Many governments are raising the eligibility age for retirement benefits in response to population ageing. These policies have been shown to reduce government spending and raise old-age employment, but there are concerns about equity.

One concern is that higher pension ages are unfair on poorer households, given that the differences in life expectancy between socioeconomic groups have increased in some developed economies. Another concern is that individuals with physically demanding jobs – who generally have lower levels of wealth – may find it harder to delay retirement than those with sedentary jobs. A further concern is that these reforms may be regressive; since low‐income households receive a larger share of their income from public pensions, raising pension ages may increase poverty and inequality among older households.

New published work in Economic Inquiry validates this final concern in the context of Australia’s Age Pension. In ‘The Unequal Burden of Retirement Reform: Evidence from Australia’, I examine the effects of a 1994 reform that gradually increased women’s eligibility age for the Age Pension from 60 to 65. I show that the reform had negative effects on household incomes that were concentrated among poorer households. These unequal impacts temporarily increased relative poverty rates among affected women by around four percentage points (20% to 31%) and inequality measures by 6% to 19%.

Background

The Age Pension is Australia’s largest social insurance program. It is the main source of retirement income for most elderly Australians, particularly those with less income and wealth. As the pension is means-tested, increases in the pension age delay low-income households from receiving retirement income, which may increase poverty and inequality.

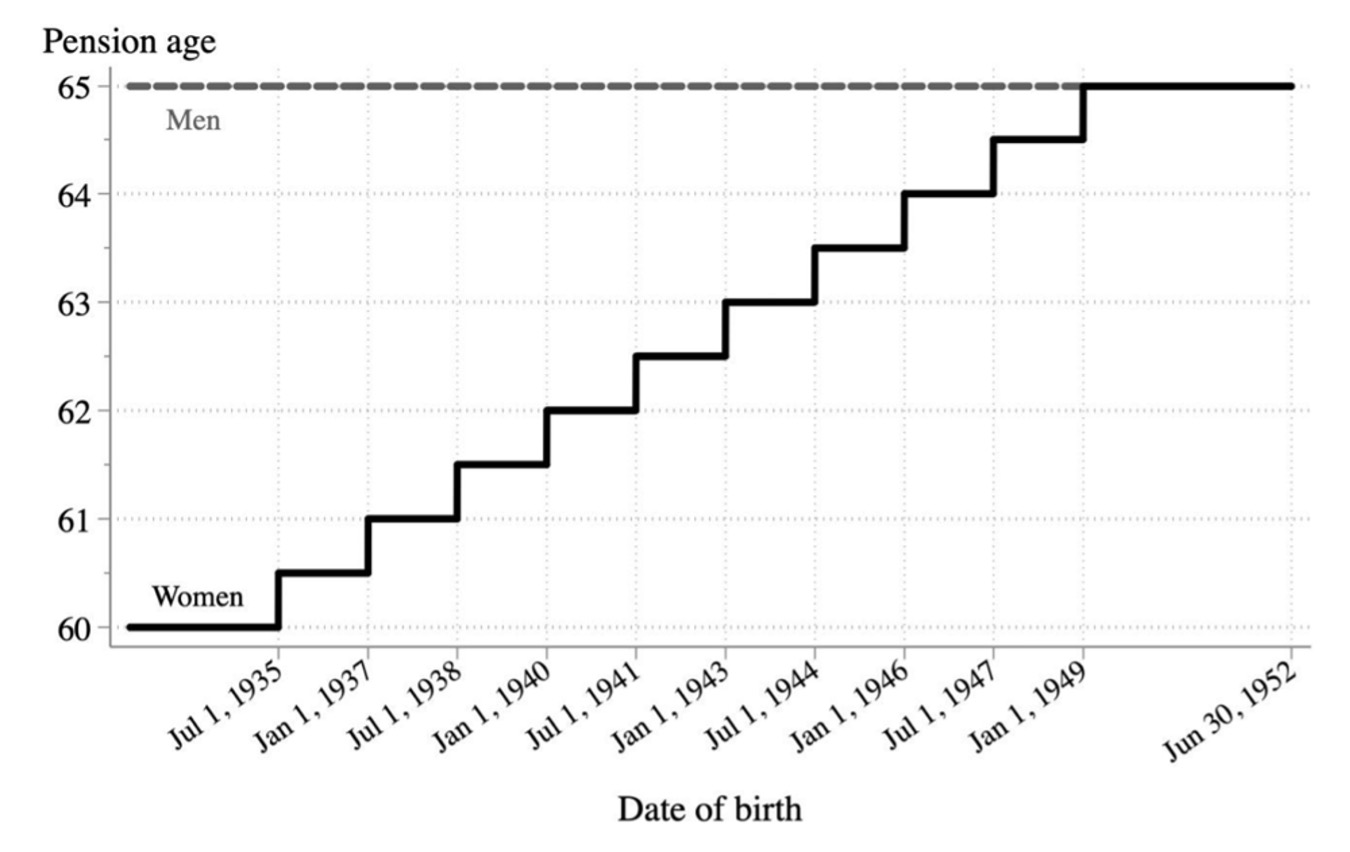

I examine the effects of the 1994 reform using longitudinal survey data between 2001 and 2015 from the nationally representative Household Income and Labour Dynamics in Australia (HILDA) survey. HILDA contains detailed information on incomes, labour supply, wealth, and other characteristics at both the individual and household level. During the sample period, there is variation in women’s eligibility for the Age Pension between the ages of 61.5 and 64.5 due to the gradual increases in the pension age across birth cohorts (see Figure 1).

Figure 1: Pension age of Australians by date of birth and gender

Economic responses to the reform

Consistent with previous studies, I find that the largest response was women remaining on other government transfers for longer. On average, women offset 63% of their income losses from the Age Pension through other transfers, such as the Disability Support Pension.

In contrast, the female labour supply response is relatively modest. On average, women offset 21% of their income losses from the Age Pension through an increase in earnings. I show that the labour supply responses were largest among single women and women in poorer households – groups that were particularly affected by the reform – but these responses are still dwarfed by the benefit-substitution effects. There is also little evidence of any effects on the labour supply of partnered women, their spouses, and wealthier groups of women.

Overall, these results broadly support the findings of Morris (2021), a recently published companion paper, which suggests that the labour supply responses to the reform were modest and smaller than found in other studies.

Distributional effects

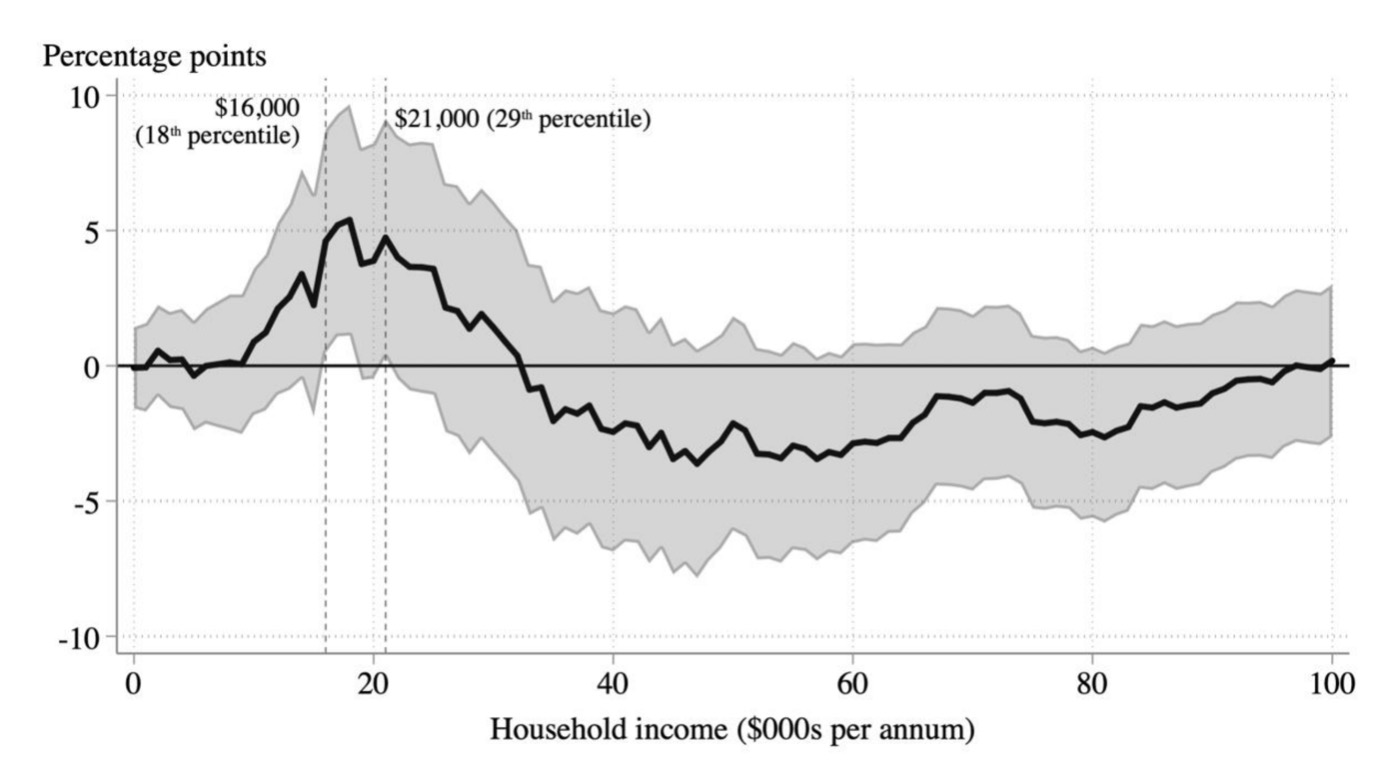

I estimate the effects on household incomes across the entire income distribution using distribution regression methods. Distribution regression is a sequence of binary regressions, where each regression estimates whether income is below a given cut‐off, and the effects are estimated at many cut‐offs across the distribution. My preferred income measure is household disposable income plus the value of pension‐related in‐kind benefits minus housing costs.

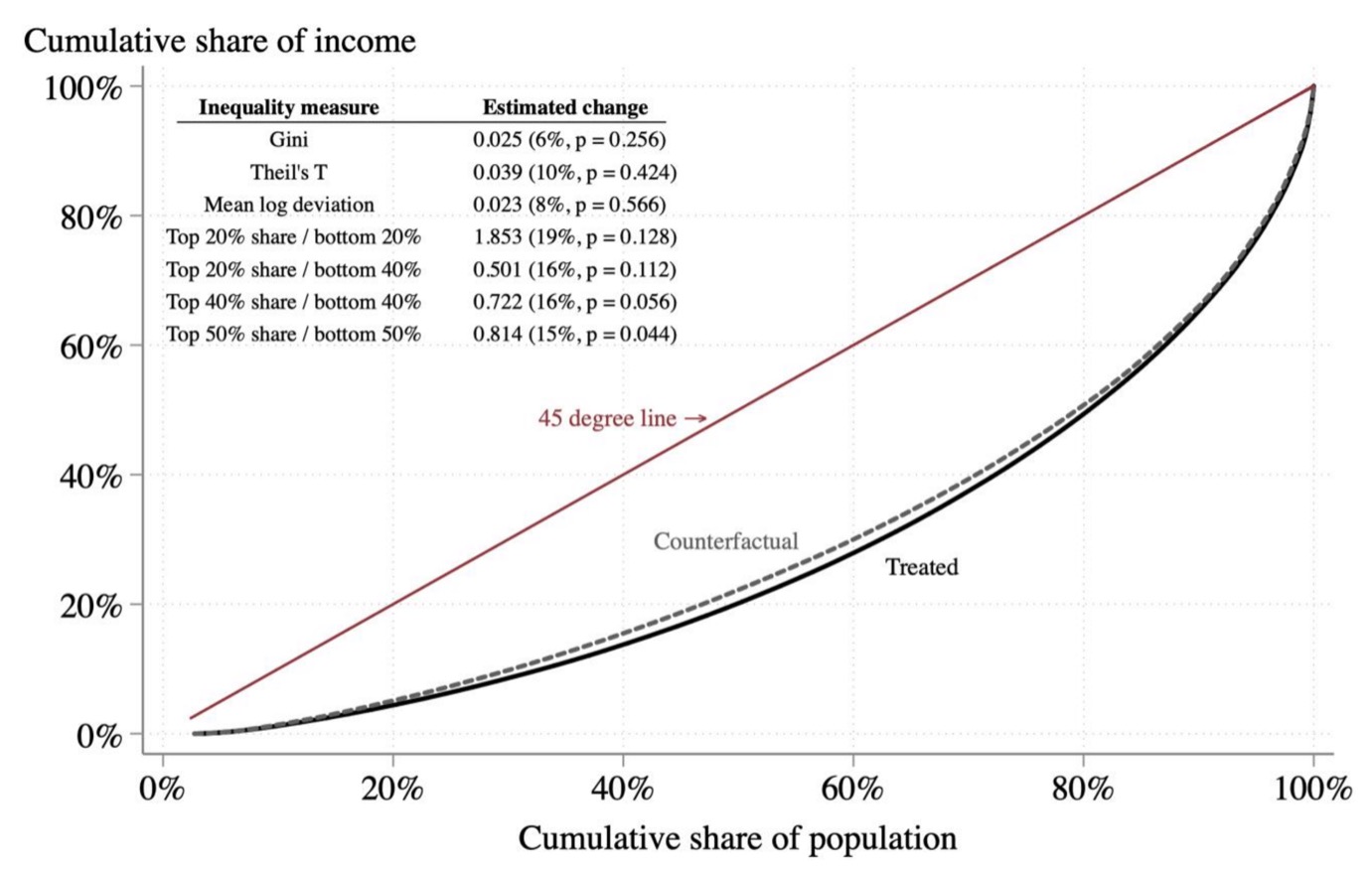

I find negative effects on the incomes of households in the bottom three income deciles and no impact on higher income households (see Figure 2). I use these estimates to construct the counterfactual income distribution (namely what the income distribution would have looked like if not for the reform) and quantify the overall effects on inequality. Using this approach, I estimate that the reform increased inequality measures by 6% to 19% among affected households (see Figure 3). These regressive impacts are substantial: the estimated increase in inequality is equivalent to an annual transfer of around AU$3500 from households in the bottom 20% of the income distribution to households in the top 20%.

Figure 2: Distribution regression estimates, household income < $X per annum

Figure 3: Observed and counterfactual Lorenz curves, and estimated effects on inequality

Figure 3: Observed and counterfactual Lorenz curves, and estimated effects on inequality

Focusing on the effects near the bottom of the income distribution, I find that the negative effects on household income are most pronounced around common poverty lines: 40% and 50% of the median household income in the entire population. Using these benchmarks, I estimate that the reform caused an increase in relative poverty rates of 3.8 to 4.0 percentage points (20% to 31%) among women at affected ages. Single women and renters explain most of this increase, and the effects on partnered women and their spouses are small and indistinguishable from zero.

Effects on public finances

To estimate the net effects of the reform on public finances, I consider (i) changes in government spending on the Age Pension, other transfers and in‐kind benefits and (ii) changes in government revenue from income tax. I estimate that each one‐year increase in the pension age saved around AU$470 million per annum, which is equivalent to 1% of current government expenditure on the Age Pension.

Implications for Australian policy

Overall, the paper highlights a clear trade‐off: while raising the pension age reduces government spending, these savings can come at the cost of higher poverty and inequality among older households.

The results also highlight the importance of other government transfers in attenuating these impacts. Back‐of‐the‐envelope calculations indicate that the budgetary savings would have been more than twice as large if women were unable to claim other transfers prior to the pension age. However, as low‐income households disproportionately rely on such transfers, the estimated increase in inequality and poverty measures would have been around four‐times larger. While these estimates assume away further behavioural responses, they suggest that governments should be cautious when considering simultaneous policies that tighten eligibility for other transfers, such as Jobseeker or the Disability Support Pension. Such policies may help governments maximise the fiscal savings of higher pension‐eligibility ages, but they are likely to magnify the effects on poverty and inequality.

The pension age is currently rising from 65 to 67 for men and women, and further increases from 67 to 70 were a long‐standing policy of the Coalition government until 2018. My results suggest that while these changes will reduce government spending, they are likely to further diminish the social safety net for older households, especially women who are single and renting. This highlights a potential role for complementary policies like expanded Rent Assistance that strengthen the safety net for vulnerable households.

Recent Comments