Australia experienced a strong increase in public debt levels after the 2008-09 Global Financial Crisis. Due to the limited scope for public spending cuts, it appears likely that government finances will remain unsustainable in the absence of major tax reforms. As a consequence, numerous options to increase tax revenue have become a matter of intense debate among economists, policy-makers and the public.

Perhaps the most controversial debate has been around a reform of the Goods and Services Tax (GST), currently a 10% value-added tax on a range of goods and services. Members of both major parties have made a case for increasing the rate of the GST to 15% and recent empirical work suggests that such an increase (without broadening the tax base) would increase tax revenues by about $29.4 billion. The same study finds that broadening the base (without changing the rate) to cover health, education and water/sewerage would yield $11.5 billion, while including currently exempted food categories would raise another $7.1 billion.

Despite the great potential of a GST reform to mitigate fiscal pressures, governments have been reluctant to make changes to the GST because of its regressive nature and negative public attitudes towards tax increases. In 2016, Prime Minister Malcolm Turnbull decided to abandon plans to reform the GST.

Our study examines the potential impact of changes in the GST on food. We still know relatively little about the potential consequences of such a reform. To understand how a GST reform would affect Australian consumers, we first need to know how they would respond to a change in food prices. Economists have a measure to quantify behavioural responses of consumers to price changes: the price elasticity of demand. The price elasticity of demand tells us by how much consumers reduce their consumption of a good if its price goes up.

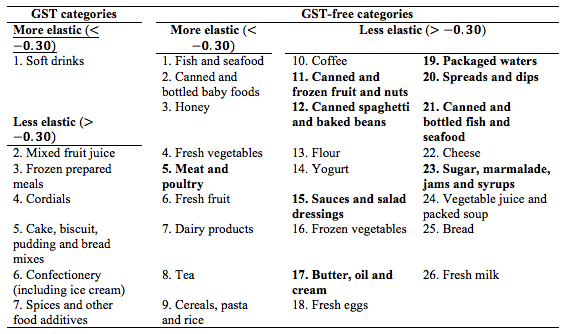

Estimating the price elasticity of demand for food requires data about how much food households consume and how much they pay for it. Fortunately, we are able to use data from the Nielson Homescan Survey, which includes detailed information about prices and quantities of millions of supermarket purchases. We compress that information and estimate price elasticities of demand for the most important food categories. Table 1 below includes a list of these categories. Some categories already attract GST but most of them are GST-free.

Table 1: Ranking of food categories by elasticity

Given the price elasticities of demand, we can rank the food categories from the most elastic to the most inelastic. Most elastic means that consumers respond a lot to price changes. Soft drinks, for example, are very elastic. They are already being taxed at 10%, which is good because they are unhealthy and we now know that taxing them will reduce their consumption because they are price-elastic.

Other food categories, such as confectionary (including ice cream) are very inelastic. They are also being taxed at 10% but that won’t affect overall consumption because people like confectionary (and ice cream) and won’t eat less regardless of how much they have to pay. But if consumers continue to buy certain (price-inelastic) food categories and we tax them, then tax revenues will be high because there are no behavioural changes.

What are the implications for tax reform?

The elasticity estimates allow us to calculate the tax revenues that would result from a reform of the GST on food. To illustrate the impact of a tax reform on tax revenues, we consider five different scenarios: (A) broadening the tax base to include selected food categories that we consider as unhealthy (such as sugar, jams and syrups) or environmentally unfriendly (such as meat and packaged water) – selected food categories are highlighted in bold in Table 1, (B) broadening the base to include all food categories, (C) increasing the GST rate from 10% to 15% without broadening the tax base, (D) increasing the rate to 15% and broadening the base to include selected food categories, and (E) increasing the rate to 15% and broadening the base to include all food categories.

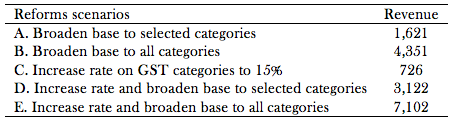

Table 2 includes the estimates of the GST revenues associated with the five reform scenarios. Our estimates indicate that broadening the base to selected food categories alone (Reform A) would raise tax revenues by about $1.6 billion, indicating that a GST reform that focuses on taxing unhealthy and environmentally unfriendly products would be beneficial from a fiscal policy perspective. Increasing the rate to 15% and expanding the base to selected food categories (Reform D) would increase revenues by about $3.1 billion. Broadening the base to all food categories and increasing the GST rate to 15% (Reform E) would increase tax revenues by about $7.1 billion.

Table 2: Estimate of additional GST revenues resulting from alternative reform scenarios (in $ million)

Overall, the numbers in Table 2 reveal that a reform of the GST on food could raise tax revenues considerably. Broadening the base alone (Reform B) would raise revenues by up to $4.4 billion, while increasing the GST rate without broadening the base (Reform C) would increase revenues by $726 million.

A potential problem of increasing the GST rate or broadening the tax base is that low-income households may no longer be able to afford to buy as much food as they used to buy before the reform. We address this issue by calculating the payments that would be required to compensate low-income households (the bottom 40% of the income distribution) for the loss in consumption associated with each reform scenario. The results are presented in Table 3.

Table 3: Compensation payments to low-income households

The numbers in Table 3 are the dollar amounts that would be needed to move low-income households back to their original welfare level before the reform. We find that it would cost $481 million to compensate low-income households for broadening the tax base to selected food categories (Reform A). This figure is considerably lower than the additional tax revenues of $1.6 billion resulting from Reform A (see Table 2).

Broadening the tax base to all categories (Reform B) would require a considerable amount ($1.3 billion) to compensate low-income households, about 30% of the additional tax revenues obtained from the reform. In contrast, only about 27% of the additional tax revenues would be needed to compensate low-income households if the GST rate would be increased to 15% without broadening the base (Reform C).

Expanding the base to selected food categories and increasing the GST rate to 15% (Reform D) appears to be a sensible policy, which would require about 30% of the additional tax revenue to compensate low-income households. Increasing the rate to 15% and broadening the base to all food categories (Reform E) would yield tax revenues of about $7.1 billion and require almost $2.2 billion to compensate low-income households (about 30% of the additional revenues).

On balance, these findings indicate that there is considerable scope to raise revenues by a reform of the GST on food. We prefer Reform D, which would broaden the tax base to unhealthy and environmentally unfriendly food categories, increase revenues by about $3.1 billion and cost $922 million to compensate low-income households. However, it appears unlikely that everyone shares our subjective opinion regarding the food categories that should be added to the tax base. We address this issue in Part 2: ‘Build your own tax reform’.

[This article is based on Hasan, S. and Sinning, M. (2017): GST Reform in Australia: Implications of Estimating Price Elasticities of Demand for Food, TTPI Working Paper No. 1/2017.]

Pingback: Reforming the GST on Food in Australia – Part 2: Build Your Own Tax Reform - Austaxpolicy: The Tax and Transfer Policy Blog