In 2022, we published a report examining alternative models of political party funding in Aotearoa New Zealand. As part of this work, we explored alternatives to the current model that relies, as most countries do, on private donations as the primary source of financing for political party electioneering. At present, the only state fund allocated for this purpose in New Zealand is the election year broadcasting allocation, which is just over NZ$4 million in 2023.

As political party membership has declined in New Zealand, and the costs of electioneering has increased, parties have become increasingly reliant on private donations. As with most countries, political parties in New Zealand mostly rely on a small number of large donors. This generates several problems, particularly the potential for this minority to have greater influence over policy than the broader public. This diminishes public trust and damages the democratic process. Moreover, there have been several scandals, resulting from large political party donations.

One option we canvassed was introducing tax credits for political party donations, alongside capping private donations (currently there is no upper limit to the amount of political donations). New Zealand currently provides a tax credit of 33 per cent for donations to approved charities and organisations but, unlike Australia, this is not available for donations to political parties.

Tax credits for political party donations can encourage participation in the democratic process by providing a financial incentive for the public to engage with political parties and a strong incentive for political parties to engage with the public to attract funding. Increased political participation increases the voices that are heard in policy debates. In the absence of state support, it is often those who are wealthier and have higher levels of discretionary income who can afford to make donations.

While donors are likely to primarily be in the higher income quintile, research shows that at least some donors are likely to be in the lowest quintile. In addition, research shows that the presence of tax credits results in the donor pool more closely resembling the general population, than in the absence of tax credits.

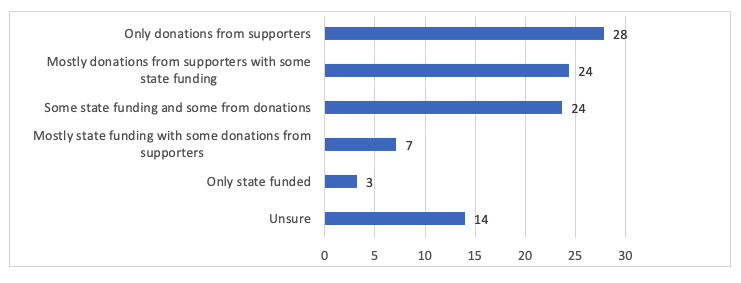

During our study we collected data from a survey of just over 1,000 respondents. We asked our survey participants what they believed was the right balance of funding for political parties. These responses are shown in the figure below. While 28% responded that they did not think political parties should receive any state funding, 58% supported at least some state funding.

Our survey also asked respondents their views on different forms of state funding. Tax credits were the most attractive to respondents, with 44% supporting or strongly supporting this option; 33% were undecided, and 23% did not support tax credits.

A relatively low cost with a potential big impact

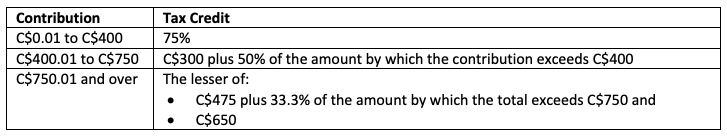

In our research, we use the Canadian tax credit model to assess if this could be viable in New Zealand. The table below outlines the tax credits that are available for political donations in Canada. Under the Canadian model, the smallest contributions generate the greatest financial incentives. As shown in the table, the first C$400 donated attracts a tax credit of 75%. What this means is that for a donation of C$400, the individual receives a C$300 tax credit. The next C$350 donated receives a tax credit of 50%. Donations over C$750 receive a tax credit of 33.3% up to a maximum credit of C$650 (achieved with a donation of C$1,275).

In our analysis, we started by calculating the total amount of large donations made to political parties in 2020 (an election year). This was just under NZ$7 million.

As the number of individual number of donors in New Zealand is not disclosed, we extrapolate from the number of donors in Canada, which was 248,080 in 2021 (an election year). Canada is approximately 7.5 times the size of New Zealand, measured by population. Adjusting for the New Zealand population gives us approximately 33,000 donors, assuming roughly equivalent political participation.

The average value of donations across the five main parties in Canada is C$239 (NZ$275). Again, assuming a similar contribution in New Zealand, this would total just over NZ$9 million: 30% more than what was donated in the last election year.

Assuming a similar tax credit scheme as in Canada, the cost to a donor, for an average donation, would be $68.75 after receiving the tax credit, about 25% of the average $275 donation. The cost to the government under this approach, again assuming an average donation value of NZ$275 made by 33,000 donors, would be NZ$6.8 million.

Therefore, for roughly NZ$2.35 per voter (there were close to 2.9 million voters at the last general election in 2020), large donations and the attendant opportunity for undue influence could be eliminated from the political funding system. In practice, the cost to the government would be lower than this as not all tax credits would be claimed. Research from Canada suggests this could be as few as 50% of eligible tax credits.

For a relatively low cost, we argue it is possible to improve trust in the funding system and minimise the potential for a small number of wealthy individuals to have undue influence from their large financial donations to political parties. Tax credits provide more opportunity for broad political participation and have the capacity to reflect voter preferences effectively.

At the time of writing in July 2023, an ongoing Independent Electoral Review is reviewing several aspects of New Zealand’s electoral system. Since the completion of our report, the New Zealand Independent Electoral Review has published its interim report. Among the recommendations is the introduction of tax credits of 33 per cent for political donations up to $1,000. While this is less generous than our proposal, it is a good starting point from which to further discussions on alternative ways of funding political parties.

This article is based on our publication: Lisa Marriott and Max Rashbrooke, “Tax credits as a mechanism for political party funding in Aotearoa New Zealand: an exploratory study” (2023) Australian Journal of Political Science 58(2):192-209 (Open Access).

Pingback: Political Donations and Tax Deductions - Austaxpolicy: The Tax and Transfer Policy Blog