Digitalisation and the platform economy have severed the connection between the international corporate tax system and economic reality. Generally, the platform economy is an economic ecosystem structured around digital platform firms. These firms supply various digital services and have a multisided business structure, which aims to create value from interactions between different groups of the platform’s customers.

Challenges of taxing multinational platform firms

The idea that the business profits of multinationals should be taxed where value is created has been described as the ‘new gold standard’ or the key ‘principle’ for the allocation of business profits among tax jurisdictions. In this paradigm, understanding value creation processes is critical to the design of international tax policy.

The task of locating where value is created is more challenging when in dealing with digital platform firms such as Google, Facebook, Uber, Booking.com and Alibaba.

The rapid rise of the giant multinational platforms has triggered a search for a mechanism to ensure a ‘fair share’ of these businesses’ profits is taxed in the jurisdictions where these businesses derive their income but where they presently often pay little or no income tax. Tax policy makers were ill-equipped to tax the profits of multilateral platforms, because tax laws and international tax system were designed around single-sided cross-border businesses. Without any international consensus on the taxation of multinational platforms, some countries have adopted unilateral measures including the extension of the permanent establishment definition, introduction of anti-avoidance taxes and provisions, levying of withholding or excise taxes on some digital services.

The profitability of a firm with a single-sided business depends on the cost of production and the total value of the economic output of the firm.

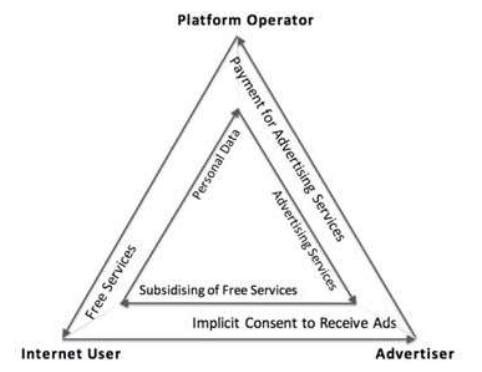

In contrast, the profitability of a platform firm is a result of an overall cycle of exchanges of resources and products that take place between the firm and its customers on all sides of the platform. This is illustrated by Figure 1 in relation to internet advertising.

Figure 1: Value Creation in a Platform Firm that Derives Income from Internet Advertising Services (source: author)

When a platform firm is multinational, this overall cycle of exchanges spans territories of many countries and takes place on these countries’ internet infrastructure. For the platform firm, this cycle creates normal returns to investment and various rents, including the rent from participation of the internet user in the firm’s production process.

The value created by a multinational platform firm cannot be neatly divided into country segments under the existing international corporate tax system. The failure of this system to allocate the business profits of multinational platform firms in accordance with value creation results from two sets of problems: (1) problems with the measurement of value added (problems of price), and (2) problems with the identification of location where value was added (problems of place).

The problems of price include measurement difficulties related to intangibles; multisided market business structures; the integrated nature of production and distribution of digital services; and customer participation in a value creation process.

The problems of place include difficulties with the identification of the geographical location of economic value creation when a value creation process is non-territorial, or suppliers of digital services are virtually present in the economic life of a market state, or income is stateless.

The problems of price could be solved, or at least mitigated, by the development of some proxies for the value added or created. However, the solution to the problems of place would require either a fundamentally new international corporate tax system or should be sought outside of this system.

Reforming the international corporate tax system

A reformed international corporate tax system must recognise three key facts.

First, a multinational platform firm, like any other multinational firm, operates as a single economic unit. This unit should be treated as a single taxpayer with corporate tax liability arising in all countries where this firm generates value.

Second, multinational platform firms (and certain other types of multinationals) create value in a single, integrated economic and technological environment that spans the territories of many countries and extraterritorial zones. In recognition of the right to impose taxes in the international corporate tax system, all the profit of a multinational platform firm should be divided among countries where the firm operates.

Profits that result from value added within a single country should be allocated to that country. Other profits (as well as losses) should be apportioned among all countries that have contributed to the integrated economic and technological environment where the firm generates its profits. This could be all of the countries in a region where the firm operates or (virtually) all countries if the scale of the firm’s operations is truly global.

Third, a multinational platform firm (and many other highly digitalised businesses) participates in the economic life of many countries via the internet. If the internet remains a global network and marketplace, then the taxation of profits should reflect the economic activities conducted within the internet infrastructure and compensate the contributions of many countries to the maintenance of this global infrastructure.

A Digital Services Tax might be a realistic alternative

An international corporate tax system reformed as suggested above seems unlikely in the foreseeable future. The lack of competition in many markets for digital services made these developments even more harmful to the tax bases of many countries. These countries can try to fix the international corporate tax system or look for alternative ways to recover the lost corporate tax revenue.

A Digital Services Tax (DST) could be a realistic alternative response to the challenges caused by the rise of the global platform economy. A DST is a tax on revenue of large digital firms from some digital services (usually online advertising and services of online marketplaces). An alternative is a government royalty charge or licence fee for access to digital data produced by or obtained from customers of a multinational platform firm who are in a country.

A DST will not entirely solve the problems of price and place. However, it will mitigate concerns of many states that they are losing significant tax revenue as a result of the lack of a recognised nexus with the business profits of multinational platform firms. The DST should be based on clear principles and supported by rules to mitigate juridical double taxation of these revenues, so the proposal should be developed in a coordinated manner.

This article is based on Victoria Plekhanova, ‘Value creation within multinational platform firms: a challenge for the international corporate tax system’, eJournal of Tax Research (2020) vol. 17, no. 2, pp. 280-320.

Recent Comments