Tax incentives, also known as tax breaks, tax exemptions, tax holidays and tax concessions, are preferential tax treatments provided to selected groups of taxpayers. This usually results in those taxpayers paying less tax or paying later than they otherwise would. My recent Energy Policy article questioned tax incentives provided to the petroleum industry in four jurisdictions in the Asia-Pacific region: Australia, Malaysia, Indonesia and Papua New Guinea (PNG). For Australia, this is timely given the ongoing review into Australia’s highly-concessional petroleum resource rent tax. The 2019 article asked whether tax incentives are economically beneficial for a host country and applied a framework of energy justice to help evaluate the costs and benefits of such tax breaks to a host country.

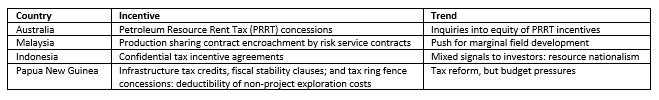

Governments traditionally justify using tax incentives to mitigate market failure associated with exogenous pressures, such as regional competition for scarce inward investment. Some tax incentives are legislated, while others are exclusively provided under confidential contracts. Tax incentives can take many forms, including accelerated depreciation of capital expenditure, double deductions, fiscal stability clauses and infrastructure tax credits. Some are listed below:

- exemptions: income is excluded from the tax base (e.g. tax holidays);

- allowances: amounts are deducted from gross taxable income (e.g. the research and development tax concession);

- credits: amounts are deducted from tax liability (e.g. social and community infrastructure tax credits and the research and development tax offset);

- rate relief: a reduced rate of tax applied to a class of taxpayers or activities (e.g. company income tax and employee taxes);

- tax deferrals: relief that takes the form of a delay in paying tax (e.g. accelerated depreciation that allows a faster schedule than is available to the rest of the economy);

- duty exemptions: duty not collected on imports that in the usual course would be collected;

- goods and services tax (GST)/value added tax (VAT) exemptions: the consumption tax is not collected either on imports, mineral production or value-added; and

- privilege zones and project-specific tax relief (e.g. tax-free zones, fully deductible resource exploration costs).

Australia, Malaysia, Indonesia and PNG are direct regional competitors in the petroleum industry, in terms of exports to customers in Asia, including Japan, South Korea, China and Taiwan (see Figure1). Previously, case studies of eight African countries’ tax incentives were considered by the 2014 PNG Tax Review. The Africa case studies indicated non-transparency, a lack of effectiveness and complexity in their tax incentive systems. The Africa cases review concluded that there was a need for simplification, a reduction in the different types of tax incentives, and the removal of inequities regarding the beneficiaries of tax incentives.

Figure 1: Petroleum export competitors: Asia-Pacific region

Source: Asia Pacific Maps, Scoop.it

A qualitative approach

The Energy Policy tax incentive research used a qualitative approach, combining two methods. First, country case studies were prepared on tax incentive practices designed to attract foreign direct investment (FDI) for exploration and development in the resource sector. The intention was to compare the trends on tax incentives and determine any nexus between those incentives and FDI value in each country.

Second, documentary evidence was sought to summarise and quantify relevant tax incentives, known as in the tax field as “tax expenditures”.

Energy justice framework

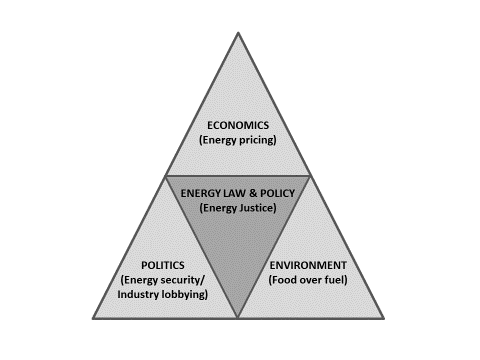

Economic analysis dominates the discourse on tax incentives, illustrated by terms such as “competitive edge”, “fiscal attractiveness”, “cost of incentives to tax base”, “FDI imperatives” and “tax competition.” While acknowledging the close relationship between energy resource policy and economics, there is a push to break new ground through the concept of energy justice.

The energy justice framework provides a decision-support tool for policymakers to balance the energy trilemma of competing aims: economics (eg, resource pricing), politics (eg. energy security) and environment (eg. climate change mitigation). Energy justice is operationalised through principles of availability, affordability, due process, transparency and accountability, sustainability, responsibility and intra- and inter-generational equity.

It is illustrated in Figure 2, below.

Figure 2: Energy Justice: the triangle of energy law and policy

Source: Heffron and McCauley (2017, p. 665).

Trends in tax incentives

The trend for Australia is to offer profit-based tax incentives, such as legislated research and development tax offsets that are listed in Australia’s tax expenditure statement. However, the tax expenditure statement does not list the major and largely unreported incentives pertaining to the petroleum resource rent tax (PRRT). The emergent theme for the petroleum sector in Australia concerns equity between resource owners (that is the community) and investors.

For Malaysia, given the fall in petroleum prices since 2014, the trend is the imperative for production from marginal petroleum fields. For Indonesia, government still trends towards high levels of discretion for tax incentives in confidential contracts, which are outside of legislation. Despite gaps in historical data for PNG, progress in tax reform has continued, except for changes to petroleum industry incentives due to budget pressures. We wait for further developments in PNG as a result of the resignation of Prime Minister Peter O’Neill.

Figure 3 compares the four country case studies in terms of major petroleum industry tax incentives and policy trends. The latter three countries do not publish tax expenditure statements.

Figure 3. Case-study countries: major petroleum industry tax incentives

Source: author

Source: author

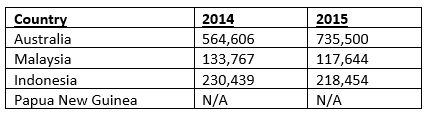

Overall, the Energy Policy article’s finding was that resource prospectivity, rather than tax incentives, is the primary motivator for FDI into the extractive industry. Australia with relatively less ministerial discretion (but a highly-concessional PRRT) attracts higher levels of FDI, as per Figure 4, below. Host country-provided tax incentives to the petroleum sector are unnecessary because extraction activities are location-based, and a government should collect rents from its country’s natural resources. The research outcomes are supported by a range of international empirical studies that cast doubt on the efficacy of tax incentives for the petroleum sector.

Figure 4. Comparative FDI for case-study countries, US dollars, million

Source: US Department of State. ‘Investment Climate Statements’, 2016 and 2017.

PRRT Review

Since the publication of the the Energy Policy article, Treasury has called for public submissions for their Review of Gas Transfer Pricing arrangements on the PRRT – our last chance to fix yet another highly-concessional design component of the PRRT before submissions close on 14 June 2019.

The gas transfer price is the price of gas used to produce LNG. For example, the integrated gas projects in the waters off Western Australia require this price to calculate their PRRT liability to government. It is the price for the stock of gas used by industry to produce LNG for export overseas. Under current PRRT regulations, the price is calculated using a residual price method, which is very problematic for many reasons (see the Callaghan PRRT Review Final Report and my previous article).

Unless the gas transfer price design flaw is fixed, the low PRRT revenue trend will continue, even with the reduction in uplift rates that take effect from 1 July 2019. A recent media report asked questions about the 2018 gas revenue gap between Australia’s PRRT ($1.12bil), Qatar ($50.9bil), and Norway ($19.5bil). A submission from a UK researcher to the Senate Inquiry on Corporate Tax Avoidance, vigorously questioned and empirically catalogued the ineffectiveness of both the UK’s petroleum rent tax and Australia’s PRRT. All the evidence suggests Australia needs an energy policy to address our overly-concessional PRRT.

The community as owners of petroleum resources, should not accept any recommendations from Treasury’s review that might only fine-tune the PRRT Regulation 2015. In the context of energy justice, merely ‘fine-tuning’ would transgress both intra- and inter-generational equity. Further, government is accountable to ensure PRRT Regulation 2015 facilitates enough tax revenue to fix environmental impacts, given the high carbon emissions from extraction and burning of gas.

Researchers and government policy-makers need to look beyond singular economic evaluations of tax incentives for the petroleum industry. The concept of energy justice is a useful tool to analyse the political and environmental realities in framing energy policy.

Hallow Diane, your article is very useful,