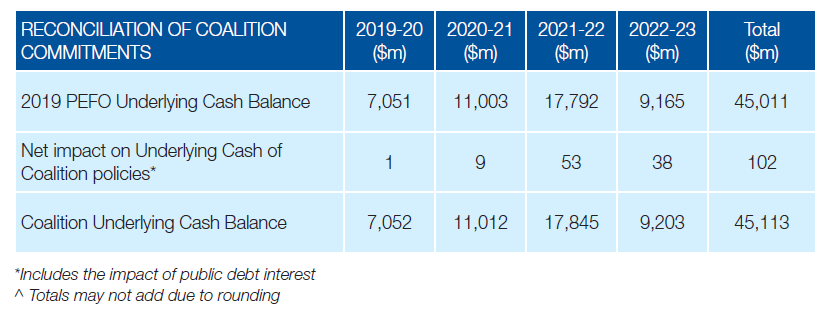

The Liberal Party of Australia has released an updated budget plan, based on its initial budget proposals on 2 April 2019. The update forecasts a slight overall increase in the cumulative surplus, expecting it to be $45.1 billion over the next four years (Figure 1).

Key points of the Liberals’ budget plan include:

- Delivers a budget surplus next year, at $7.1 billion (around 0.4 per cent of GDP). It forecasts budget surpluses exceeding one per cent of GDP from 2026-27 onwards.

- Keeps taxes as a share of GDP capped at 23.9 per cent.

- Reduces debt as a share of GDP, forecasting zero net debt for 2029-30.

- Increases the cumulative surpluses outlined in the 2019 PEFO by $102 million over the forward estimates period, building spending commitments to $3.8 billion over the medium term.

- Offsets spending commitments by new savings of $1.5 billion over the forward estimates, building to $5 billion over the medium term.

Figure 1. Liberals Budget Plan

Projected savings come from an equivalent $1.5 billion reduction of departmental funding to Government agencies. The budget plan proposes maintaining this efficiency dividend at its current level of 2 per cent for a further two years, before stepping it down to 1.5 per cent in 2021-22 and returning to the base rate of 1 per cent from 2022-23.

Related news

AusVotes2019: Labor Releases Budget Plan

AusVotes 2019: Pre-Election Economic and Fiscal Outlook Report

Australian Budget 2019-20: $7.1 Billion Surplus Forecast and More Tax Cuts

On the blog: Budget Forum 2019

The Instant Asset Write-off Will Lift Investment—but Is That What We Want?, by Steven Hamilton

Refundable Franking Credits: Why Reform Is Needed (and Why It Should Be Targeted) – Part 1, by John Taylor and Ann Kayis-Kumar

Refundable Franking Credits: Why Reform Is Needed (and Why It Should Be Targeted) – Part 2, by John Taylor and Ann Kayis-Kumar

“All Without Increasing Taxes”? A Closer Look at Treasurer Frydenberg’s Refrain Repeated Eight Times in His Budget Speech, by John Taylor and Ann Kayis-Kumar

Tax Offsets and Equity in the Scheme for Taxing Resident Individuals, by Sonali Walpolaand Yuan Ping

Forecasts and Deviations – the Challenge of Accountable Budget Forecasting, by Teck Chi Wong

Targeted Tax Relief Makes the Tax System Fairer but the Economy Poorer, by Steven Hamilton

A Simpler Tax System Should Spark Joy—Eliminating Tax Brackets Sadly Doesn’t, by Steven Hamilton

A Budget That Supports Indigenous Australians?, by Nicholas Biddle

Women in Economics 2019 Federal Budget Reflections, by Danielle Wood

Tax Progressivity in Australia: Things Aren’t as Simple as They Seem, by Chung Tran and Nabeeh Zakariyya

Coalition and Labor Voters Share Policy Priorities When They Are Informed About Inequality, by Chris Hoy

Future Budgets Are Going to Have to Spend More on Welfare, Which Is Fine. It’s Spending on Us, by Peter Whiteford

Recent Comments