The Charter of Budget Honesty Act 1998 provides for the Secretary to the Treasury and the Secretary of the Department of Finance to release publicly a Pre‑election Economic and Fiscal Outlook report (PEFO) within 10 days of the issue of the writs for a general election. The information in the report takes into account all Government decisions and all other circumstances that may have a material effect on the economic and fiscal outlook that were in existence before the issue of the writs for the election.

The PEFO does not include the impact of commitments made in the context of the current election campaign. However, the report includes:

- fiscal estimates and projections for the current financial year (2018‑19) and the following four financial years (2019‑20, 2020‑21, 2021‑22 and 2022‑23);

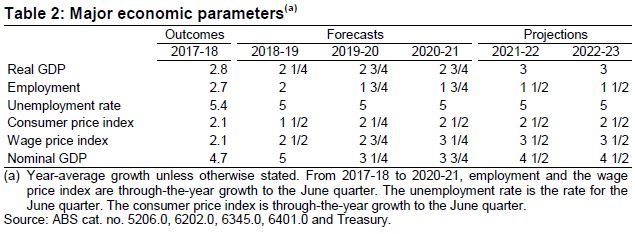

- economic and other assumptions for the current financial year and the following four financial years used in preparing these updated fiscal estimates;

- discussion of the sensitivity of updated fiscal estimates to changes in those economic and other assumptions and refers to the detailed analysis in the 2019‑20 Budget that remains unchanged;

- Appendix A: an updated set of financial statements and summary of the external reporting standards used in the preparation of the PEFO;

- Appendix B: a list of policy decisions taken by the Government since the 2019‑20 Budget and decisions that were taken but not announced at that time;

- Appendix C: an updated statement of the risks that may have a material effect on the fiscal outlook.

Highlights

- As the writs for the 2019 election were issued on 11 April, the report notes that the economic and fiscal outlook for the Commonwealth has not materially changed since the publication of the 2019-20 Budget on 2 April 2019.

Source: Pre‑election Economic and Fiscal Outlook report.

Source: Pre‑election Economic and Fiscal Outlook report.

- In regards to the fiscal outlook, an underlying cash surplus of $7.1 billion (0.4 per cent of GDP) is expected in 2019-20, with further surpluses expected across the forward estimates.

- The ‘Energy Assistance Payment – extension to additional payments’ accounts for 94% of the increase in 2018-19 expense measures since the Budget 2019-20, at 87.1 million.

(Source: PEFO 2019)

On the blog: Budget Forum 2019

The Instant Asset Write-off Will Lift Investment—but Is That What We Want?, by Steven Hamilton

Refundable Franking Credits: Why Reform Is Needed (and Why It Should Be Targeted) – Part 1, by John Taylor and Ann Kayis-Kumar

Refundable Franking Credits: Why Reform Is Needed (and Why It Should Be Targeted) – Part 2, by John Taylor and Ann Kayis-Kumar

“All Without Increasing Taxes”? A Closer Look at Treasurer Frydenberg’s Refrain Repeated Eight Times in His Budget Speech, by John Taylor and Ann Kayis-Kumar

Tax Offsets and Equity in the Scheme for Taxing Resident Individuals, by Sonali Walpolaand Yuan Ping

Forecasts and Deviations – the Challenge of Accountable Budget Forecasting, by Teck Chi Wong

Targeted Tax Relief Makes the Tax System Fairer but the Economy Poorer, by Steven Hamilton

A Simpler Tax System Should Spark Joy—Eliminating Tax Brackets Sadly Doesn’t, by Steven Hamilton

A Budget That Supports Indigenous Australians?, by Nicholas Biddle

Women in Economics 2019 Federal Budget Reflections, by Danielle Wood

Tax Progressivity in Australia: Things Aren’t as Simple as They Seem, by Chung Tran and Nabeeh Zakariyya

Coalition and Labor Voters Share Policy Priorities When They Are Informed About Inequality, by Chris Hoy

Future Budgets Are Going to Have to Spend More on Welfare, Which Is Fine. It’s Spending on Us, by Peter Whiteford

Recent Comments