In 1977, I published a paper in the Economic Journal entitled ‘Measurement of Tax Progressivity: An International Comparison.’ In this paper, I developed an index of tax progressivity that is extensively used to analyse equity in taxation and government expenditures. The index, popularly known as the Kakwani index, has become a popular tool for analysing equity in public finance and delivering health care.

I developed the index by measuring the extent of the overall deviation of a tax system from proportionality. It is an overall measure of tax progressivity. Its value is zero when the tax system is proportional. The positive (negative) value of the index signifies the tax system as progressive (regressive). The index is void of any social welfare foundation.

The relevance of tax progressivity measures to policymaking depends on whether they help assess the social welfare implications of taxation. The literature on taxation has not explored the social welfare implications of tax progressivity measures until very recently. My paper entitled ‘Normative Measures of Tax Progressivity,’ co-authored with Hyun Hwa Son and published in March 2021 in the Journal of Economic Inequality, has proposed a general social welfare framework. All tax progressivity measures proposed in the literature can be derived from any given social welfare function. Using the general social welfare framework, our paper derived the Kakwani index from Amartya Sen’s social welfare function, which captures the relative deprivation suffered by society.

Social welfare interpretation of the Kakwani index

Suppose the government collects the tax revenue of $1 per person. The government can invest in public goods, other government services such as education, health, and welfare programs. Many governments in developed countries offer relief packages to their population in response to the COVID-19 pandemic. ‘There is no such thing as a free lunch’ is a well-known phrase implying that someone must pay the cost of implementing a policy. When the government collects tax revenue, society must incur social welfare loss. We can judge the efficacy of the tax system by the magnitude of social welfare loss contributed by the tax system.

The social welfare loss due to taxation can be decomposed into three contributions. First is the loss due to horizontal inequity, which occurs when the tax system does not treat all persons equally. The second is the loss when the tax system is proportional. The third is when the tax system is progressive or regressive. The progressive tax system contributes to the gain in social welfare, whereas the regressive tax system entails the loss in social welfare.

This decomposition provides the empirical estimates of each contribution. Thus, it informs policymakers how much gains (losses) a society suffers when the tax system is proportional, or progressive, or regressive.

Pre-tax income distributions

The blog offers an international comparison of tax progressivity in nine developed countries. This comparison requires pre-tax income distributions. We obtained these distributions for nine developed countries from the Luxembourg Income Study (LIS) database for 2013. Gross household income is the total monetary and non-monetary current income. Disposable income is the gross income net of taxes and social security contributions. Thus taxes include both income tax and social security payments.

We equalized household incomes and taxes (including social security payments) by dividing them by the square root of the number of household members. This equalizing procedure accounts for different needs of household members and economies of scale that occur in larger households.

An international comparison of tax progressivity

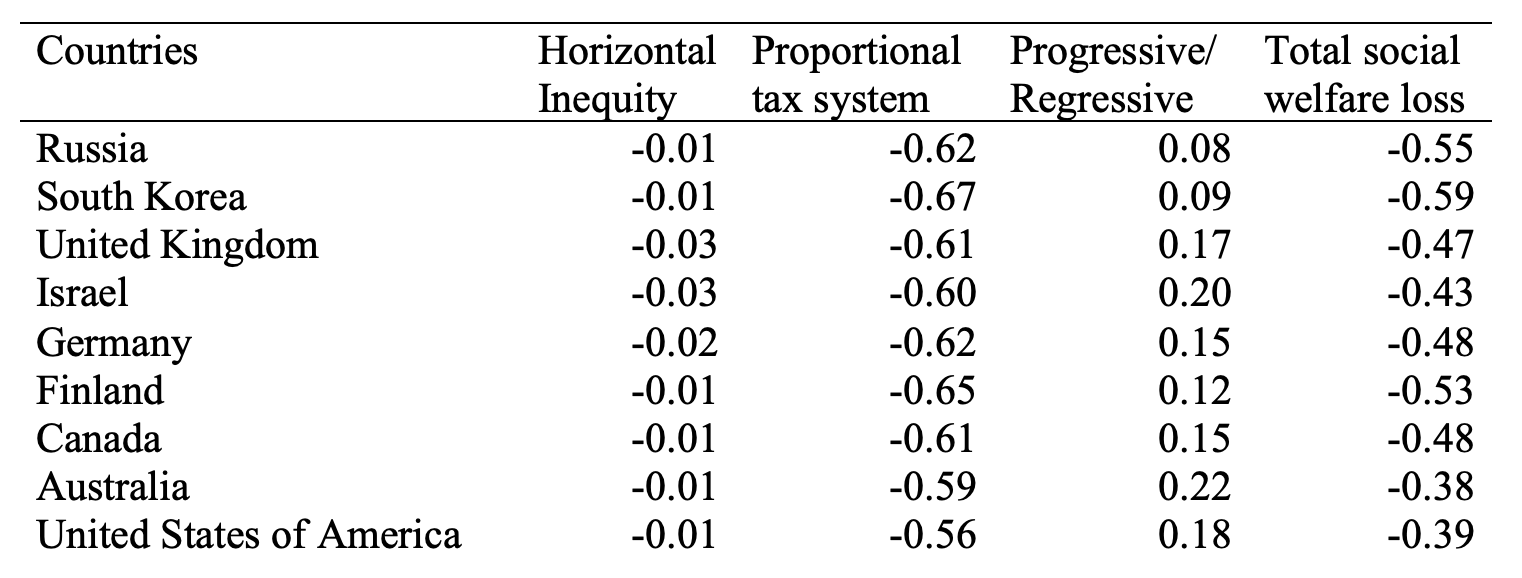

Table 1 presents the social welfare loss for nine countries when the governments collect the tax revenue of $1 per person in 2011 purchasing power parity (PPP). The PPPs are currency conversion rates used in cross-country comparisons. They ensure that all countries collect the same one dollar of tax in US dollar. Thus, we can compare the social welfare losses of countries with different currencies.

Table 1: Social welfare contributions of tax systems when the average tax collected is one dollar per person

Taking Australia as an example, the value of the progressivity index is 0.22, implying that the Australian tax system is progressive and contributes to a social welfare gain of 22 cents. If the tax system was proportional, there would be a loss of social welfare equal to 59 cents. Thus, the net loss of social welfare contributed by the Australian tax system is 37 cents. The Australian tax system also incurs a welfare loss of 0.01 cents due to horizontal inequity. The Australian tax system, therefore, contributes to the total social welfare loss of 38 cents. The Australian government gets one dollar of tax revenue, which it can invest in various social programs. For the Australian government to break even, it has to generate a social rate of return of 38% from its investments.

The social welfare lost due to taxation in other countries is much larger. For instance, the social welfare loss for Korea is 59 cents, which implies the Korean government has to generate a social rate of return of 59% when it invests its tax dollars in public investments. The main reason for this high social welfare loss is that the Korean tax system is relatively less progressive.

Almost all governments worldwide mobilise a significant proportion of their tax revenues from indirect taxation, which is always regressive. Hence, the loss of social welfare from taxation would be much higher. Suppose hypothetically, the tax in Australia was mildly regressive with the value of the progressivity index equal to –0.10. Under this scenario, the total loss of social welfare for Australia would have been 0.61. Hence to break even, the government needed to generate a social rate of 61% from its investment in public programs instead of 38% under the progressive tax. If the government failed to generate such a social rate of return, it would not be beneficial to impose a tax to finance the government’s other programs.

Furthermore, since the government incurs the administrative costs of tax collection, it will need to create a much higher social rate of return to break even. Optimal social welfare, therefore, requires three factors: (i) a tax system designed to be progressive; (ii) minimum administrative costs in collecting taxes; and (iii) efficient investments of tax revenues to maximise the social rates of return.

So, where does Australia stand relative to other advanced countries?

Table 1 makes informative comparisons of tax progressivity between nine advanced countries. In all nine countries, the progressivity index is positively contributing to gains in social welfare. All countries in our sample have progressive tax systems. Still, magnitudes of progressivity generating welfare gains vary widely.

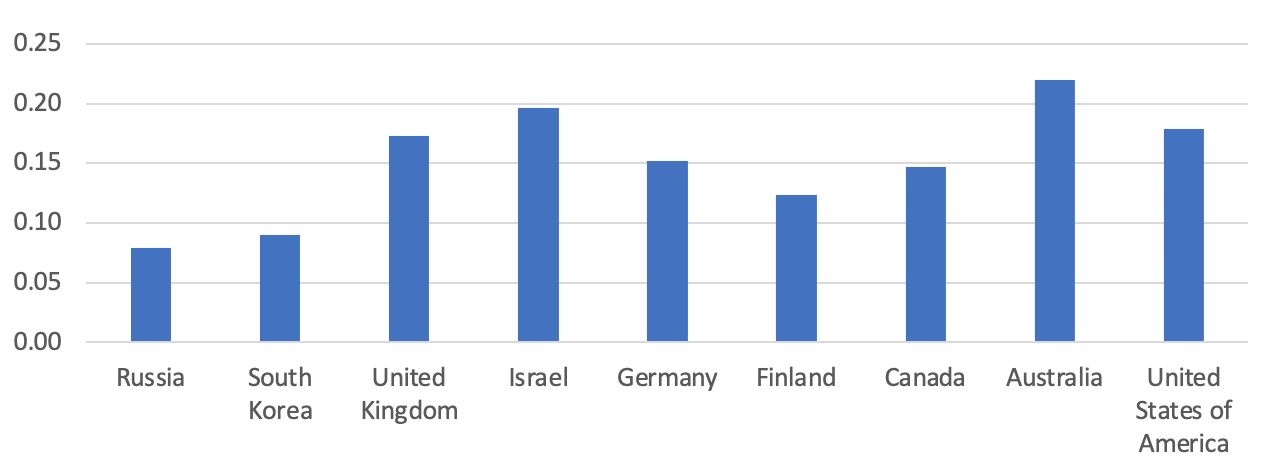

Figure 1 reveals that the Australian tax system generates the highest gain in social welfare due to tax progressivity at 22 cents for every dollar of tax the government collects. Its total social welfare loss of 38 cents is also the lowest. Russia and South Korea have the lowest progressivity gains of 8 and 9 cents, respectively. Their social gains are not significantly greater than 0, implying that their tax systems are almost proportional.

Figure 1: Gain in social welfare due to tax progressivity

The tax systems of all nine countries show small social welfare losses due to horizontal inequity, varying from 1 to 3 cents. So the horizontal inequity is not a severe issue in the tax systems across the developed countries. However, all countries’ tax systems reveal substantial total social welfare losses. To break even, they need to generate social rates of return varying from 38 to 59 percent.

Concluding remarks

Tax progressivity measures would be relevant for public policies if they gauge how tax systems lead to social welfare gains and losses. The literature on taxation has not explored the social welfare implications of the measures of tax progressivity.

This blog has explained how much progressivity (regressivity) of a tax system contributes to social welfare gains (losses). The blog concludes that any tax reform must consider three factors: (i) a tax system is progressive; (ii) it incurs minimum administrative costs in collecting taxes; and (iii) efficient investments of tax revenues to maximise the social rates of return.

Recent Comments