Did you ever donate to a charity? Chances are that you have. Approximately one third of Australians give money to charity each year. Donating to charity is a lot like purchasing any other good and service – except when it is not. Economists and treasury officials like to talk and think about the tax price of charitable giving. But what is the tax price of charitable giving, and how important is it for donors, charities and policy makers?

Donations do not have an explicit price tag attached to them

In Australia, the tax price of charitable donations is the price of a dollar donation to a designated gift recipient (DGR) after it has been claimed as a deduction on one’s tax return. By claiming the charitable donation deduction, a tax lodger reduces their taxable income. For every dollar donated, a tax lodger reduces their tax obligation by the marginal tax rate that would have been applied to that additional dollar of income. For example, suppose you face a marginal tax rate of 25 per cent, and gave $100 to a DGR, then that $100-dollar donation cost you only $75 out of pocket after taxes.

The provision by the government of a less-than-one-dollar tax price represents a significant savings to the average donor, but only if they know about it. The trouble with the tax price is that donors may not be responding to it, because unlike swimsuits and tennis shoes, donations to charity do not have an explicit price tag attached to them.

This is a big problem from a treasury perspective, because it suggests that the charitable deduction could be subsidising donation activity that would have taken place even in the absence of the charitable deduction as donors give to causes that resonate with them. The “treasury efficiency” of the donations and gifts tax expenditure requires that people respond to the tax price in a very particular way – by passing on that additional savings to charities. Otherwise, the government may have done well in the absence of this tax expenditure by simply sending checks to charities themselves.

Do people respond to this tax price?

There is good reason to believe that people under-respond to the tax price of charitable donations. The first reason is that people may not think about the deduction at the time of giving. The second is that the time of claiming the deduction is in the future. This makes claiming the charitable deduction like claiming a rebate on the purchase of a consumer durable. However, instead of mailing in the rebate to the vendor, it is submitted on a tax form.

To gain a better understanding of the response of donors to the tax price of their donations, my colleagues and I studied a unique policy scenario in Quebec, Canada. In the aftermath of the devastating Haiti earthquake of 2010, the Government of Canada gave all Canadians an additional incentive to give to the relief efforts through a dollar-dollar match on eligible donations. The Government of Quebec independently went one step further, announcing that donors to the relief efforts could claim their donations on their 2009 tax form (submitted in April 2010), instead of waiting until April 2011 to claim it.

This unanticipated policy did two things: first, it closed the time between giving and filing; second, it raised awareness of the presence of a tax credit for donations in Canada. Both are significant and important actions. Allowing earlier filing effectively reduces the tax price if potential donors discount future consumption, so we should expect donors to give more in Quebec if they respond to tax price. In addition, the announcement of the policy itself, instructing donors how the credit system works in Quebec at the same time that donors were considering a donation, increased the salience of the tax price. This should further increase the donations if donors were unaware that they could save money at tax time through the donation.

Evidence from Canada

We used propensity score matching (PSM) to match Quebec communities with other Canadian communities, on the basis of the incidence of Francophones and the percentage of the community that were of Haitian ethnicity. This allowed us to construct treatment (Quebec) communities, and control (rest of Canada) communities to credibly evaluate the policy.

We found that those exposed to the policy were 3 percentage points more likely to give, and that their donations increased by 9 percentage points. While we could not untangle the “salience” and “discounting” effects of the policy, one thing is clear – that this provides evidence that donors do respond to the tax price of giving. Further research, however, should evaluate whether the policy is effective enough to pass the treasury efficiency cost-benefit analysis.

What does this mean for Australian policy?

While Canada is a different context that calculates the tax price in a different way – as a credit instead of the Australian deduction – we think that this study raises some interesting policy questions for Australians.

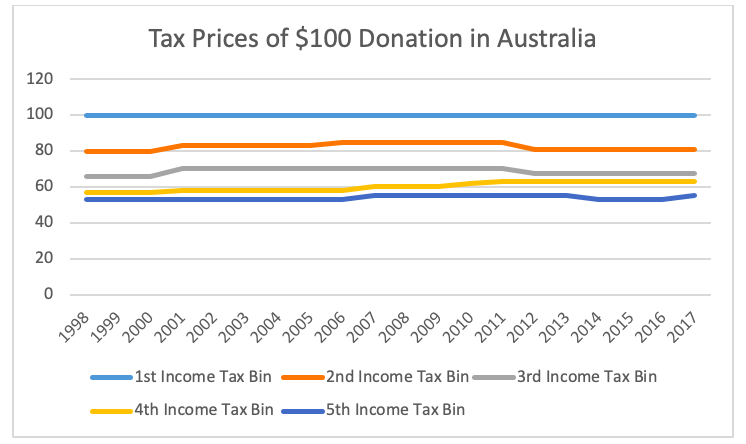

Australians face four tax prices of charitable donations depending on their level of taxable income. Figure 1 plots the tax prices for donations in Australia between tax year 1997-1998 and 2016-2017. In the 2016-2017 tax year, a $100 donation costs those earning $18,200 or less $100 (the 1st Income Tax Bin below), those earning between $18,201 and $36,999 $81 (the 2nd Income Tax Bin below), those earning between $37,000 and $86,999 $67.5 (the 3rd Income Tax Bin below), those earning between $87,000 and $179,999 $63 (the 4th Income Tax Bin), and finally those earning $180,000 and above $55 (the 5th Income Tax Bin).

Figure 1: Tax Prices of a $100 Donation in Australia

Since 2010 Australia’s tax prices of charitable giving have increased for those earning between $87,000 and $179,999 because of marginal income tax rate reductions for these tax lodgers. Over the same time, we have seen a reduction in the tax price for tax lodgers whose last dollar earned places them in the bottom two tax brackets. The perennial highest income earners in Australia are the only tax filers to have experienced both an increase, followed by a decrease in the tax price of charitable donations.

If Australian tax filers are, like Canadians, sensitive to the tax price of giving and if giving in Australia follows a similar pattern across the income distribution as Canada, then it is this highest income earning tax bracket that has the largest effect on charitable donations. This is because in Canada we find that 80 per cent of all tax receipted donations are made by the top 20 per cent of tax filers. This makes the highest income tax bracket’s marginal tax rate, and hence tax price of giving, the most important tax price for the sector.

If we collectively believe that we would like to see more tax receipted donations made to Australian charities, then we may want to adjust the tax price at the top end of the distribution. In the current tax setting system, there are immediate trade-offs to consider with such a policy. A lower tax price for high-income earners can only be achieved by raising the top marginal income tax rate. However, if Australia were to follow in the footsteps of Canada or New Zealand and introduce a tax credit for charitable donations, it would allow a decoupling of the tax price from the marginal income tax rates, allowing the government to encourage giving with a new policy instrument.

Further reading:

Ross Hickey, Bradley Minaker, and A. Abigail Payne (2019), ‘The Sensitivity of Charitable Giving to the Timing and Salience of Tax Credits’, National Tax Journal, vol. 72, no. 1, pp. 79-110. The paper is also available as a Melbourne Institute working paper.

Recent Comments