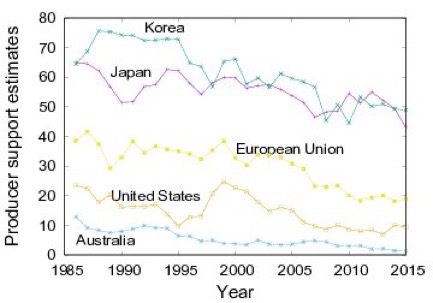

Japan is one of the world’s largest agro-food importing countries and provides significant support to its producers. According to the OECD Agricultural support (indicator), the producer support estimate (PSE) for Japanese farmers in 2013 was 52% of gross farm receipts, well beyond the PSE for most other OECD countries (see Figure 1).

Figure 1: Producer support estimates as % of gross farm receipts

Source: OECD Agricultural support (indicator).

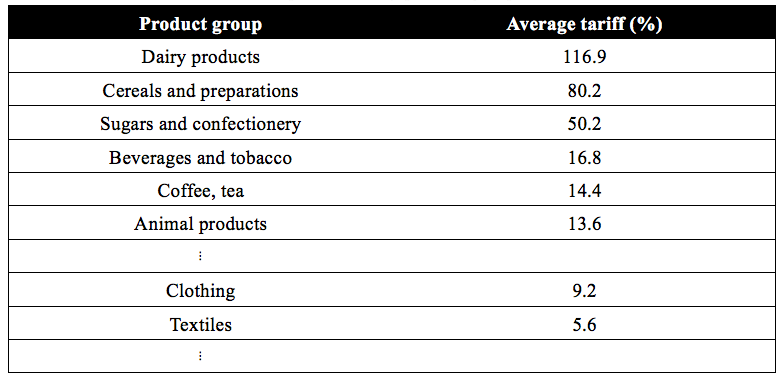

Indeed, the World Tariff Profiles 2013 in Table 1 below indicate a high average tariff rate on Japanese agricultural imports such as dairy products (117%), cereals and preparations (80%), and sugars and confectionery (50%).

Table 1: Japan’s tariff by product group in 2013

Source: World Trade Profiles 2013 (WTO, ITC and UNCTAD).

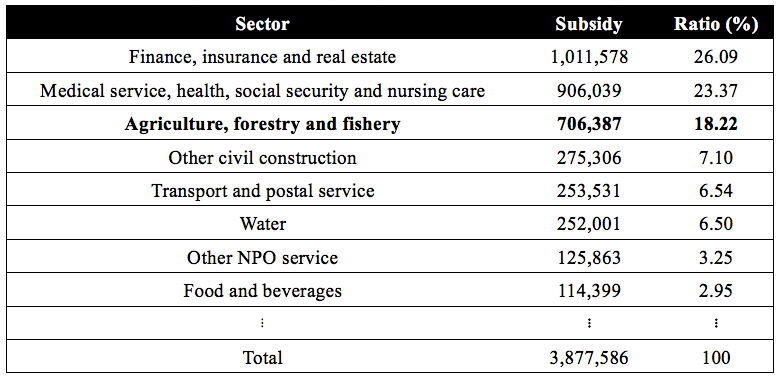

Agricultural producer support in Japan also operates through government subsidies. The Updated Input-Output Table (Ministry of Economy, Trade and Industry, METI) suggests that in 2013, government subsidies allocated to the ‘Agriculture, Forestry and Fishery’ sector are the third largest following the ‘Finance, Insurance and Real Estate’ sector and the ‘Medical Service, Health, Social Security and Nursing Care’ sector (see Table 2). Focusing only on the subsidies allocated to primary and manufacturing sectors, the subsidies allocated to the ‘Agriculture, Forestry and Fishery’ sector exceed 80%. On the contrary, protection for other import-competing sectors — e.g. ‘Textile Products’ and ‘Wearing Apparel and Other Textile Products’ — have been rather modest in terms of both import tariffs and subsidies.

Table 2: Subsidy allocation in Japan by sector in 2013 (in million Japanese Yen)

Source: Updated Input-Output Tables 2013 (METI).

The Japanese government included the majority of the rice, wheat, meat, dairy products and sugar items into the exception list in the Trans-Pacific Partnership (TPP) negotiation process. The public is engaged in an active discussion of whether these items should be liberalised, but there seems to be no agreement on whether removing tariffs for some items, whilst maintaining tariffs for other items (typically those that attract high tariffs) will benefit the economy.

With the above characteristics of the Japanese economy in mind, we study the welfare effect of such partial tariff reduction policies in Asano and Kosaka (2017). The analysis investigates the effect in the short-run where two import-competing sectors A and B are protected by tariffs while only A is subject to a production subsidy. Our particular interest is the case where the tariff for imports in Sector A is greater and we examine whether a tariff reduction in Sector B is welfare improving.

Our analysis is complicated by multiple distortions resulting from the two tariffs and the subsidy. Suppose that the tariff in Sector B is the only distortion, i.e. there is no tariff or subsidy in Sector A. Since the Sector B tariff raises the domestic price of its good, the consumption of the Sector B good is discouraged and its production is encouraged. The tariff reduction alleviates these inefficiencies (in consumption and production) and unambiguously improves the economy’s welfare by encouraging relatively more consumption of the Sector B good as well as drawing productive resources out of Sector B into other non-distorted sectors (the import-competing sector, A, and an export sector, C).

However, if Sector A is already more heavily protected by a tariff and/or subsidy and hence more distorted than Sector B, the story is not that simple. The Sector B tariff reduction increases the Sector B good consumption in lieu of reduced consumption of both Sector A and C goods. The reduction of the Sector C good consumption is desirable because its consumption was originally inefficiently high due to its relatively low domestic price. However, the reduction in consumption of the Sector A good has a negative effect on the economy’s welfare because it was already inefficiently low (because the protection forced its domestic price to be relatively high). The same mixed effect of the Sector B tariff reduction can be seen on the production side. The Sector B tariff reduction lowers the production of the Sector B good and the production of both Sector A and C goods increases. The increase in the Sector C good production is desirable but the increase in the already inefficiently high Sector A good production has a negative welfare effect. In the presence of these mixed effects, we have resorted to a numerical analysis to better understand the welfare effects of such a partial tariff reduction policy.

We calibrated our model to the Japanese economy in 2013 using a range of data, including the Updated Input-Output Table, the Financial Statements Statistics of Corporations by Industry (Ministry of Finance), as well as the World Tariff Profiles. To do so, we divide the Japanese economy into four sectors: the two import competing sectors mentioned earlier, an export sector, and a non-traded goods sector. Using the World Tariff Profiles, we calculate the weighted averages of the import tariffs for Sectors A and B, which turn out to be significantly different from each other: 24.4% and 4.1%, respectively. Our calibration also finds that the production subsidy in Sector A is 4%. This result suggests that Sector A production is predominantly protected by the import tariff.

Given the calibrated value of the production subsidy in Sector A, we have found that a small tariff reduction in Sector B is harmful to the Japanese economy. In fact, the same remains true even if the production subsidy in Sector A is completely removed. The results demonstrate that the tariff in Sector A is so high that even after the full removal of the subsidy, Sector A’s over-production and under-consumption make the partial tariff reduction policy undesirable. We find that, for a small tariff reduction in Sector B to be welfare improving – provided that the current production subsidy does not change – Sector A’s tariff needs to be more than halved (to 10%). We also find that the welfare loss caused by this partial tariff reduction is mainly attributable to further inefficiency in production. Roughly 70% of the overall (negative) welfare effect is explained by the further inefficient allocation of productive resources whilst the rest is attributable to increased inefficiency in consumption.

This post is based on the paper ‘Asano, A. and Kosaka, M. S. (2017): The welfare effects of a partial tariff reduction under domestic distortion in Japan, ANU Working Paper in Economics and Econometrics 650, Australian National University.’

Recent Comments