Australia has now formalised its Paris Agreement commitment to reduce greenhouse gas emissions by 43 per cent below 2005 levels by 2030 to reach net zero emissions by 2050 and has legislated these targets in the Climate Change Act 2022. The October Budget 2022-23 (pp. 15-19) contained a number of measures aimed at meeting these targets, including total climate-related spending of $25 billion over 2022-23 to 2029-30.

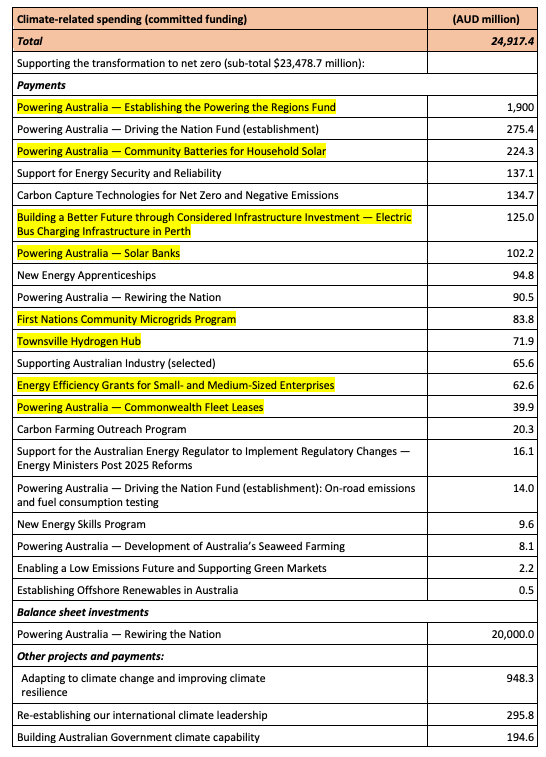

The Budget included major climate-related spending for a range of projects — of which eight can be classified as demand-side projects that include tax-related funding. Demand-side funding for project schemes is part demand management, which has the key purpose to change the shape and timing of consumption, either by avoiding end-use consumption of fossil fuels, or by improving supply efficiencies, such as reducing fossil fuel wastage. The demand-side projects are highlighted in Table 1, and include: the Driving the Nation Fund ($275.4 million) —that covers delivering electric vehicle (EV) public charging infrastructure, the Fringe Benefits Tax (FBT) exemption for EVs, and the exemption from the five percent car import tariff; — the community batteries for household solar program ($224.3 million); electric bus charging infrastructure in Perth ($125 million); solar banks ($102.2 million); the First Nations Community Microgrids Program ($83.8 million); Townsville hydrogen hub ($71.9 million); energy efficiency grants for small- and medium-sized enterprises ($62.6 million); and Commonwealth EV fleet leases ($39.9 million).

Table 1. Value of key climate-related spending measures over 2022-23 to 2029-30.

(Source: October Budget 2022-23, Budget Paper 1, Table 3.7, p. 112)

Why the Budget 2022-23 demand-side funding for climate change is important

Demand-side management is a strategy used by electricity utilities to control demand by encouraging consumers to modify their level and pattern of electricity usage. A sobering fact is that in 2022, fossil-fuel electricity contributed to 32.8%, the highest of Australia’s carbon emissions.

Energy market regulators are recognising the potential of demand-side management and distributed energy resources (DER) to reduce costs for consumers, and have been establishing regulations to support this aim, but progress to models that are attractive to consumers is slow.

DER is the name given to renewable energy units or systems that are commonly located at houses or businesses to provide them with power. Another name for DER is “behind the meter” because the electricity is generated or managed ‘behind’ the electricity meter in the home or business.

As noted above, the October Budget 2022-23 provides demand-side funds allocation for an FBT exemption to electric vehicles. Battery electric vehicles (BEVs) are both a transport and an energy product, as the energy stored in BEV batteries can also be used to power a home. According to the Australian Energy Regulator, BEVs are considered a key element in DERs that also include small-scale rooftop solar, large-storage batteries and energy management systems such as smart meters. There are a range of schemes that can be classified as ‘incentive programs to support DERs in Australia.

The Australian Energy Regulator’s Demand Management Incentive Scheme (DMIS) and Demand Management Innovation Allowance (DMIA) are two incentive examples since 2017. The DMIS objective is to provide electricity distribution businesses (the energy supply-side) with an incentive to undertake efficient expenditure on DER options relating to demand-side management. The DMIA objective is to provide distribution businesses with funding for research and development in demand management projects that have the potential to reduce long term network costs. Both apply to Victoria, Australian Capital Territory and New South Wales, Queensland, South Australia, Tasmania and the Northern Territory.

In 2019, the Australian Renewable Energy Agency (ARENA) funded Distributed Energy Integration Program (DEIP) examined how the just-mentioned network incentives could evolve so that consumers get the best value from innovations from DER. The report suggests incentives should focus on demand-side incentives for consumers that are equitable and affordable. This is why the October Budget 2022-23 inclusion of demand-side climate-related funding and schemes are important and of interest.

Tax relief for electric vehicles

The Federal October Budget 2022-23 included a demand-side FBT exemption for electric vehicles (for vehicles with a Luxury Car Tax value under $84,916 in 2022-23).

In the lead up to the Federal Budget, a report was published in July 2022 by my colleagues and me that centred on battery electric vehicles (BEVs) for business fleets and necessary taxation support. It investigated the necessity of demand-side tax changes to accelerate the uptake of BEVs by business fleets. The report recommended 17 short-term and long-term tax changes that address the research criteria of: the need to increase BEV uptake, BEV affordability for business; and support for home charging of business fleet vehicles at fleet employees’ place of residence. The report’s short-term tax changes included a full exemption from FBT for employer-provided BEVs.

Following the report and other pressure from other constituents, in July 2022 a federal parliamentary bill, ‘Treasury Laws Amendment (Electric Car Discount) Bill 2022’, which includes a full exemption from FBT for electric vehicles, was read and accepted in the House of Representatives in September 2022. Then the Senate referred the bill to an inquiry in August 2022. Due to three Senators’ dissenting views, at the time of writing, the Albanese government is still trying to negotiate bill amendments to gain passage to legislation.

The bill amendment will either apply an FBT exemption to just BEVs, also known as zero emission vehicles (ZEVs) and hydrogen fuel cell vehicles for the FBT exemption; or, apply the FBT exemption to all electric vehicles —— for example, battery electric vehicles, hydrogen fuel cell vehicles and plug-in hybrid electric vehicles.

Any form of hybrid vehicle should not be FBT exempt, as those cars use fossil fuels and will not sufficiently contribute to lowering C02 emissions to meet Paris Agreement commitments. The 2022 report on ‘BEVs for business fleets and taxation support’ recommends that only BEVs be eligible for an FBT exemption.

Conclusion

The October Budget 2022-23 included major climate-related spending for a range of projects — of which eight can be classified as demand-side projects that include tax-related funding. It is a good start. The ‘Treasury Laws Amendment (Electric Car Discount) Bill 2022’ that covers the FBT exemption will soon be debated again in the Senate — after amendment negotiation with dissenting Senators. Those Senators argue that tax exemptions for hybrid electric vehicles are a poor use of taxpayer dollars, as hybrids are ineffective in reducing CO2 emissions.

The two-week UN Climate Change Conference COP27 in Egypt starts on 6 November 2022 and the Australian Government will host a pavilion there for the first time, after a long absence. Climate Change and Energy Minister Chris Bowen and Assistant Minister Jenny McAllister will attend in Week 2 to outline Australian Government plans to meet the Paris Agreement. Australia needs to evidence their commitment to lowering CO2 emissions with supportive legislation, such as the successful passage of the bill for FBT exemption on employer-provided electric vehicles — that will actually lower emissions.

Recommended reading

Anna Mortimore, Diane Kraal et al. 2022. Business Fleets and EVs: Taxation changes to support home charging from the grid, and affordability. Fast track project. Sydney: RACE for 2030 CRC.

Other 2022 October Budget articles

Improving Tax Compliance of Large Multinational Companies, by Max Bruce.

What the Budget Did Not Address – Unfair Tax Minimisation Using Discretionary Trusts, by Sonali Walpola.

Australia’s First Wellbeing Budget Leaves People Behind, by Ben Spies-Butcher, Troy Henderson and Elise Klein.

Proposed Changes to Australia’s Thin Capitalisation Rules, by Mark Brabazon.

The Vested Interests Behind the Technical Expertise of the Big Four in Global Tax Reform, by Ainsley Elbra, John Mikler and Hannah Murphy-Gregory.

Click here for 2022 March Budget articles.

Recent Comments