Prime Minister Anthony Albanese unveils his tax cuts plan today. He said “everyone will be getting a tax cut”, but what does this mean?

Details of the Federal Government’s proposed changes to the stage three rates are now available. They include changes to the income tax brackets and rates for Australian resident individual taxpayers, along with a shift in the low-income threshold to which the Medicare levy applies. Currently most Australian resident individual taxpayers with taxable income above a certain threshold pay a 2 per cent Medicare levy. This threshold amount is expected to increase. This article focuses on the changes to the income tax rates.

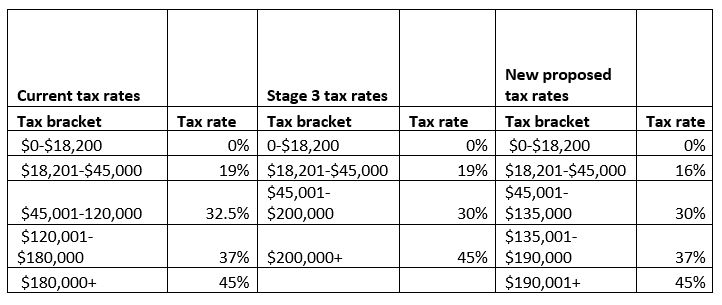

Under the new Albanese plan, there are no changes for Australian resident individual taxpayers with taxable income of $18,200 or less. The tax rate has dropped for those with taxable income between $18,201 to $45,000. It was expected that under stage three, there would be a 30% tax rate for those with taxable income between $45,001 and $200,000. Instead, the 30% tax rate will now only be applicable for those with taxable income between $45,001 and $135,000.

For those with taxable income between $135,001 and $190,000 the tax rate will be higher than expected under the stage 3 tax cuts (37% rather than 30%). The 45% tax rate will apply to those with taxable income above $190,001. It was expected this tax rate would apply to those with taxable income above $200,000.

Table 1: Current tax rates, the expected stage three rates and the new proposed rates

Below I will discuss some examples of what this may mean for you.

Taxable income below $45,000

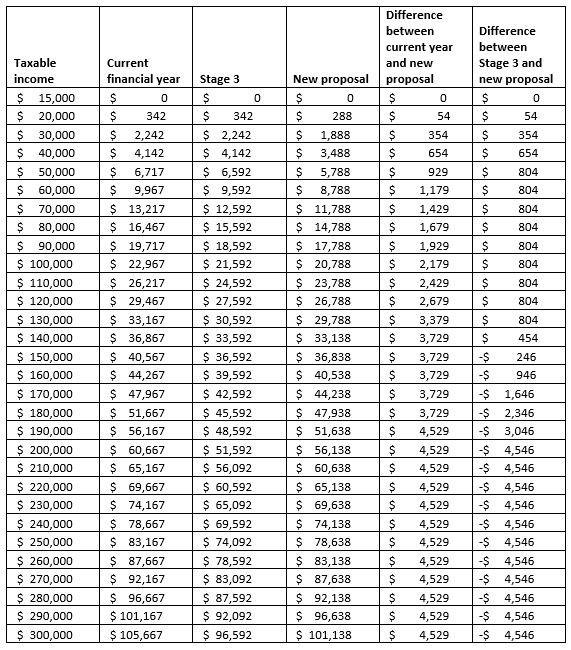

Under the new proposal you would be up to $804 better off than what you would have been under stage three. Previously it was expected that you would not benefit from the implementation of the stage three tax cuts.

Taxable income between $50,000 to $135,000

It is expected that you will be $804 better off under the new proposal. For example, if your taxable income is $50,000 you will save $929 rather than $125 under the originally proposed stage three tax cuts. If your taxable income is $70,000 you will save $1,429 rather than $625.

Taxable income between $135,001 to $150,000

You will get less of a tax saving under the proposal than people with lower taxable income. For example, if your taxable income is $140,000 you would only be $454 better off under the new proposal than you would be under stage three.

Taxable income above $150,000

You will be worse off than you would be under stage three. If your taxable income is $150,000 you will be $246 worse off. At $200,000 you will be $4,546 worse off than you would be without the proposed changes, but it is still expected you would pay less tax than this year.

Table 2: Difference in tax between the current tax rates, the stage three rates and the new proposed rates

Note: The figures in this table do not consider the effect of the Medicare levy, Medicare levy surcharge and low income tax offset. They are based purely on the tax rate multiplied by taxable income.

Implications of the new proposed plan

This three-staged tax reform plan was legislated in 2018. Scott Morrison, the Treasurer at the time, stated that the plan would provide tax relief to low and middle-income earners, protect Australians from bracket creep and ensure Australians pay less tax.

Under stage three our progressive tax rate structure which taxes people in higher tax brackets at higher tax rates was to be flattened. Both the 32.5% tax rate currently applying to individual resident taxpayers earning between $45,001 and $120,000 and the 37% tax rate applying to those earning between $120,001 and $180,000 were to be removed. A 30% tax rate was to apply to those earning between $45,001 and $200,000. Given the stated objectives of the tax reform plan, it is interesting that the new proposal involves as many tax brackets as is currently the case.

Treasury expected that under stage three about 95% of taxpayers would have “a marginal tax rate of 30 per cent or less” from 1 July. However, there has been criticism that the proposed stage three tax cuts benefited high income earners the most. In 2022 the results of a survey by the Australia Institute showed 41% of Australians supported repealing the stage three cuts.

The proposed changes to the stage three tax cuts appear to go some way to addressing concerns about the vertical equity of the tax system. Low- and middle-income earners will be better off with the proposed tax rates.

The most recent estimates from the Parliamentary Budget Office show the stage three tax cuts were expected to reduce government revenue by $323.6 billion over 10 years. The Greens have been amongst those to raise concerns about this amount and about the cost-of-living crises. This month the International Monetary Fund reported that economic growth in Australia is expected to slow, and there is merit in comprehensive tax reform and rebalancing the tax system “from high direct tax to underutilized indirect taxes”. It noted that average income tax rates in Australia are high.

Recent discussion regarding the changes to the stage three cuts provide a good illustration regarding the functions of our tax system and the importance of tax to society. While there has been much criticism reported regarding the Prime Minister breaking an election promise, there is also a recognised need for tax systems to be flexible, so as to meet current revenue needs and adapt to changing circumstances. The Government changing the stage three cuts is an example of fiscal policy and how tax can be used to influence the economy.

Recent Comments