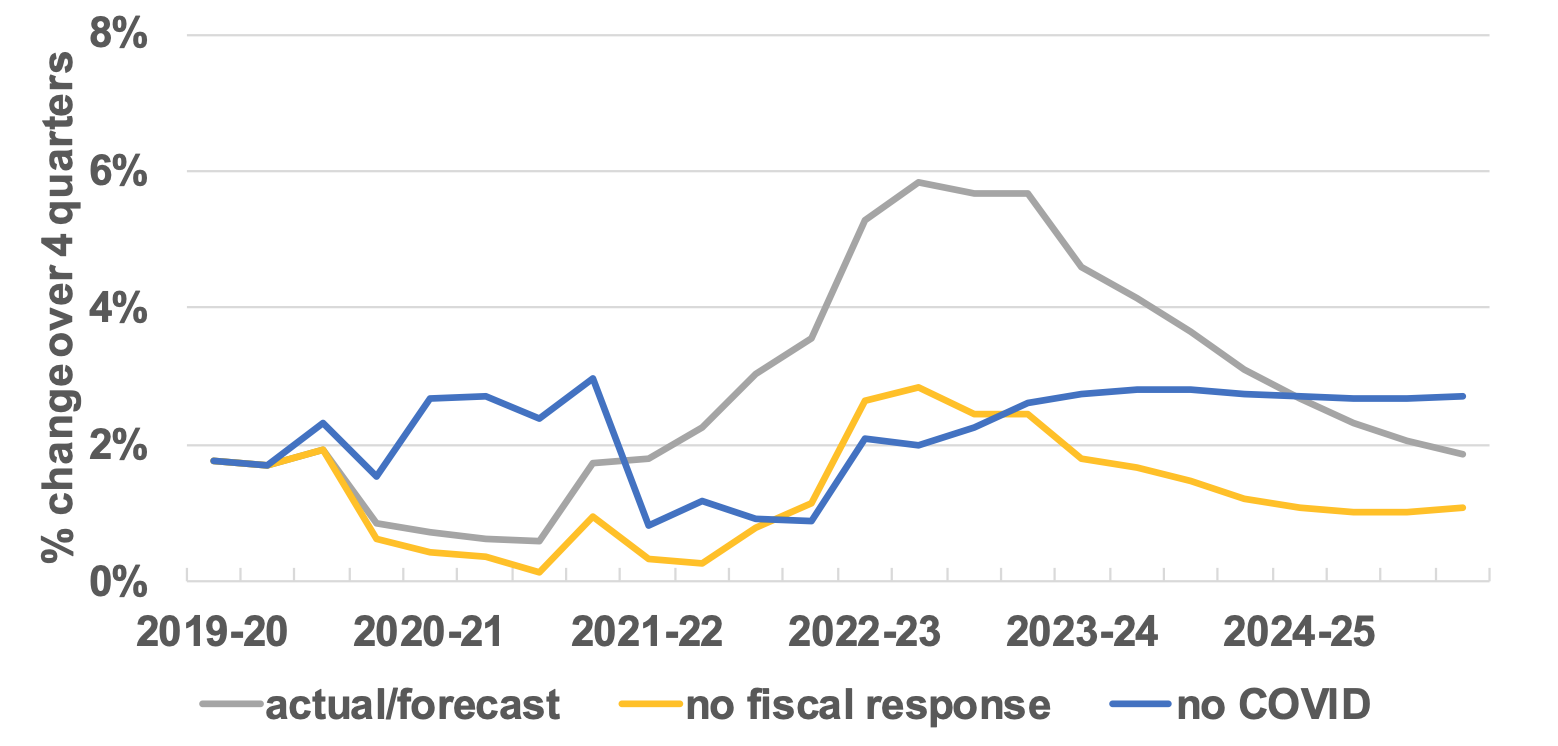

These developments in consumer demand and unemployment drive the COVID effects on inflation (Figure 3). With no COVID, inflation would have been close to 2.7 per cent from 2022-23 (blue line), achieving the Reserve Bank’s 2 to 3 per cent target. Under COVID, with no fiscal response, weak consumer demand and high unemployment would have pushed inflation well below this target, with inflation still as low as 1 per cent in 2024-25 (yellow line). However, the actual fiscal response led to unsustainably high consumer demand and, to a lesser extent, unsustainably low unemployment, and is forecast to drive inflation up to near 6 per cent in the year to the June quarter 2023 (Figure 3, grey line), as noted at the outset.

Figure 3. Consumer price inflation

If we also modelled a fourth scenario in which there was full compensation instead of the over-compensation that actually occurred, it would generate outcomes approximately midway between the yellow and grey lines in the three figures. This implies greater macroeconomic stability, although not quite to the extent seen in the no COVID scenario.

The extra dose of stimulus in the Budget

Despite the inflation dangers now posed by over-compensation, the 2022-23 Budget added more fiscal stimulus. Measures announced since the 2021-22 MYEFO and up to and including the Budget have a net cost of $27 billion to 2024-25. While this is modest compared to the stimulus of $429 billion in the COVID era, it takes fiscal policy further in the wrong direction.

Comparing with the Budget forecasts

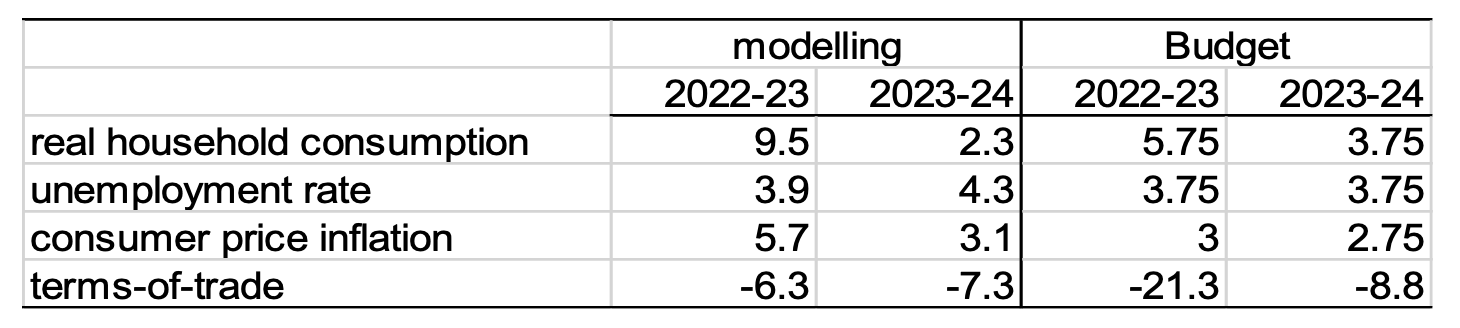

Table 2 compares the inflation forecasts and their main drivers between the Budget and the modelling here. In the Budget, the recovery in real household consumption is less pronounced and more drawn out. As a result, real consumption grows by 5.75 per cent rather than by 9.5 per cent in 2022-23. This less rapid growth in consumer demand results in the lower inflation forecast of 3.0 per cent compared to 5.7 per cent.

The less pronounced recovery in consumption is due to a highly pessimistic forecast for the terms-of-trade. “The terms of trade are projected to return to around their 2006-07 level from 2023-24 and remain around this level over the medium term” (Budget Paper No. 1, p. 66). The extreme nature of this forecast, with its very large fall in the terms-of-trade of 21.3 per cent in 2022-23 (Table 2), can be appreciated from Chart 2.23 (Budget Paper No. 1, p. 63). This large decline reduces real incomes. This in turn accounts for the less pronounced recovery in consumption, one of the two factors leading to the lower forecast of inflation.

Usually, a large fall in the terms-of-trade such as that forecast in the Budget would be accompanied by a large depreciation in the exchange rate. Instead, “the exchange rate is assumed to remain around its recent average level” (Budget Paper No. 1, p. 37). This odd assumption leads to a blow-out in the current account deficit to 6 per cent of GDP by 2023-24, the highest since 2007-08. If the Budget had more realistically allowed for a depreciation of the exchange rate in line with its highly pessimistic terms-of-trade forecast, higher import prices would have pushed up its forecast for consumer price inflation.

The more drawn out nature of the recovery in consumption in the Budget reflects an assumption that the household saving ratio does not complete its downward adjustment to a normal level until the June quarter 2024 (Budget Paper No. 1, Chart 2.9, p. 50). Yet government COVID restrictions that have led to forced household saving have largely been lifted and household holdings of financial assets are already well above normal levels, partly due to the over-compensation. The modelling in this paper more plausibly assumes that household consumption/saving behaviour has largely normalised by the beginning of 2023.

The Budget uses a lower estimate of the sustainable rate of unemployment (4.25 per cent versus 4.6 per cent) but its sensitivity analysis to this assumption shows (Budget Paper No. 1, Box 2.5) that this would only account for about 0.25 percentage points of the 2.7 percentage points difference in the inflation forecasts for 2022-23.

In summary, the much lower forecast for inflation in the Budget is based mainly on an implausible story in which there is a steep decline in the terms-of-trade yet a steady Australian dollar, while consumers continue to save at above normal rates for a further two years, despite being highly cashed up from government over-compensation during COVID.

Table 2. Modelling versus Budget forecasts

Macroeconomic policy ahead

The forecast here of high consumer price inflation of 5.7 per cent in 2022-23 assumed no further fiscal stimulus after 2021 and that the Reserve Bank began increasing interest rates at its April 2022 meeting. Instead, there has been more fiscal stimulus and the process of increasing interest rates was deferred again at the April meeting. To correct this, fiscal policy makers should now be looking for savings measures to reduce the fiscal stimulus and the Reserve Bank should commence raising interest rates without further delay. The longer this change in course is deferred, the more abrupt and severe the tightenings will have to be.

To reduce the risks of a similar situation developing in the future, the principle should be adopted that there should be compensation, but not over-compensation, for the income losses in any future pandemic. Government methods for forecasting inflation should also be independently reviewed, particularly focusing on whether the linkages from fiscal policy to the inflation outlook are adequately represented.

Other Budget Forum 2022 articles

Trusts and Tax Avoidance – Extension of Funding for ATO Taskforce, by Sonali Walpola.

Vehicle Taxing Dilemma Between Environment and Inequality, by Yogi Vidyattama, Robert Tanton and Hitomi Nakanishi.

Budget Reveals No Plan for Disaster Volunteering, by Jack McDermott.

A Fairer Tax and Welfare System for Australia, by Ben Phillips and Richard Webster.

Claiming Crypto Donations under Division 30, by Elizabeth Morton.

Natural Disasters and Government Policy Challenges, by John Freebairn.

Petrol Excise Cut in the Budget! What About the Transition to Zero-Emission Cars? by Diane Kraal.

For Social Infrastructure and Tax Reform, We Need a New Federal Fiscal Bargain, by Miranda Stewart.

A Free Lunch From Government Debt? It Certainly Looks That Way, by John Quiggin and Begoña Dominguez.

On the Limits of Fiscal Financing in Australia, by Chung Tran and Nabeeh Zakariyya.

Recent Comments