The fossil fuel excise has been cut by 50% in the Federal Budget, effective from 30 March 2022 and will continue for the next six months. This is a “cost of living” adjustment, according to the Treasurer. The budget presentation made no mention of the cost to the environment of ‘business as usual at the bowsers’, or Prime Minister Scott Morrison’s rush to the United Nations climate change conference in Glasgow in 2021 to endorse net zero emissions by 2050.

The cut was floated two days before the Federal Budget, with Treasurer Josh Frydenberg suggesting the government a reduction to the 44c per litre fuel excise to help motorists with the price of petrol, which is now more than $2.20 a litre. The measure was ‘confirmed’ the next day with media stating that ‘Prime Minister Scott Morrison and Treasurer Josh Frydenberg have agreed on a temporary cut in fuel excise’ before the Budget.

The Federal Budget on Tuesday 29 March confirmed the fuel excise cut, which the government states is the result of high petrol prices from disruptions caused by the Russian invasion of Ukraine. Treasurer Josh Frydenberg had followed the strategy of pre-emptively announcing the controversial budget item of a fossil fuel tax concession — to soften the impact of post-budget criticisms.

Transport emissions

Instead of temporary measures to lower operating costs of fossil-fuel cars that will only drive up CO2 emissions —— how about budgeting for tax expenditure that will drive down transport emissions? It seems the Federal Government has overlooked its undertaking on net zero targets by 2050. At the Glasgow conference, member governments, businesses and investors agreed to work towards 100% zero emission vehicles sales by 2040 (or earlier) – in order to meet the United Nations’ Paris Agreement. The Paris Agreement goal is to limit global warming to below 1.5 to 2 degrees Celsius, compared to pre-industrial levels. The UN has agreed to target transport as one of the sectors needing to reduce CO2 emissions.

The Budget’s fuel excise cut will drain $2.9 billion of revenue over six months for short term political gain. Yet, it missed the opportunity to achieve long term environmental gain by facilitating the transition to zero-emission cars.

My collaborative research offers short-term tax changes and long-term tax solutions to lower transport CO2 emissions by increasing the uptake by business of zero emission cars. The research targets the business segment because fleets account for almost half of light vehicles on the road in Australia. Tax changes are investigated to accelerate uptake by business fleets of zero emission cars in the form of battery electric vehicles in Australia. The tax changes preference battery electric vehicles over fossil-fuel vehicles, with minimal negative impact on revenue. The research addresses affordability and support for home-charging of business fleet vehicles at fleet employees’ place of residence, as a recent survey shows up to 47% of business passenger cars might be garaged at home overnight. Eventually the wider community benefits from business cars on the second-hand market.

Statistics

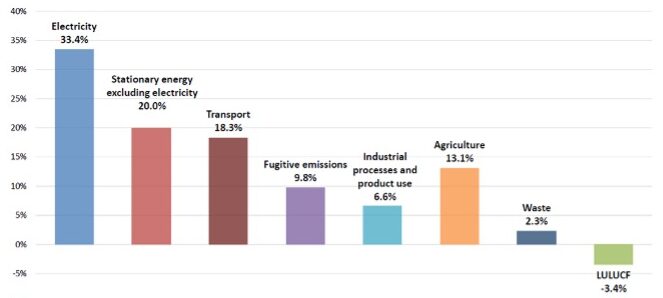

The statistics depicted in the graphs below indicate why we need the tax system to preference battery electric cars over fossil-fuel cars. Graph 1 shows the transport contributed to 18.3% or one-fifth of Australia’s carbon emissions. In 2021 around 20 million vehicles were registered in Australia, mostly passenger vehicles. Of these vehicles, about 40% are business cars, but the battery electric vehicle penetration in fleets is only 1.2%.

Graph 1. Australia: share of total emissions, by sector. Annual to June 2020

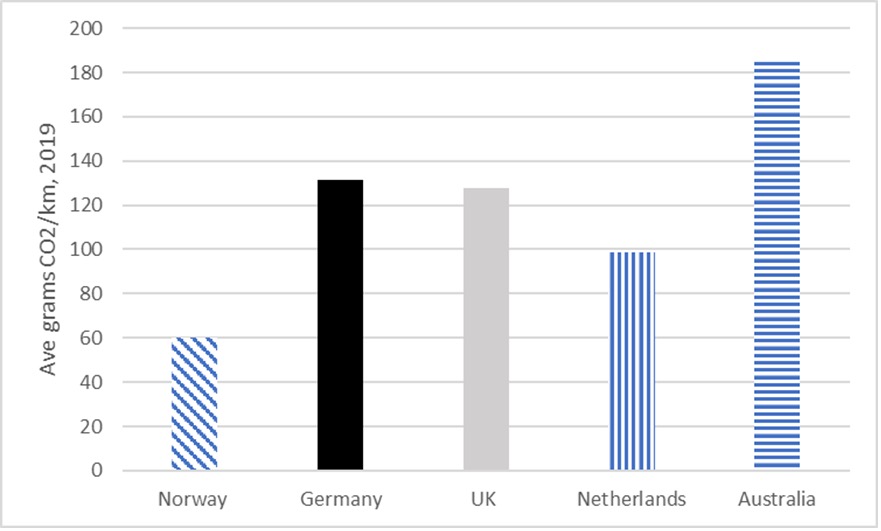

Graph 2 shows that in 2019 selected overseas countries reported emissions of less than 132 grams of CO2 per kilometre (gCO2/km) from passenger vehicles, in contrast to Australia generating a very high 181 gCO2/km from vehicles. The comparative overseas jurisdictions are limited to Norway, Germany, the UK and the Netherlands, given their success in lowering CO2 emissions from passenger vehicle transport.

Graph 2. Selected countries: Average passenger vehicle CO2 emissions, 2019

Source: Author

We need to switch tax support from fossil-fuel to zero-emission cars — to reduce CO2 emissions. The fiscal system needs to preference tax incentives for zero emission cars over fossil fuel cars to achieve the goal of net zero emissions by 2050, as endorsed by Prime Minister Scott Morrison in 2021.

Tax recommendations to replace the fuel excise cut

My collaborative research project recommends 17 tax changes. This includes short-term changes to Fringe Benefits Tax (FBT) to close the capital cost gap between a similarly specified but lower-priced fossil-fuel car — and a zero emissions car; and, short-term changes to current income tax provisions to promote home charging of zero-emission cars. These changes merely require ministerial sign-off and are not major legislative reforms.

The long-term FBT recommendations are based on FBT formula changes and added links to lower CO2 emission cars. In Europe, regulations prescribe new car performance standards to achieve low emissions and are linked to tax laws. This type of regulation is lacking in Australia. Last, long-term income tax recommendations concern subsidies and rebates drawn from successful policies in Europe.

These tax recommendations will reduce CO2 emissions generated by the light passenger vehicles, and should be on the election agenda. This type of forward-thinking policy is superior to the limited vision embodied in the Budget’s fossil-fuel excise cut.

Other Budget Forum 2022 articles

Trusts and Tax Avoidance – Extension of Funding for ATO Taskforce, by Sonali Walpola.

Vehicle Taxing Dilemma Between Environment and Inequality, by Yogi Vidyattama, Robert Tanton and Hitomi Nakanishi.

Budget Reveals No Plan for Disaster Volunteering, by Jack McDermott.

A Fairer Tax and Welfare System for Australia, by Ben Phillips and Richard Webster.

Claiming Crypto Donations under Division 30, by Elizabeth Morton.

The Budget, Fiscal Policy and an Outbreak of Inflation, by Chris Murphy.

Natural Disasters and Government Policy Challenges, by John Freebairn.

For Social Infrastructure and Tax Reform, We Need a New Federal Fiscal Bargain, by Miranda Stewart.

A Free Lunch From Government Debt? It Certainly Looks That Way, by John Quiggin and Begoña Dominguez.

On the Limits of Fiscal Financing in Australia, by Chung Tran and Nabeeh Zakariyya.

Recent Comments