Among the tax changes proposed in the 2018-19 Federal Budget was a suite of measures to address the black economy. The measures arise out of the Black Economy Taskforce inquiry, which defined the black economy as referring to “people who operate entirely outside the tax and regulatory system, or who are known to the authorities but do not correctly report their tax obligations”. The numerous deleterious effects of the black economy include uncollected government revenue through tax evasion and fraud; and avoidance of other regulatory obligations such as work cover, superannuation and consumer regulations.

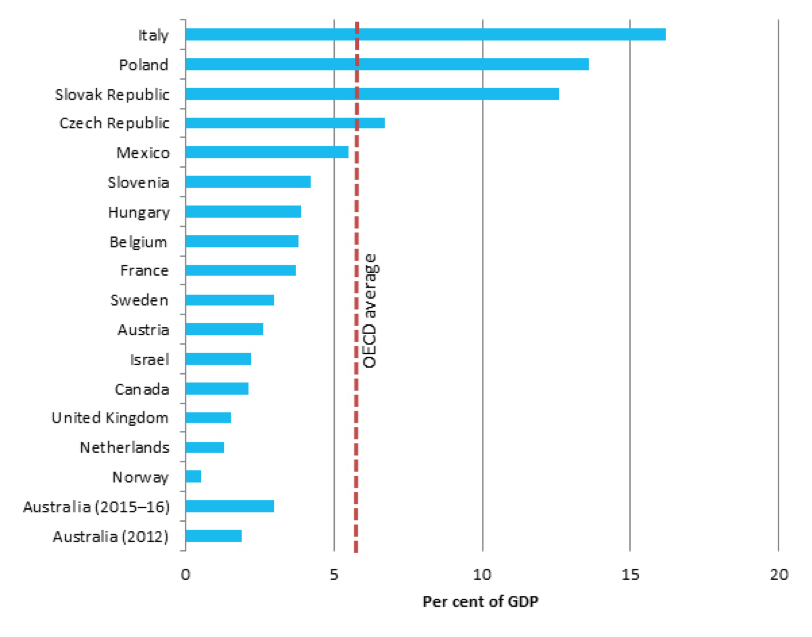

The black economy is difficult to quantify but it is estimated by the Taskforce to have grown by 50% between 2012 and 2017, to as much as 3% of Australia’s GDP, or $50 billion. Last year’s budget introduced several initial measures. This year, the budget proposed measures implementing some recommendations of the October 2017 Final Report of the Black Economy Taskforce.

Figure: Estimated Size of the Black Economy (Australia; OECD comparison)

Source: Black Economy Taskforce Final Report, Figure 2

The Black Economy Taskforce

The Black Economy Taskforce’s Final Report made findings about the black economy’s significant (and previously somewhat unclear) breadth, scale and growth. It argued that:

“A sense of urgency is needed from policymakers, leaving behind business-as-usual approaches from the past. A new strategy and commitment is required: one which addresses underlying causes, not symptoms, while keeping regulatory burdens low; one which goes beyond tax; and one which breaks down agency silos and embraces joint action and the intelligent use of data and analytics … This agenda has a clear purpose and objective: to make our society both fairer and more equitable by creating a level playing field.”

The Final Report makes 62 recommendations, combining short-term, urgent measures and broader efforts to lay the foundation for long-term, institutional and societal changes. The final Report and the Government response were released on budget night.

Black economy budget measures

In response to the issue and Taskforce recommendations, the black economy measures in the 2018-19 Budget comprise:

- Increasing the ability of enforcement agencies to detect and disrupt black economy participants.

- Removing the unfair advantage of black economy participation by removing deductions for non-compliant payments and changing the Government’s procurement procedures to incentivise tax compliance in supply chains.

- Consulting on reforms to the Australian Business Number system including development of rigorous new identification systems for company directors.

- Introducing an economy-wide cash payment limit for large cash transactions of $10,000 to reduce the ability of black economy operators to avoid their tax and reporting obligations and launder the proceeds of crime using cash.

- Providing additional funding to the Tax Practitioners Board to take action against tax agents that facilitate activity in the black economy.

- Expanding the taxable payments reporting system to contractors in industries with higher risks of not reporting their income. These industries include security providers and investigation services, road freight transport, and computer systems design and related services.

- Combating illicit tobacco markets through the creation of an Illicit Tobacco Taskforce to investigate, prosecute and dismantle organised crime in illicit tobacco.

These measures are far from a complete solution, but they are a promising start. The taxable payments reporting measures alone are estimated to increase net revenue by almost $300 million by 2021-22 (p 22). The nature of some of the measures makes it difficult to quantify their revenue impact, but estimates for the effect of the measures in aggregate are in the region of net revenue increase of around $6.1 billion (of which, almost $3.6bn relates to illicit tobacco measures) over the next four years.

But this is a complex problem which cannot be solved purely by specific legal amendments. The black economy measures are commendable in recognising the need for a more holistic solution. Some immediate legal changes are designed to make non-compliance more difficult (for example, the taxable payments reporting system expansion and the $10,000 cash payment limit).

The restriction on the maximum value for cash transactions has been successful in other countries, and the $10,000 threshold is consistent with existing anti-money laundering rules. This change is appropriate in a broader regulatory perspective.

More generally, the measures aim to improve enforcement and drive larger, structural changes (for example, increasing the robustness of transaction compliance through Australian Business Number and company director identification reforms; and increased enforcement funding).

Tax system integrity and the black economy

Addressing the black economy to protect tax revenue is clearly a significant objective. But there is a deeper consideration, grounded in the need to ensure the actual and perceived integrity and fairness of the tax system.

Academic research on tax compliance, as surveyed by Devos, has drawn a link between general perceptions of a tax system’s integrity and fairness, and individual taxpayer compliance. Lower levels of trust can see voluntary compliance decrease, and may contribute to taxpayer willingness to illegally reduce their tax bill through cash or other black economy activities.

In recent years, public revelations like LuxLeaks and the Panama Papers have made headlines of large-scale tax avoidance by multinationals and wealthy individuals. These reports may have an insidious impact on other taxpayers, by reducing trust in the tax system’s fairness and integrity.

To date, the Government has focused chiefly on integrity measures to address tax avoidance by large companies, effected through legal changes (including amendments to the general anti avoidance rule for multinationals and the introduction of the Diverted Profits Tax). Such measures have set the tone for responses to perceived tax unfairness. The black economy measures are most likely to be felt by individuals and small businesses.

Where to next?

The black economy measures introduced in this budget focus on some of the most recognised problem areas: high value cash payments, non-reporting in high-risk industries and non-compliance with certain transaction reporting and remittance requirements.

However, these reforms address just a fraction of the long list of ways that black economy participants may exploit the tax system. Future efforts should look at other systemic opportunities for evasion. This could include concessional thresholds, reporting obligations, and a lack of clarity in tax rules. For example, the Commissioner has indicated that many taxpayers – and their tax agents – are over-claiming work related deductions. The Commissioner will carry out random audits to investigate the extent of this problem. Maintaining or boosting funding for the ATO to administer the tax law is an important aspect of enforcing such changes.

The extent to which black economy measures ought to focus directly on those actually conducting transactions in the black economy, rather than just indirectly facilitating them, is a controversial question.

In isolation, such rules can seem authoritarian. When connected to efforts to preserve perceptions of tax integrity, and aligned with changing attitudes towards tax evasion, they can be a justifiable way of comprehensively targeting the problem.

The Black Economy Report highlights the speed at which new technologies can give rise to new, often unforeseen challenges. The sharing economy is one such example in the context of the black economy, and solutions are only beginning to emerge. Cryptocurrency also raises novel tax and enforcement issues, even more so if participants tailor their activity to avoid the clear application or enforcement of regulation. For example, might cryptocurrency payments be a means of avoiding the $10,000 cash payment limit?

Clearly, the black economy measures in the 2018-19 Budget are only the beginning of developments in this space.

Further reading:

Parliamentary Library Budget Review

Black economy measures: Limits on cash payments

More from our Budget Forum 2018 series:

Budget Forum 2018: This is not a Genuine or Equitable Way to Simplify the Personal Income Tax System by Andrew Podger

Budget Forum 2018: A Missed Opportunity for Enhancing Australia’s Budget Transparency on Distributional Information by Teck Chi Wong

Budget Forum 2018: Tax Caps and Tax Cuts: Good for Australia? by Miranda Stewart

Budget Forum 2018: Risks Greater Than I Can Recall in My Working Life by John Hewson

Budget Forum 2018: Should Australia Produce a Citizen’s Climate Budget? by Usman W Chohan

Budget Forum 2018: The Future of Corporate Taxation by David Ingles

Budget Forum 2018: Cuts to Personal Income Tax – A Mixed Bag by Robert Breunig

Budget Forum 2018: A Political Budget Unlikely to Work Politically by John Hewson

Budget Forum 2018: The Government Could Be Boosting the Budget Bottom Line with a Change to How It Taxes Gas by Diane Kraal

Pingback: Budget Forum 2018: Tax Caps and Tax Cuts: Good for Australia? - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: Risks Greater Than I Can Recall in My Working Life - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: Should Australia Produce a Citizen’s Climate Budget? - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: The Future of Corporate Taxation - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: Cuts to Personal Income Tax – A Mixed Bag - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: A Political Budget Unlikely to Work Politically - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: The Government Could Be Boosting the Budget Bottom Line with a Change to How It Taxes Gas - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: Budget Forum 2018: A Missed Opportunity for Enhancing Australia’s Budget Transparency on Distributional Information - Austaxpolicy: The Tax and Transfer Policy Blog