Taxing Wages is an annual publication by the Organisation for Economic Co-operation and Development (OECD), providing details of taxes paid on wages in OECD countries. The report covers personal income taxes and social security contributions paid by employees, social security contributions and payroll taxes paid by employers, and cash benefits received by in-work families. It illustrates how these taxes and benefits are calculated in each member country and examines how they impact household incomes.

Highlights

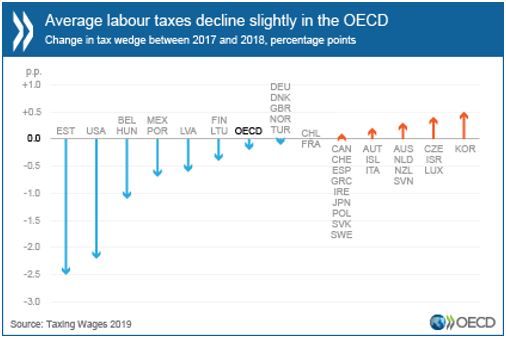

- Income tax and social security contributions declined slightly for the average worker across the OECD in 2018, driven by major reforms in a handful of countries (Estonia, the United States, Hungary and Belgium), according to the OECD report.

- The “tax wedge” – total taxes on labour costs paid by employees and employers, minus family benefits, as a percentage of the labour cost to the employer – was 36.1% in 2018. This represents a fall of 0.16 percentage points from 2017, and is the fourth consecutive annual decrease in the tax wedge on the average OECD worker.

- The report also considers the net personal average tax rate, which measures the income tax and social security contributions paid by employees, minus any family benefits received, as a share of gross wages. In 2018, the OECD average rate was 25.5%.

Median worker’s wage 20% lower than that of the average worker

The report also includes a Special Feature this year that looks at the taxation of the median worker in OECD countries, comparing this to the taxation of the average worker. In all OECD countries, the median worker has a lower wage than the average worker, due to higher differentials at the upper end of the income distribution. On average, the median worker earns 80.8% of the average wage and consequently faces a lower average tax wedge, at 34.3% compared to 36.1% for the average worker. This difference is primarily due to lower income taxes.

Country Summary: Australia

The employee net average tax rate is a measure of the net tax on labour income paid directly by the employee.

According to the report, in Australia, the average single worker faced a net average tax rate of 24.6% in 2018, compared with the OECD average of 25.5%. This means that the take-home pay of an average single worker, after tax and benefits, was 75.4% of their gross wage, compared with the OECD average of 74.5%.

Taking into account child related benefits and tax provisions, the employee net average tax rate for an average married worker with two children in Australia was reduced to 16.9% in 2018, which is the 14th highest in the OECD, and compares with 14.2% for the OECD average. This means that an average married worker with two children had a take-home pay, after tax and family benefits, of 83.1% of their gross wage, compared to 85.8% for the OECD average.

The tax wedge is a measure of the tax on labour income, which includes the tax paid by both the employee and the employer.

| Australia | 2018 tax wedge |

| Single person. 167% of average wage | 34.3% |

| Single person. 100% of average wage | 28.9% |

| Two-earner couple with 2 children. 100% and 67% of average wage | 27.0% |

| Two-earner couple with 2 children. 100% and 33% of average wage | 24.8% |

| Two-earner couple. 100% and 33% of average wage | 24.8% |

| Single person. 67% of average wage | 24.1% |

| One-earner couple with 2 children. 100% of average wage | 21.5% |

| Single person with 2 children. 67% of average wage | 1.9% |

Source: OECD Taxing Wages 2019, Compare your Country.

According to the report, the tax wedge for the average single worker in Australia increased by 0.3 percentage points from 28.6 in 2017 to 28.9 in 2018. The OECD average tax wedge in 2018 was 36.1 (2017, 36.2). In 2018 and 2017, Australia had the 30th lowest tax wedge among the 36 OECD member countries.

Australia had the 24th lowest tax wedge in the OECD for an average married worker with two children at 21.5% in 2018, which compares with the OECD average of 26.6%. The country occupied the 26th lowest position in 2017.

(Source: Media Release | Taxing Wages 2019 | Australia | Compare your Country)

Recent Comments