In Part 1, we presented empirical results on the costs and benefits associated with reforming the GST on food. Part 2 of our reform discussion provides detailed information on the impact of broadening the tax base and increasing the GST rate from 10% to 15% on single food categories. Readers can use this information to ‘build their own tax reform’ by selecting the food categories that they think should be included in the tax base.

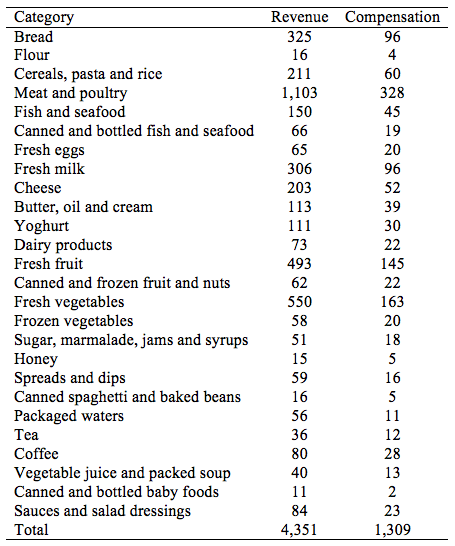

Table 1 below includes GST revenues and compensation payments that would result from compensating low-income households (the bottom 40% of the income distribution) for the loss in consumption as a result of broadening the tax base to include a particular food category but without increasing the tax rate. The numbers in Table 1 reveal that tax revenues would mainly come from broadening the tax base to meat and poultry ($1.1 billion), fresh vegetables ($550 million), fresh fruit ($493 million), bread ($325 million) and fresh milk ($306 million).

A number of other categories would raise tax revenues by about $100-$200 million, such as cereals, pasta and rice ($211 million), cheese ($203 million), fish and seafood ($150 million), butter, oil and cream ($113 million), yoghurt ($111 million). Each of the remaining 16 categories would raise less than $100 million but broadening the base to include them all would increase revenues by $788 million, indicating that it would be important to consider these categories when making a decision about broadening the tax base. Compensation payments to low-income households typically make up around 20% to 30% of tax revenues.

Table 1: The impact of broadening the base (without increasing the rate):

Additional GST revenue and compensation payments ($ million) by category

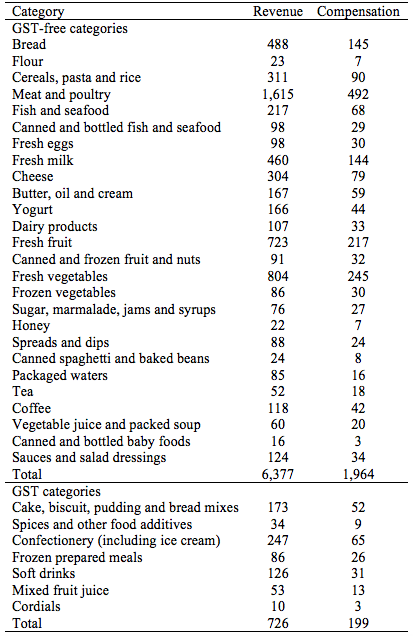

We also consider the implications of broadening the tax base to single food categories and increasing the rate of the GST to 15%. The results are presented in Table 2. We distinguish between food categories that already attract GST and categories that are currently GST-free. Taxing currently GST-free items at 15% would increase tax revenues considerably. Compared to broadening the base without increasing the rate (Table 1), a higher tax rate on currently GST-free categories would increase tax revenues by up to $2 billion ($6,377 million – $4,351 million=$2,026 million).

We find that increasing the rate of the GST only leads to a relatively small increase in tax revenues if we consider food categories that already attract GST ($726 million in total), the main contributors being confectionery and ice cream ($247 million), cake, biscuit, pudding and bread mixes ($173 million) and soft drinks ($126 million). Again, compensating low-income households typically requires around 20% to 30% of tax revenues.

Table 2: The impact of broadening the base and increasing the rate to 15%:

Additional GST revenue and compensation payments ($ million) by category

This part of our article leaves it to our readers to select the food categories that they think should be taxed. Part 1 includes a discussion of our preferred tax reform.

[This article is based on Hasan, S. and Sinning, M. (2017): GST Reform in Australia: Implications of Estimating Price Elasticities of Demand for Food, TTPI Working Paper No. 1/2017.]

Pingback: Reforming the GST on Food in Australia – Part 1: Costs and Benefits - Austaxpolicy: The Tax and Transfer Policy Blog