The egalitarian asks: Should we equalise opportunities (resources) or outcomes (welfare)?

Moral philosophers, economists, and societies have long debated this question, but in practical policymaking we opt to worry about both. Because if we equalise resources—voicing the mantra ‘let people take responsibility of their actions’—we may still not want to ignore ‘bad’ outcomes.

For example, the long-term outcome of 1 dollar on a child depends on its family and resources that cannot be equalised such as ‘talent’ (a word used by public finance economists to lump together all these ‘non-transferable’ resources such as ability and health, inter alia).

In part, however, the resources of the family are transferable, or in other words, can be made less unequal, which goes to the heart of the discussion on the effects of sharp wealth inequality and wealth taxation.

The generational effects of wealth inequality

We limit this extensive discussion here to one particular aspect: Does parental wealth affect income inequality in the next generation? That is, does parental wealth impact the equality of opportunity in the next generation? A question that is also relevant for the effects of—and the responses to—the COVID-19 pandemic that has worsened preexisting inequalities.

The literature suggests that i) the wealth distribution is highly skewed at the top; and ii) parental wealth is a significant predictor of future wealth of the children through mechanisms such as direct wealth transfers and capital income. A question that received less attention thus far is whether parental wealth also affects labour income in the next generation.

Rich parents, better paid children

In a recent study, we estimate the effect of parental wealth in the 1990s and early 2000s on the wages of the children in 2010-2017 using Norwegian intergenerational data.

We find that children have higher wages than peers from less wealthy families with similar characteristics, including education. The effect is not large but significant: One additional million of parental wealth increases wages by NOK 14,000. This effect diminishes at the top of the wealth distribution as capital income becomes the primary source of income.

Moreover, higher parental wealth is found to be associated with higher intergenerational labour income mobility (as measured by the position on the wage distribution relative to that of the parents).

These results suggest that the Norwegian wealth tax in the 1990s and 2000s made the labour income distribution during 2013-2017 less unequal (lowering the Gini coefficient of the wage distribution by about 1 point).

Risk profile could be an explanation

There can be several mechanisms through which parental wealth affects the wages of the children.

For example, differences in wealth can potentially affect human capital formation, and thus wages, through: i) generating disparity in affordability of private education (particularly relevant for countries with higher private provision of education and less relevant for a country like Norway); and ii) the decision to invest in human capital (for example, to attend a graduate school or not).

But, the results in our study control for education of the parents and the children, indicating that potentially there are other mechanisms.

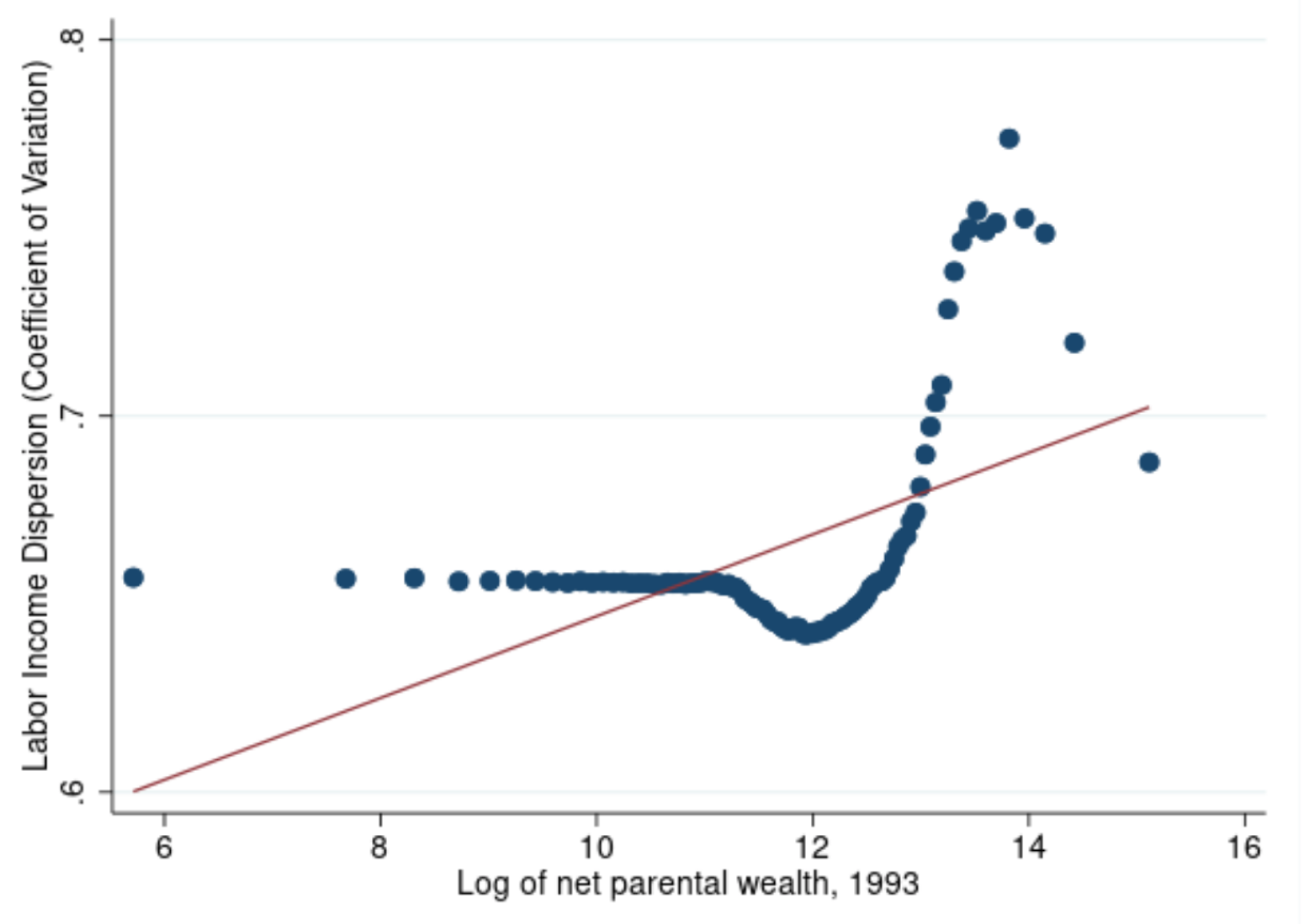

The paper presents suggestive evidence that high parental wealth is associated with higher ‘risk-taking’, in labour-related decisions (for example, the occupational choice) of the children, and thus higher return to labour (as indicated in the figure below). This is consistent with the hypothesis that parental wealth can act as an insurance in the form of a private safety net.

The welfare impacts of parental wealth on labour risk taking is yet to be studied. And more research is needed to shed light on how parental wealth influences wages of the children.

Figure: Parental Wealth and Labour Income Dispersion, Controlling for Education

Source: Berg and Hebous (2021)

If the income tax system covers all sources of capital income, do we still need a wealth tax?

The positive analysis in our paper does not state that the wealth tax is the only, or the optimal, policy tool to influence intergenerational income inequality. There are normative arguments in favour and against taxing net wealth. Taxing net wealth strengthens progressivity at the very top and can complement capital income taxes. Skeptics worry about efficiency consequences on capital accumulation and point out that taxing capital income from all sources is (theoretically) equivalent to a wealth tax with an appropriate tax rate choice.

One can argue that intergenerational labour income mobility should be free of a parental wealth privilege. Reflecting on the opening paragraph, the study presents evidence that differences in resources (wealth, in the study) affect outcomes in the next generation (wages). In other words, unequal opportunity appears to affect choices that feed into unequal opportunities in the next generation.

If parental wealth results in higher labour income in a country like Norway with a relatively strong provision of education, health and other public goods, this raises the question whether this effect is even more pronounced in countries with lower provision of public goods. In conclusion, the findings implicitly urge policymakers to think of the underlying reasons behind unequal opportunities and a set of policy tools (rather than a single instrument) to influence the income distribution.

Further reading

Berg, Kristoffer, and Shafik Hebous. 2021. “Does a Wealth Tax Improve Equality of Opportunity? Evidence from Norway,” IMF Working Papers 2021/085, International Monetary Fund.

Recent Comments