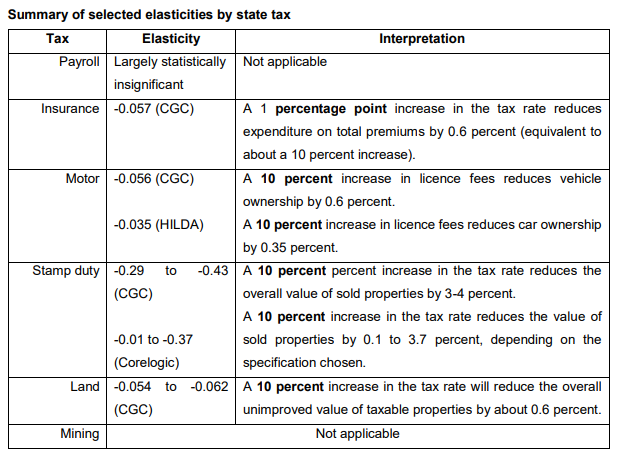

The Tax and Transfer Policy Institute has recently written a detailed report on Australian state and territories taxes and their elasticities (of revenue bases) for the Commonwealth Grants Commission. The results of this consultancy will be used to inform the Commission’s decision on whether to apply elasticity adjustments to its calculations of States’ revenue bases in the 2020 review.

State Tax Elasticities of Revenue Bases

Authors

Ralf Steinhauser, Mathias Sinning and Kristen Sobeck (TTPI)

Introduction

Determining the fiscal capacity of Australian States and Territories is challenging because variation in tax rates can affect the level of economic activity and the underlying revenue bases. The aim of this study is to estimate tax elasticities for a number of State taxes from a variety of existing data sources. In particular, we combine different data sources and econometric techniques to obtain reliable estimates of the effects of changes in tax rates on revenue bases (“tax elasticities”). As our main empirical strategy, we apply a difference-in-difference estimation approach by exploiting the variation in tax rates (and thresholds) across States and Territories and changes over time as ‘natural experiments’ to identify the effects of tax rate changes on revenue bases. We pay particular attention to potential endogeneity problems and employ instrumental variable appropriate to deal with possible specification problems.

Recent Comments