Our study sought to engage with the Māori perspectives in the Tax Working Group Future of Tax report and surrounding documentation. We agree with the assertion of the Tax Working Group that a Māori worldview can contribute to a more equitable and sustainable tax system. However, we argue that a clarification and recognition of Māori rights are required prior to transforming the tax system to reach this potential.

A troubling history of taxes and Māori

The application of taxation and accounting techniques for Māori in New Zealand have had a somewhat troubling history. This is because taxation and accounting techniques have been implicated in the dispossession of Māori land and other resources.

Keith Hooper and Kate Kearins have illustrated this historical relationship through various studies. For example, taxation by pre-emption through the monopoly purchase of land by the State for substantial profit effectively operated as a capital gains tax on Māori. Further, because of a lack of formal representation, this was taxation without representation. Hooper and Kearins also note examples of undervaluing Māori land, exploiting the State’s single-buyer position, extortionate transaction and valuation costs, and the use of local Land Boards as agents, as implicated in dispossession.

More recently, Te Maire Tau outlines some of the challenges faced by Māori regarding use of their own land. A combination of legislation and regulation resulted in difficulties for decision-making. This included the cutting up of land into smaller parcels creating commercial challenges, and then the rezoning of land creating residential challenges. Soon after these changes, Māori land was subject to rate charging and because this land was not commercially or residentially viable, it often had to be sold to cover unpaid rates.

These land subdivision, zoning and rate charging practices had the dual effect of making cheap Māori reserve land available for the predominantly settler agricultural economy, and causing Māori to move into cities to provide labour for the predominantly settler industrial economy. These subtle techniques of colonisation and dispossession are often hidden under the guise of equality, but have devastating intergenerational effects nonetheless.

Any reform of the tax system must recognise and confront this historical reality and honour the rights guaranteed to Māori under Te Tiriti o Waitangi (the Treaty of Waitangi), which is a written agreement between the British Crown and more than 500 Māori leaders. Te Tiriti makes concrete promises to Māori regarding their rights.

The He Ara Wairora framework

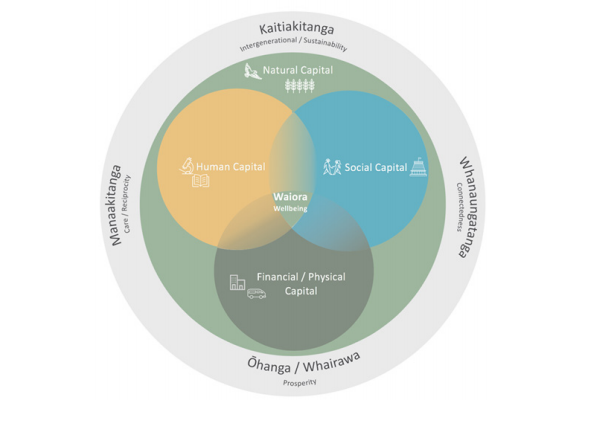

The frameworks that have emerged out of close consultation with the diverse layers of Māoridom around The Treasury’s Living Standards Framework and the Tax Working Group inquiry have the potential to transform the tax system. For example, Figure 1 below depicts the He Ara Waiora framework. Here we engage with the report on Recommendations for Advancement of this framework, developed in consultation with Māori communities by Sacha McMeeking, Hamuera Kahi and Komene Kururangi.

The framework is centred on the concept of ‘waiora’, a Māori expression of wellbeing. This acknowledges that wai (water) is the source of all life. Here a moral imperative for wellbeing within the tax system could be ‘all New Zealanders live a life they value, with specific recognition of Māori living the lives that Māori value and have reason to value’.

Figure 1: He Ara Waiora — A Pathway towards Wellbeing

Source: Tax Working Group (2019)

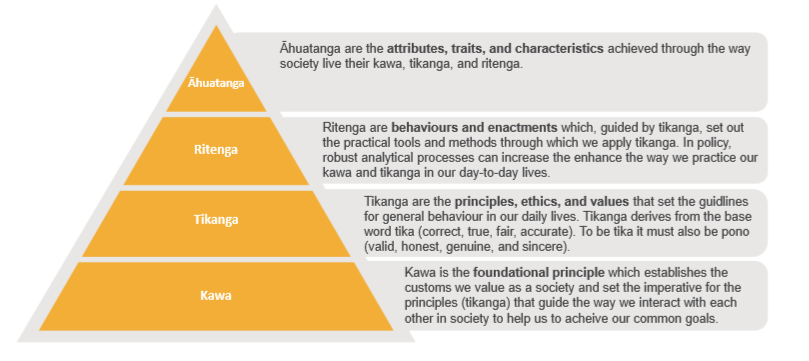

During consultations around the He Ara Waiora framework, the potential for tokenistic gestures and the distortion of Māori values and ethics emerged as a concern. By tokenistic gestures, we mean gestures that have no substance nor display any sort of material change.

To counter this concern, Mānuka Henare proposed a cascading implementation model to provide a tangible way to operationalise the values into practical and measurable objectives and outcomes. This model is designed to give ‘cascading and tangible guidance to the purpose’, performance measures, and outcome elements of policy design while maintaining the integrity of Māori ways of knowing and being. This is depicted in Figure 2.

Figure 2: Cascading Tikanga Implementation Model

Source: Tax Working Group (2019)

A Māori worldview could transform the tax system, but rights must first be acknowledged

These frameworks do have the potential to transform the taxation system, by operationalising a Māori worldview into tangible policy objectives and outcomes, while ensuring the integrity of the worldview that recognises intimate relations between people and place across generations. While these frameworks present useful ways to develop, implement and evaluate a tax system according to Māori custom, clarifying rights under Te Tiriti o Waitangi is a fundamental means through which to address these concerns.

Well-defined rights will address the concerns of tokenism, distortion and performance gaps by providing more certainty and authority in policy development. In contrast, extracting Māori knowledge from communities of practice in symbolic ways, without respecting the rights of Māori guaranteed under the Te Tiriti and the United Nations Declaration on the Rights of Indigenous Peoples, is simply another form of colonial dispossession.

Māori perspectives are particularly useful because they can provide the necessary systems-thinking to tax policy in order to make that policy work for current and future generations, and for the environment. Māori are more than happy to share and develop this worldview in order to imagine and create more positive futures together, although it is worth restating the diversity of thought within the Māori world. While a Māori perspective on the development and implementation of an equitable tax system can have clear benefits with nuance and time, these benefits require effective communication.

Achievement of genuine Government–Māori partnerships requires clear and concise strategies that communicate to the public why Māori engagement in developing tax policy is not just an obligation on the Government under Te Tiriti, it is a process that will bring positive outcomes for all New Zealanders.

Editorial note: This post is part of a special series to mark the anniversary of the release of the final report of New Zealand’s Tax Working Group and to assess its findings. The final report, Future of Tax, was released on 21 February 2019. The Group, chaired by former New Zealand Finance Minister Michael Cullen, was established by the Government of New Zealand in 2017 to consider the future of the New Zealand tax system. It was the latest major tax review after reviews in 2001 and 2010. Discussion papers and submissions to the Working Group are available at the website: https://taxworkinggroup.govt.nz/.

A minor correction about author attribution of a report was made on 3 April 2020 subsequent to publication of the article.

Further reading

Scobie, M & Love, TR 2019, ‘The Treaty and the Tax Working Group: Tikanga or tokenistic gestures?’, Journal of Australian Taxation, vol. 21, no. 2, pp. 1-14.

New Zealand’s Tax Working Group series

How NZ Tax Working Group Recommendations Differs From Previous Reviews? The Influence of the Living Standards Framework and Māori Principles, by Alison Pavlovich.

The Tax Working Group and Capital Gains Tax in New Zealand — A Missed Opportunity?, by Andrew Maples and Sue Yong.

The Tax Working Group and the Circular Economy: Context and Challenges, by Jonathan Barrett and Kathleen Makale.

Recent Comments