Against the backdrop of the 2022-23 Federal Budget and the coming federal election, Saint Vincent De Paul Society released a research report which outlines some simple and relatively modest changes to the tax and welfare system in Australia that can remove up to a million Australians from poverty – cutting poverty by around 25 per cent.

The report focuses on changes within the existing framework of the Australian tax and welfare system that make welfare cash payments more generous by up to $20 billion per year. The reforms are paid for with a more equitable tax system including a more progressive superannuation tax system, smaller capital gains tax concession and replacing the stage 3 tax cuts with tax thresholds that have been indexed since 2018 with wage growth.

Policy proposals

The paper proposes three policy options – ‘Low’, ‘Modest’ and ‘High’. The welfare payment increases are set using our optimal policy modelling algorithm whereby payment increases are based on ensuring the largest possible reductions in poverty and financial stress for a given welfare budget.

The low option increases spending by around $4 billion per year from 2022-23 onwards by increasing rent assistance by 50 per cent and JobSeeker payments by $150 per fortnight. Funding is achieved through a reduction in capital gains tax concession from 50 percent to 37.5 per cent. Under this proposal, the JobSeeker payment for singles would increase from around $640 per fortnight to $790 per fortnight.

The ‘Modest’ option costs around $10 billion per year and increases all working age payments (single rates) by $200 per fortnight. These payments include JobSeeker, Disability Support, Parenting Payment Single and Carer Payment. There is also an increase to rent assistance of 50 per cent. The proposal is funded through the capital gains changes in ‘Low’ but also the stage 3 tax cuts are replaced with a wages indexed threshold system for personal income tax. Superannuation contributions and earnings would be taxed based on an individual’s top marginal tax rate minus 20 percentage points. Low and middle income earners would typically pay less superannuation tax while very high income earners (in the top tax bracket) would pay more tax compared to current policy.

The ‘High’ option costs around $20 billion per year and extends the ‘Modest’ option to increase JobSeeker payments by $436 per fortnight (to around $1074 for a single) and increases Family Tax Benefit Part A payments by 20 per cent. Superannuation taxation is as per ‘Modest’ but with a lower discount of 15 percentage points.

Poverty results

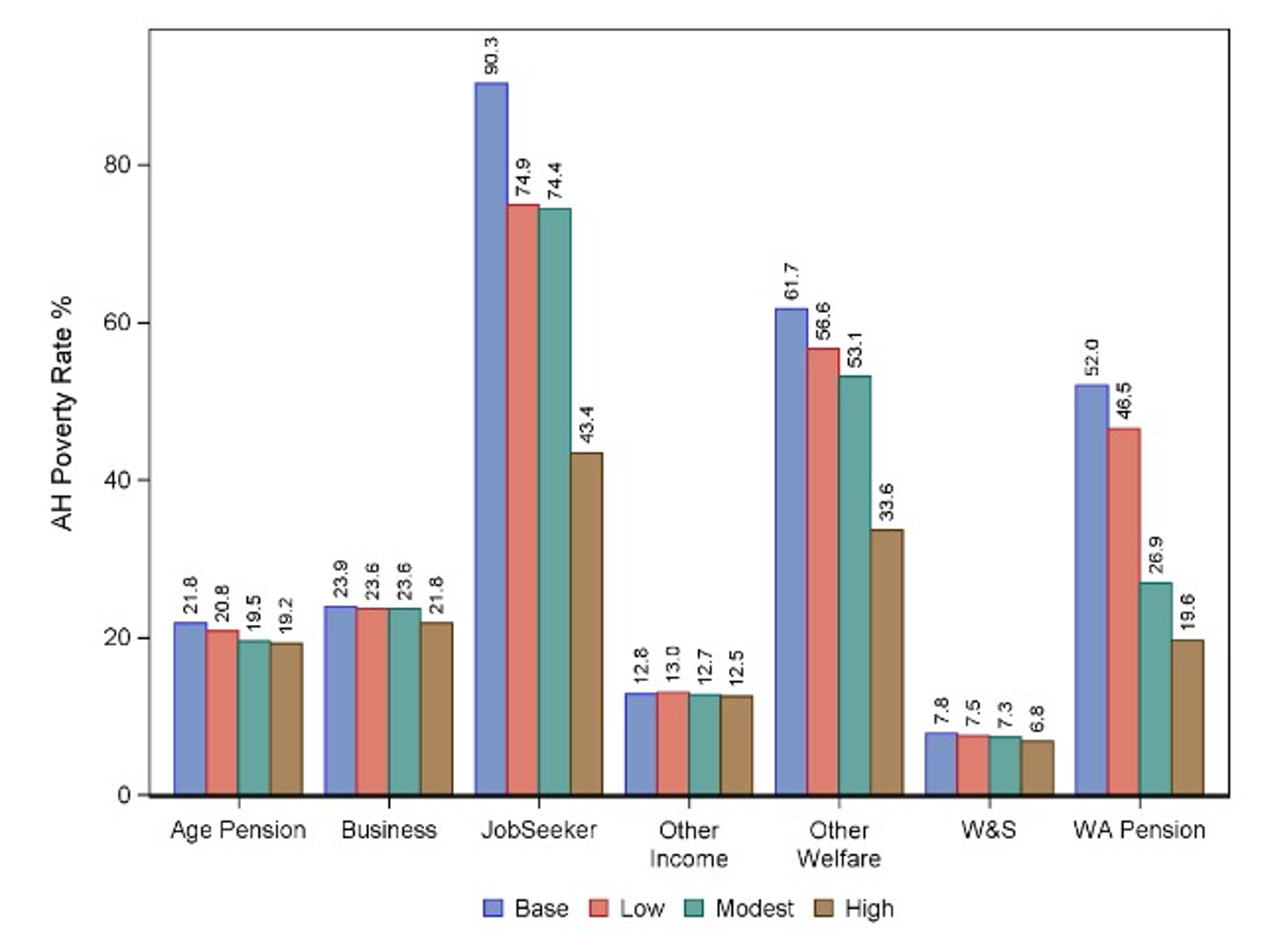

The proposed changes are fully funded over the forward estimates period (2022-23 to 2025-26) and make significant reductions in poverty. For Australia’s most at-risk groups of poverty and financial stress, the changes cut poverty by more than half. Figure 1 shows the estimated reductions in poverty by main source of income.

Figure 1 – After-Housing Poverty Rates by Household main source of income

Poverty rates for households who rely most heavily on the JobSeeker payments decline from around 90 per cent to 43 per cent. Working Age pensioner households (those reliant mostly on disability support, Carer and single parent pensions benefit from a reduction in poverty from 52 to 20 per cent. Single parent poverty rates decline from around 36 per cent to 18 per cent and lone persons from 23 to 14.5 per cent.

Gains and losses

The proposals generally stay within current policy frameworks, acknowledging that large scale reforms of the tax and welfare system are politically challenging even where the rationale for change may be strong. The ‘Mid’ and ‘High’ policies introduce a progressive tax system to superannuation in contrast to the current, mostly flat (15 per cent rate) system, that exists for both contributions and income.

The proposed changes of a 15 or 20 per cent discounted rate of tax for both income and contributions increases tax revenue and lowers the concessional treatment that exists in the current superannuation system. The modelling shows that in the short run the reduction in superannuation tax concessions is in the order of $4 and $12 billion for the ‘Modest’ and ‘High’ policies respectively. Current tax concessions (relative to an income tax benchmark) for superannuation are estimated by Treasury to be around $40 billion per year – closely matching the estimates in PolicyMod.

According to the 2020 Retirement Income Review, the current superannuation tax concessions flow heavily to the wealthiest households and do little or nothing for low income and low wealth households. Our modelling considers the expected retirement balance of every Australian aged 15 to 64 using income transition data from the longitudinal Census produced by the Australian Bureau of Statistics. The progressive taxation approach proposed in the research report estimates a benefit of up to 25 per cent in terms of larger balances for low wealth, younger women. The largest negative impacts would be on those persons who are on track to have very significant superannuation balances (well over $1 million in today’s dollars), who are in the top 10 per cent of the superannuation distribution.

The research report shows that a modest increase in welfare payments combined with equitable tax changes can improve the equity and utility of the existing welfare system with considerable reductions in poverty for those groups most at risk of poverty and financial stress. These improvements in the welfare system are paid for by those individuals with the greatest ability to wear a modest additional contribution.

Other Budget Forum 2022 articles

Trusts and Tax Avoidance – Extension of Funding for ATO Taskforce, by Sonali Walpola.

Vehicle Taxing Dilemma Between Environment and Inequality, by Yogi Vidyattama, Robert Tanton and Hitomi Nakanishi.

Budget Reveals No Plan for Disaster Volunteering, by Jack McDermott.

Claiming Crypto Donations under Division 30, by Elizabeth Morton.

The Budget, Fiscal Policy and an Outbreak of Inflation, by Chris Murphy.

Natural Disasters and Government Policy Challenges, by John Freebairn.

Petrol Excise Cut in the Budget! What About the Transition to Zero-Emission Cars? by Diane Kraal.

For Social Infrastructure and Tax Reform, We Need a New Federal Fiscal Bargain, by Miranda Stewart.

A Free Lunch From Government Debt? It Certainly Looks That Way, by John Quiggin and Begoña Dominguez.

On the Limits of Fiscal Financing in Australia, by Chung Tran and Nabeeh Zakariyya.

Recent Comments