A key aim of the welfare system in Australia is to provide a buffer against unexpected or unpredictable events that reduce one’s income stability. Relationship separation brings with it a substantial financial shock, in particular for women with children. They rely upon a range of mechanisms to smooth the financial shock of a relationship separation, including income support payments from the government, employment, as well as repartnering.

In our paper, we explore post-separation outcomes for Australian mothers obtained from data on welfare entry and exit. Key findings are that:

- Income transfers in Australia perform a classic insurance role for middle-income women as they enter and then leave the benefit system at faster rates than poorer women.

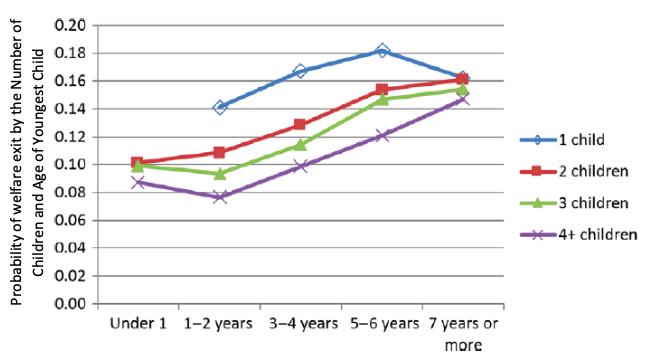

- Family size is just as important a predictor of welfare exit as is age of youngest child.

- The characteristics associated with exit from welfare via employment are different from those associated with exit via partnering.

Middle-income women enter and then leave the benefit system faster

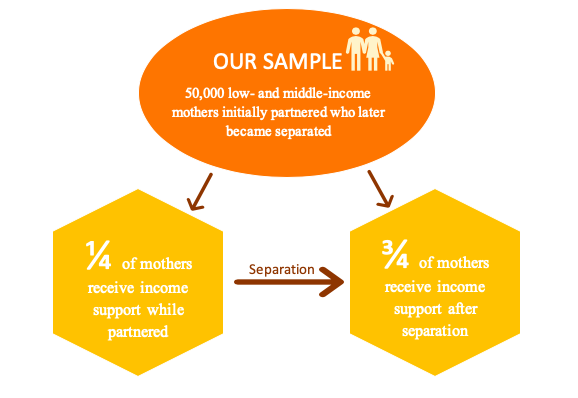

Our sample follows, on a bi-weekly basis, approximately 50,000 low and middle-income mothers who received Income Support or Family Payments anytime between 2001 and 2006. These mothers were initially partnered and later became separated from their married or de-facto partner.

Looking at welfare payments made between 2001 and 2006, the proportion of mothers receiving an income support payment sharply increased after they separated from their partner. When all mothers in this sample were partnered, approximately a quarter were receiving income support, mostly in the form of partnered parenting payments. Immediately after separation, this rose to almost three-quarters as the majority of them begin receiving single parenting payments.

Figure 1: The proportion of mothers receiving income support sharply increased post-separation

For mothers in more socioeconomically advantaged neighbourhoods, defined using the Australian Bureau of Statistics Socio-Economic Indexes for Areas (SEIFA) score for different postal areas, separation led to a greater increase in income support, primarily because they started off with much lower rates of welfare receipt – an illustration of the social insurance role played by income support.

These more advantaged women also had faster exit rates from welfare, as did younger women, those with smaller families and older children, and those not receiving public housing assistance. Receiving child maintenance payments, repartnering and living in regions with high labour demand were also found to increase the speed of welfare exit.

Patterns of welfare exit vary greatly according to the initial socioeconomic characteristics of the mother. In particular, mothers who had been receiving income support when partnered spent an additional 6.5 months on welfare in their first spell of welfare receipt after separation than those not receiving income support when partnered.

Similarly, mothers who had been receiving income support when partnered were 25 percentage points more likely to receive income support throughout the entire period that was analysed. Receiving a disability-related payment added an additional 4 months to the expected duration. Mothers with a weaker attachment to the workforce when they were partnered spent longer periods on income support after separation. Mothers spent less time on welfare as their family income increased and as their employment increased.

Overall, the evidence on the demographic characteristics associated with welfare suggests that relationship separation leads to a convergence in outcomes for women from different social classes. Mothers with higher socioeconomic status increase their income support receipt at a faster rate after separation relative to mothers with lower socioeconomic status. As a result, the gap in the rate of income support receipt between the top and bottom socioeconomic groups fell from 22 percentage points to 15 immediately after separation. After 2 years, the gap fell further to 12 percentage points. Subsequent exits from welfare, however, act to re-establish the divergence in income support between these two groups.

Family size also matters

One policy challenge is how to balance the goals of supporting mothers during financial hardship while encouraging them towards greater economic independence.

In Australia, age of the youngest child is used as a key targeting feature of the lone parent income support program. In particular, policy changes since our data were collected have reduced benefit rates and imposed additional job search requirements for lone mothers with older children. Our data do support the view that mothers with younger children have greater difficulty finding financial independence, with exit rates from benefit increasing as the age of the youngest child increases past 2 years.

However, family size is an equally important predictor of welfare exit. For example, mothers with four or more children increase their time spent on welfare after separation by almost 6 months relative to mothers with one child. While mothers of toddlers face considerable workforce impediments, so do those with many children. Indeed, as shown in Figure 2, mothers with a single toddler have higher exit rates than mothers with four or more children where the youngest is starting school.

This suggests that a simple targeting based on age of youngest child alone is unlikely to identify those mothers who are most able to engage with employment and exit from welfare receipt. A better understanding of the barriers to welfare exit can help to inform targeting efforts and the design of future welfare policies.

Figure 2: The likelihood of leaving the welfare system is higher for mothers with a single young child than for mothers with older children in large families.

Repartnering versus employment exits

Around half of women experiencing relationship breakdown repartner within 5 years. This represents an important and distinct channel through which household income recovers. An alternative channel through which women exit welfare is employment. However, repartnering and employment per se do not necessarily lead to welfare exit.

Personal characteristics play a large role in the likelihood of leaving the welfare system. Their effects, however, differ by type of exit: repartnering versus employment. Mothers are less likely to leave welfare via partnering if they are older, Indigenous, born overseas or on disability payments. On the other hand, factors that improve the chance of welfare exit in association with finding employment include having older children and smaller families, as less time must be devoted to caring responsibilities. This suggests that new partnership-driven and employment-driven exits are distinct, and that the factors that constrain or facilitate welfare exits stemming from employment do not necessarily apply to exits stemming from finding a new partner.

Turning to socioeconomic factors, mothers living in relatively advantaged neighbourhoods are much more likely to exit the welfare system after finding employment, but they are less likely to exit if they find a partner. This positive relationship between neighbourhood advantage and employment-driven welfare exits is potentially explained by better-off neighbourhoods having better employment opportunities and transport systems. Alternatively, it could be because those with more skills or education congregate in relatively wealthy neighbourhoods. The chance of exit from repartnering for women in richer areas is still higher relative to women in poorer areas as they are more likely to find a higher-income partner.

Policy implication

Although this suggests that certain characteristics may act as barriers to welfare exit, the results do not automatically reflect causal relationships. However, they do indicate the groups of mothers who are at higher risk of staying on income support payments for longer after separation.

One policy implication from these results is that more services or resources, which have been shown to mobilise greater welfare exits, can be directed at these at-risk groups. Regardless of the origin of their disadvantage, more directed targeting efforts can help to reduce overall welfare burdens.

Recent Comments