The Budget 2018-19 has failed again to include more distributional information, which would provide clarity on what the impacts are for different individuals and households. With the centrepiece of the budget being a seven year personal income tax cut plan which will have significant distributional effects on Australian households, this is a missed opportunity.

In a recent post about Open Budget Survey 2017, Miranda Stewart and I highlighted this lack of distributional information in Australia’s recent budgets, despite the budget documents providing substantial financial information on a range of other issues for the public. Gender budget analysis was last presented in 2013-14, while the budget papers ceased to include the impact of taxes and expenditures by different types of household in 2014-15.

This is in contrast to the practice now in the United Kingdom which incorporates a detailed household distributional analysis of taxes, welfare and other government spending in its budget documentation. This includes reporting on the Gini coefficient, a key indicator of income inequality, and comparing with other G7 countries and trends over time.

Why is distributional information important?

A key function of government is to distribute the benefits and burdens of taxing and spending. The release of distributional information would be in line with the public interest, helping people to understand how the budget measures affect them and the broader population.

This is particularly relevant when there is growing distrust in government around the world, including in Australia. Distributional information will allow a more informed public debate.

There is no technical obstacle for the Treasury to include such information, as they have full access to statistics and distributional modelling. Static distributional modelling does not take account of behavioural economic changes in response to government policy, but it does provide a snapshot of the immediate impact of policy change on households.

Tax cuts but no increase to Newstart

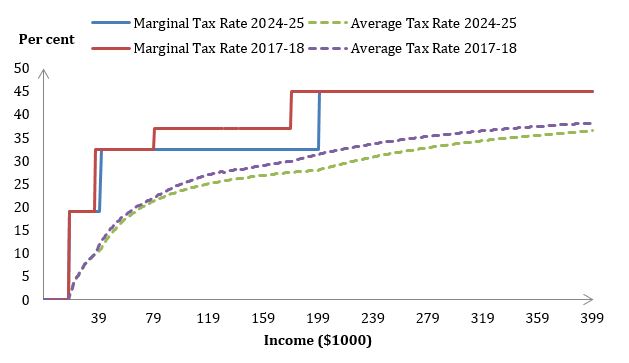

The focus of the government in this Budget is to ‘provide tax relief to encourage and reward working Australians’ and ‘make personal income tax lower, fairer and simpler’. This includes providing a tax relief of up to $530 per year to middle and lower income Australians and addressing bracket creep, by increasing the top threshold of the 32.5 per cent tax bracket gradually to $200,000 in 2024-25. The 37 per cent tax bracket would also be abolished.

Eventually, Australia will see a flatter and less progressive personal income tax structure.

Figure: Marginal and average tax rates, 2017-18 compared to 2024-25

Source: Tax and Transfer Policy Institute, Stocktake Report 2015 Figure 1.1, updated.

Source: Tax and Transfer Policy Institute, Stocktake Report 2015 Figure 1.1, updated.

Distributional analysis would show who are winners and losers from the budget. For example, in the lead up to the Budget 2018-19, there were increasing calls from different sections of society—including business interests and the community sector—to increase unemployment benefits. The Newstart payment of $272.90 per week is indexed to inflation, not wages, and has fallen far below the national minimum wage of $694.90. A recent tax survey by think tank Per Capita suggested a majority of Australians want to see more government spending on social security. However, this Budget does not increase Newstart, leaving the poorest worse off relative to most others in the population.

Distributional analysis independent of government

Modelling of the tax cuts by the ANU Center for Social Research and Methods and the Grattan Institute outside government show higher income households will enjoy most of the tax cuts, while lower income households receive little or none at all. In particular, households in poverty who pay no tax are left out because the tax relief can only be used to set off tax payments, while there is no increase in Newstart payment. The University of Canberra’s NATSEM also publishes an analysis of the budget using its distributional model STINMOD+.

External analysis is independent and valuable. But if the Government itself was required to publish analysis, that should also contribute to explaining and justifying its proposed policy and its effects.

Stylised cameos provided, but not enough

The Budget website does provide stylised cameos of different family scenarios to illustrate the taxes saved as a result of the tax cuts. The different family scenarios include a single person household, a couple with an income earner, and a dual earner couple (equal income split and two-thirds and one-third split). However, these do not tell us how these benefits are distributed across different income levels. Nor do they consider the interaction between various tax and welfare changes that alter the net impact to different households.

For example, the Government proposes to increase the work pension bonus, allowing pensioners to earn more without impacting the pension, and it will provide more home care packages to older Australians. However, it also increases the waiting period before a migrant can have access to welfare, and extends the controversial electronic debt recovery scheme. These will affect the distribution of the budget for particular community groups.

Freedom of Information documents in the past indicate the Treasury did undertake analysis to study how different income groups would be impacted by Budgets on an aggregate level.

On Budget night, Treasurer Scott Morrison started his speech with the questions that people want to ask the Government: ‘What have you achieved? What are you going to do now? What does it mean for me?’ Answers for these questions—both the individual and the broad social impact—are still missing in the Australian budget. Australia should consider emulating the UK in releasing a distributional analysis statement of its own in future budgets.

More from our Budget Forum 2018 series:

Budget Forum 2018: This is not a Genuine or Equitable Way to Simplify the Personal Income Tax System by Andrew Podger

Budget Forum 2018: Targeting the Black Economy by Joel Emery

Budget Forum 2018: Tax Caps and Tax Cuts: Good for Australia? by Miranda Stewart

Budget Forum 2018: Risks Greater Than I Can Recall in My Working Life by John Hewson

Budget Forum 2018: Should Australia Produce a Citizen’s Climate Budget? by Usman W Chohan

Budget Forum 2018: The Future of Corporate Taxation by David Ingles

Budget Forum 2018: Cuts to Personal Income Tax – A Mixed Bag by Robert Breunig

Budget Forum 2018: A Political Budget Unlikely to Work Politically by John Hewson

Budget Forum 2018: The Government Could Be Boosting the Budget Bottom Line with a Change to How It Taxes Gas by Diane Kraal

Pingback: Budget Forum 2018: This is not a Genuine or Equitable Way to Simplify the Personal Income Tax System - Austaxpolicy: The Tax and Transfer Policy Blog

Excellent piece that makes a strong cases for greater distributional transparency in budget information