Government budgets can be framed in purely financial terms. How much tax and other revenue is coming in, how much expenditure is going out, and what is the difference between the two (budget surplus or deficit).

Budget surpluses or deficits are important to keep track of as they ultimately add to or draw down on government debt, which one way or another needs to be paid back by current or future generations. But, budgets are also about priorities. Who we place the greatest tax burden on is an indication of who we feel has the greatest capacity and ought to pay. Where we spend money tells us about the policy areas that we see as being of highest priority.

In a well-functioning democracy, the priorities held by the voting public would closely align with the priorities articulated in the budget. There wouldn’t be a perfect overlap, as governments have more information than the voting public and try in some cases to lead rather than follow public opinion. Governments also (rightly) need to balance the needs of minorities with the majority, as well as future versus current generations.

However, too much divergence may lead to political disillusionment and ultimately a loss in public support.

In the lead up to the delivery of the 2023-24 Commonwealth Budget, the Albanese Labor Government certainly has public support. This is undoubtedly due in part to the quite negative view of the Opposition Leader Peter Dutton amongst the general public. However, such high levels of support cannot be due solely to a negative perception of the Opposition. The Government’s policy settings must be reflecting the priorities of the general public, at least to a certain extent.

Policy priorities

In April 2023, the Social Research Centre on behalf of the ANU Centre for Social Research and Methods collected detailed survey data from almost four-and-a-half thousand adult Australians as part of the ANUpoll series of surveys. The main data collection commenced on the 12th of April 2023, with fieldwork concluding on the 23rd of April. Once processed, this data will be available through the Australian Data Archive.

The April 2023 ANUpoll asked respondents amongst many other things ‘How much of a priority should each of these following be for the Federal Government to address this year?’ across 22 policy areas.

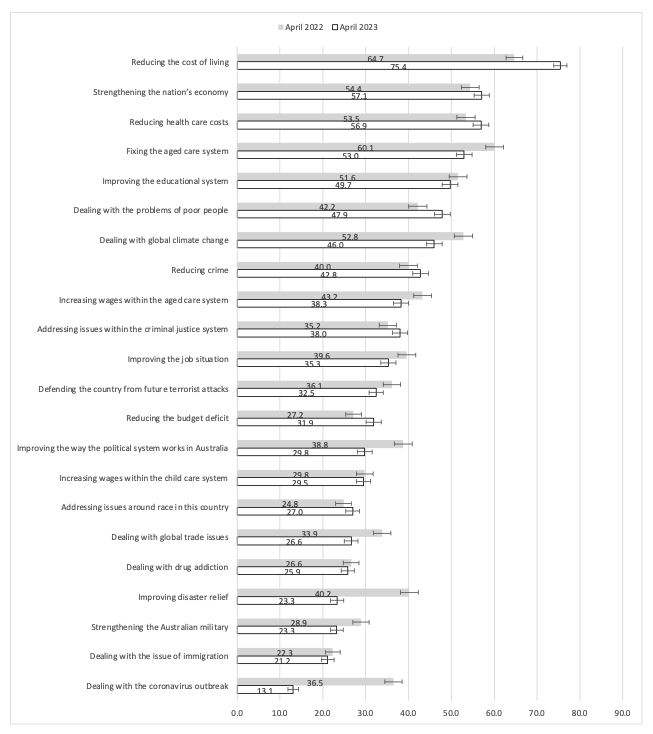

We summarise this data via the estimated proportion of adult Australians who think that particular policy areas are a ‘top priority’, ordered from the highest to lowest priorities as of April 2023, and comparison made with data from April 2022 (see Figure 1).

Figure 1: Per cent of Australians who reported policy areas as a ‘top priority’ – April 2022 and 2023

Note: The “whiskers” on the bars indicate the 95 per cent confidence intervals for the estimate. Results incorporate population weights. The April 2022 survey incorporates final population weights. The preliminary dataset from April 2023 does not have final population weights and we therefore either use January 2023 weights (for those respondents that completed the January 2023 ANUpoll) or modelled weights based on sex, age, Indigenous status, country of birth, language spoken at home, highest level of education, location, and whether or not completed online.

Ahead of the 2023-24 Budget, Australians are clearly worried about economic issues, both nationally and for them as individuals and households. Around three-quarters of Australians reported that reducing the cost of living should be a top priority for the Government over the next 12 months. While the fact that this was the highest priority may not be overly surprising, the large increase over the last 12 months is somewhat unexpected.

Other policy areas that had a relative increase in prioritisation over the last 12 months were ‘Dealing with the problems of poor people’, with 47.9 per cent of Australians listing it as a high priority in April 2023 compared to 42.2 per cent 12 months earlier, and ‘Reducing the budget deficit’ which increased from 27.2 to 31.9 per cent.

There were also a number of areas of policy that people were less likely to think were a top priority in 2023 compared to 2022. The two largest declines were for ‘Dealing with the coronavirus outbreak,’ which declined from 36.5 per cent of people saying it was a top priority to 13.1 per cent, and ‘Improving disaster relief’ (from 40.2 per cent to 23.3 per cent). These declines likely reflect the particular circumstances in April 2022, with COVID-19 restrictions still a recent experience then, and much of the east-coast of Australia experiencing devastating floods.

Some of the other declines are perhaps more of a surprise, and may reflect policy success of the Albanese government, or at the very least some policy progress. There was a decline by 9.0 percentage points in those who thought that ‘Improving the way the political system works in Australia’ was a top priority (from 38.8 to 29.8 per cent), which may reflect the heightened focus on political integrity at the time of the 2022 Federal Election and relatively popular changes put in place since.

The decline in the per cent of Australians who thought that ‘Dealing with global climate change’ is a top priority (from 52.8 to 46.0 per cent) may also be a reflection of the more popular policy settings under the Albanese Government compared to the former Morrison Government.

Views on taxation

Figure 1 highlights a number of areas of policy that Australians think should be the focus of government over the next 12 months. There is strong pressure on the Government to reduce the cost of living, and also to deal with issues of poverty. Indeed, in the January 2023 version of the ANUpoll survey we found that there had been a more than doubling of support for paying more on unemployment benefits compared to March 2008 – from 17.8 per cent to 39.6 per cent in the January survey.

The challenge for the Government, of course, is that this must come from payments to other priorities, an increase in revenue, or an expansion in the deficit. The April 2023 data suggests that reductions in the budget deficit are a high priority amongst the general public, so the first two of these options are likely to be more politically palatable.

In the January ANUpoll, we found that the second of these options (increased revenue) may be more palatable than the government is assuming. We asked using a long-standing question ‘If the Government had a choice between reducing taxes or spending more on social services, which do you think it should do?’. Weighted responses across 3,346 observations suggest almost exactly one-third (33.4 per cent) favour reducing taxes compared to 42.8 per cent in favour of more spending. The remaining 23.9 per cent responded that it depends.

It is never easy for a government to increase taxes. Our data suggests that, politically at least, now may be a time when targeted support for the disadvantaged funded from increased revenue receives public support. The 2023-24 budget will tell us whether this is one of the Albanese Government’s priorities, as well as the general public’s.

Other Budget Forum 2023 articles

The Costly and Unfair Stage 3 Tax Cuts Will Undermine the Progressive Income Tax and Worsen Inequality, by Kathryn James, Guyonne Kalb, Peter Mares, Miranda Stewart and Roger Wilkins.

Inflation Forecast, Fiscal Policy and Personal Income Tax Rates, by Chris Murphy.

Financial Support for Those on Low Incomes, by John Freebairn.

Will the Budget Reduce Inflation? By Michael Coelli.

Stage 3 Tax Cuts and JobSeeker – A Slightly Different View, by Andrew Podger.

Equity Is Hard to Achieve When Unfairness Is Baked into the System, by Robert Breunig.

A Small Investment in the Budget With a Big Policy Return? By Nicholas Biddle.

Labor Could and Should Have Gone Stronger on the Petroleum Resource Rent Tax, by Rod Sims.

How Removing Parenting Payments When Children Turned 8 Harmed Rather Than Helped Single Mothers, by Kristen Sobeck.

Straightening Out the Super Tax Breaks Debate, by Brendan Coates and Joey Moloney.

Recent Comments