Ahead of next week’s Federal Budget, the annual Per Capita Tax Survey provides important insights into the views held by Australians of all ages, from across the country, about the role of tax and public services in the wake of COVID-19.

The 2020 survey is our tenth and, as in previous years, we put the poll out to a representative sample of Australians in February 2020, intending to publish the results ahead of the scheduled federal budget in May. And then everything changed. The onset of the COVID-19 pandemic in March caused chaos across the world, upending social and economic norms and throwing the plans of families and workplaces into disarray. Governments scrambled to shore up businesses and households as economic activity was shut down almost overnight, and the federal budget was put on hold until October.

In the wake of the carnage, it seemed that the views of Australians towards their tax and transfer system in that final, normal month before COVID hit were largely irrelevant to the urgent decisions being taken by policy makers and political leaders across the country. So we put the 2020 tax survey into a digital drawer, and directed our attention to more pressing issues.

Six months later, as we slowly became accustomed to the unpredictable, unsettling and uncertain reality of our ‘COVID-normal’ new lives, it seemed appropriate to venture a second survey, repeating the questions, updated where necessary to reflect policy changes, in order to see what, if any, changes the extraordinary circumstances of 2020 may have made to the views of Australians toward their economic system.

And so we have, for the first time in the Survey’s decade-long history, two sets of results – one from February, before the world changed, and one from August, when the country was beginning to grapple with the fallout of the pandemic, and the biggest economic collapse in a century.

Political and policy debates in the lead up to the October Budget

These changed social and economic circumstances have, of course, also changed the political context in which the second 2020 survey was conducted. The impact of an unprecedented health crisis put pause to the usual political bickering over the finer points of social and economic policy between the major parties.

Similarly, our state and federal leaders have rightly tried to put partisan politics aside as they work together to protect businesses and households from the worst of the economic damage wrought by the pandemic, and sought consensus on a range of measures to provide support for people in the face of the highest levels of unemployment in a generation or more.

However, as we approach the federal budget in October, policy differences and disputes are beginning to emerge. Voices from business, academia, civil society, and the press are growing more urgent in their calls for specific medium- and long-term interventions to hasten the return of economic activity, and put Australia back on a path towards sustainable growth.

Some champion a return to the policies of the past, focussing on supply-side solutions for what is clearly the most demand-led economic collapse in Australia’s history. Others are demanding nothing less than an economic revolution, asserting that government debt is a mirage, and sovereign nations can simply ‘print money’ to spend their way out of this depression.

The most persuasive voices, as always, lie somewhere in between. the overwhelming majority of mainstream economists agree that the size of government debt is the last thing to worry about in the face of such a serious economic collapse, particularly with unemployment rates tipped to hit double digits by Christmas and remain close to 10% throughout 2021. The Reserve Bank entered the crisis with little firepower left in its monetary arsenal and, with the price of federal debt at record lows, has been urging the Government to unleash fiscal policy in order to invest heavily in the productive capacity of the economy since mid-2019.

With renewed appreciation of public services, Australians want governments to borrow more and spend more

In the context of these challenges, the 2020 Per Capita Tax Survey lays bare the views of Australians during the most significant social and economic disruption in living memory. It provides valuable insights to policy makers for the months ahead.

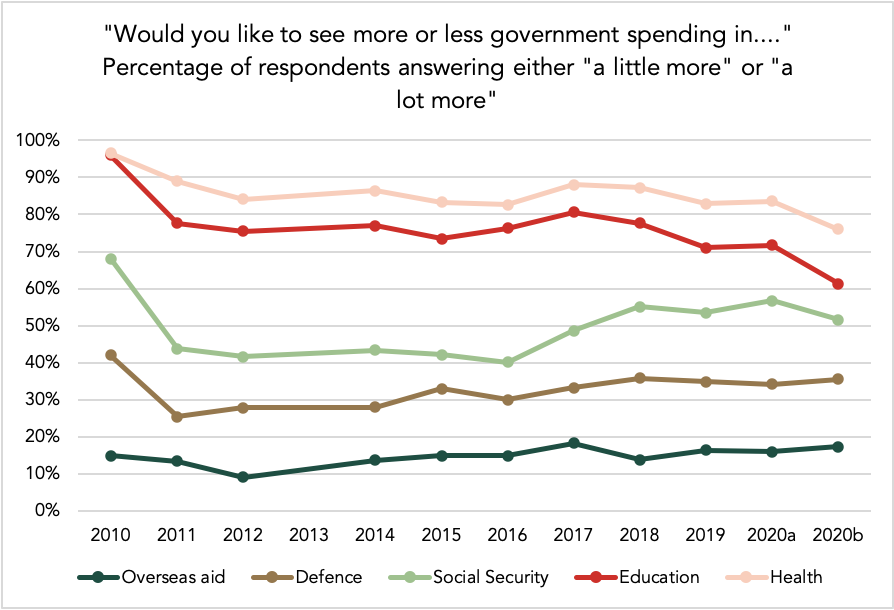

Australians apparently have a renewed appreciation of the essential services provided through our system of government: scores for the value, accessibility, quality and usefulness of public services all showing notable increases between February and August. A greater number of Australians also appear to be more comfortable with the level of government spending on services now than they were prior to COVID-1, and despite the record outlays of recent months, a majority of respondents still want to see governments spend more on health, education and social security.

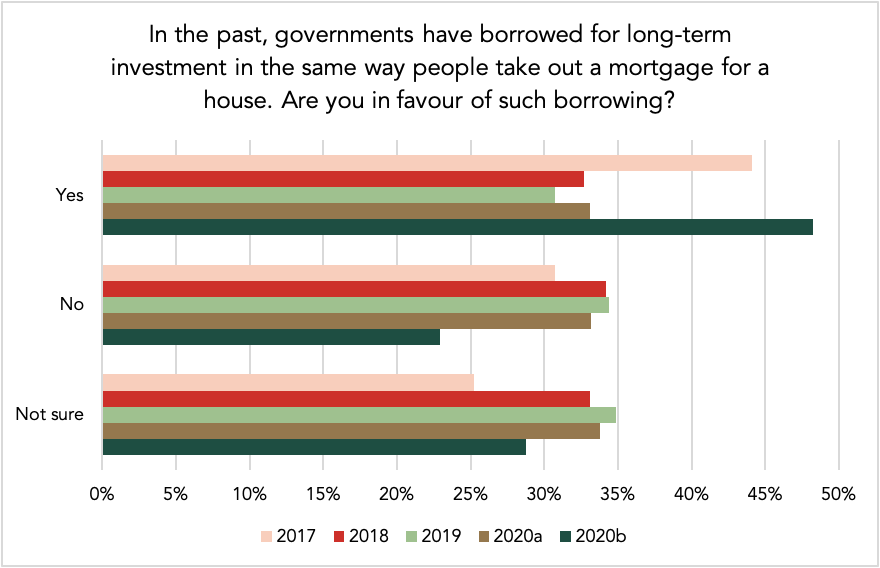

Public approval of the use of government debt to underpin long-term investment is also significantly higher compared to previous surveys, with a remarkable 15 percentage point increase in support over the six months since the pandemic hit.

Australians also seem to be more comfortable with the levels of tax they pay, with the proportion of those complaining they pay too much dropping by around 5 percentage points, and a commensurate increase in the percentage who feel their contribution is about right.

As in previous years, though, a significant majority of respondents believe that big business doesn’t pay its fair share of tax, and that corporate tax avoidance affects the fairness of Australia’s taxation system. Most survey participants also believe that high income earners should pay more tax.

Support is weak for Stage 3 tax cuts and high for increase to JobSeeker

Some of the most interesting findings this year relate to changed attitudes to current policy debates between February and August.

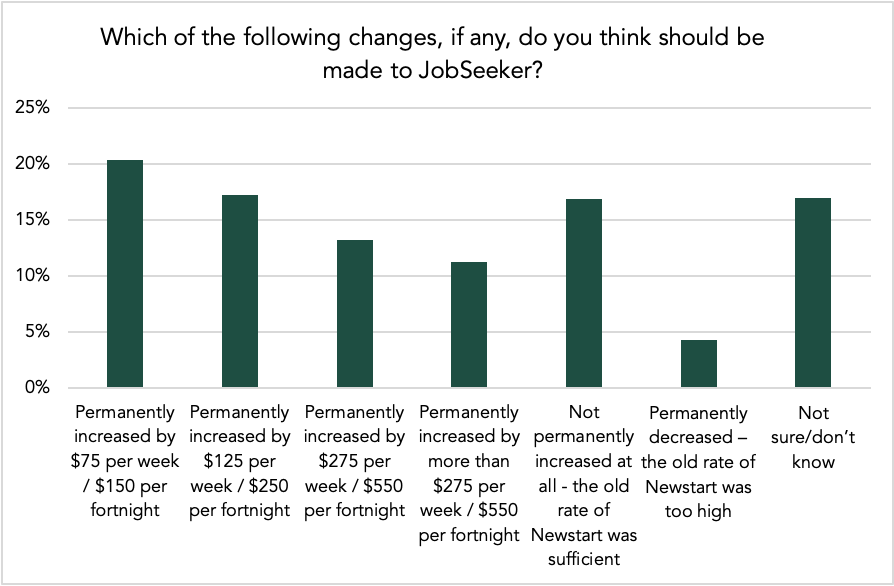

Support for a significant, permanent increase in the rate of JobSeeker (previously known as Newstart) is significantly higher than it was pre-pandemic, and enjoys majority support among voters of all persuasions, with almost 6 in 10 of Coalition voters, and 7 in 10 of those who vote for Labor or the Greens supporting a long-term lift in the rate of at least $75 per week.

Despite the Government’s decision to reduce the Coronavirus supplement by $300 per fortnight, to $250, from 25 September, almost one in four respondents wanted to see the $550 a fortnight supplement implemented in April retained permanently and in full.

Conversely, level of support for the Government’s Stage 3 tax cuts is weak, with only 13% of respondent supporting the current distribution of the cuts, which overwhelmingly favour high income earners.

By August, support for those tax cuts for high income earners, even if bigger tax cuts were given to those lower down the income scale, was down to 29.9% while the proportion who said the Stage 3 cuts should be reduced or stopped was 46.4%. This issue is divided along party lines, with over a third of Coalition voters in support, compared to just over a quarter of Greens voters and only one in five of those who vote for Labor.

Choices are clear, the Government should support a fair go

It seems there is little doubt that Australians would prefer the Government to invest in supporting the living standards of those unable to find work in the most challenging labour market we have seen in three decades, rather than giving more money away to those who are lucky enough to still have a job paying in excess of $180,000 a year.

As we seek to restore and rebuild after this tremendous social and economic shock, the choices before us are clear, as are the views of Australians. Most of us want to see an approach to fiscal policy that will promote fairness and reduce inequality. Most of us want to see investment in the essential services and public goods that have, for generations, provided Australians with among the highest average standards of living in the world.

The Per Capita Tax Survey 2020 demonstrates that the crisis caused by COVID-19 has only strengthened Australians’ belief in the fair go, and in ensuring that we keep the promise of Australia for our children and grandchildren.

Emma Dawson is author of the 2020 Per Capita Tax Survey. The full report of the survey can be accessed here: https://percapita.org.au/our_work/the-per-capita-tax-survey-2020/.

Other Budget Forum 2020 articles

Blink and You’ll Miss It: What the Budget Did for Working Mums, by Miranda Stewart.

Economic Stimulus through a Gender Lens: Why the Budget Did Not Deliver, by Helen Hodgson.

Progressivity and the Personal Income Tax Plan, by Sonali Walpola and Yuan Ping.

Training Subsidies and Market Failures, by John Freebairn.

Getting Coherence into the Equity Debate – Part 3, by Andrew Podger.

Getting Coherence into the Equity Debate – Part 2, by Andrew Podger.

Getting Coherence into the Equity Debate – Part 1, by Andrew Podger.

What Has Volunteering Got to Do With the Budget? By Sue Regan.

Talk of Aspiration Is Not Borne Out in Federal Budget Papers, by John Hewson.

Asymmetric Taxation of Business Income and Losses, by John Freebairn.

Economic Security for Older Partnered Women and Widows: Fixing Gaps in Australia’s Superannuation System, by Monica Costa, Helen Hodgson, Siobhan Austen and Rhonda Sharp.

Heroic Assumptions in Budget Omit One Major Threat: A Global Debt Crunch, by John Hewson.

Dream Budget or Not? by Shumi Akhtar.

Will Instant Asset Write-Offs Boost Jobs? by Michael Coelli.

It’s Not the Size of the Budget Deficit That Counts; It’s How You Use It, by Steven Hamilton.

Looking for Bold Reform? Get Rid of Payroll Taxes, by Robert Breunig.

It’s Time to Meet Key Social Policy Challenges in COVID Recovery, by John Hewson.

Meet the Liveable Income Guarantee, a Budget-Ready Proposal That Would Prevent Unemployment Benefits Falling off a Cliff, by John Quiggin, Elise Klein and Troy Henderson.

Amazingly well constructed information at this important time, which I’ll be sharing and discussing a lot over the next week. Thankyou for all your work @PerCapita