The OECD Taxation Working Papers are working papers from the Centre for Tax Policy and Administration of the OECD, covering the full range of the Centre’s work on taxation with the main focus on tax policy related issues.

Taxing vehicles, fuels, and road use: opportunities for improving transport tax practice

By Kurt van Dender

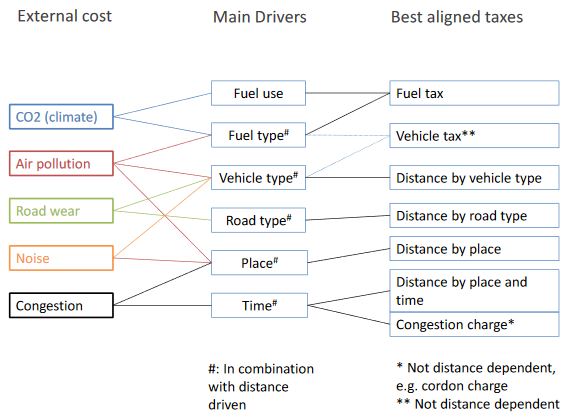

This paper discusses the main external costs related to road transport and the design of taxes to manage them. It provides an overview of evolving tax practice in the European Union and the United States and identifies opportunities for better alignment of transport taxes with external costs. There is considerable scope for improving transport tax practice, notably by increasing the use of taxes based on road use. Distance charges offer great promise in delivering more efficient road transport. In heavily congested areas, targeted charges are a cost-effective way of reducing congestion. Fiscal objectives provide an impetus for change as improving vehicle fuel efficiency and fleet penetration of alternative fuel vehicles erode traditional tax bases, particularly those relating to fossil fuel use. A gradual shift from an energy-based approach towards distance-based transport taxes has the potential to establish a stable tax base in the road transport sector in the long run.

Figure. External costs, drivers of external costs and tax instruments

Source: OECD 2019, Taxing vehicles, fuels, and road use: opportunities for improving transport tax practice, p. 21.

Source: OECD 2019, Taxing vehicles, fuels, and road use: opportunities for improving transport tax practice, p. 21.

The use of revenues from carbon pricing

By Melanie Marten and Kurt van Dender

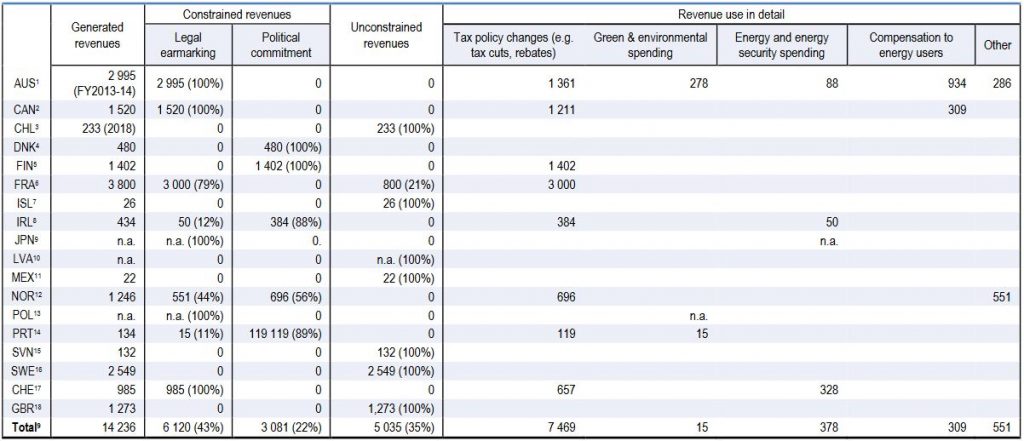

The paper collects comprehensive and detailed data on what 40 OECD and G20 economies do with the revenues from carbon taxes, emissions trading systems, and excise taxes on energy use. It notes that constraints – which can take the form of political commitments or legal earmarks – on revenue use differ between carbon taxes, emissions trading systems, and excise taxes. Constraints are less common for excise taxes, which also raise the most revenue. Carbon tax revenues are relatively often associated with environmental tax reforms, involving reductions in personal or corporate income taxes. Revenues from emissions trading systems are frequently directed towards green spending. The results may be relevant to the political economy of ambitious carbon pricing schemes in the sense that the political expedience of choices on revenue use may depend on the amount of revenue raised.

Table. Overview of use of constrained revenues generated from carbon taxes (EUR million) [click image to enlarge]

Source: OECD 2019, The use of revenues from carbon pricing, p. 38. The total generated revenues estimate does not include revenues generated from the (abolished) Carbon Pricing Mechanism in Australia.

Source: OECD 2019, The use of revenues from carbon pricing, p. 38. The total generated revenues estimate does not include revenues generated from the (abolished) Carbon Pricing Mechanism in Australia.

(Source: OECD iLibrary).

More from Austaxpolicy:

- Failing to See the Wood for the Trees? A Critical Analysis of Australia’s Tax Provisions for Land and Forest Conservation, by Evgeny Guglyuvatyy.

- From Dragon to Janus: Exploring Tax Policy for the Water-Energy Nexus, by Deborah Jarvie.

- Evaluating Australian Environmental Taxes through Behavioural Economics: A Case Study of the Sydney Harbour Bridge Charge, by Anna Belgiorno-Nettis.

Recent Comments