Progressive taxes and government transfers are often seen as essential policy tools that automatically help protect households from unexpected financial hardship.

When a household experiences a sudden drop in income due to illness or job loss, a progressive income tax schedule can help by reducing taxes more, offering immediate financial relief. Similarly, government transfers such as unemployment and disability benefits directly support households in need.

But how effective are these policy tools in practice? In our study, we measure the insurance value built into progressive taxes and transfers by analysing detailed household survey data from Australia and the United States.

The Australian and United States tax and transfer systems

Our analysis draws on two household survey datasets – Household Income and Labor Dynamics Australia (HILDA) for Australia and Panel Survey of Income Dynamics (PSID) for the United States. By using these datasets, we are able to compare the tax and transfer systems between the two countries with different levels of progressivity.

When estimating a “degree of progressivity” parameter, we find that Australian households face a relatively high level of progressivity, with a parameter value of 0.24 and a “break-even” income level—namely where a household shifts from being a net taxpayer to a net transfer recipient—of AUD $52,731. The median annual household income in Australia was AUD 74,776 in 2016.

By contrast, US households face a lower level of progressivity, with a value of 0.17 and a break-even income level of USD $20,527. The median annual household income was USD 73,520 in 2016.

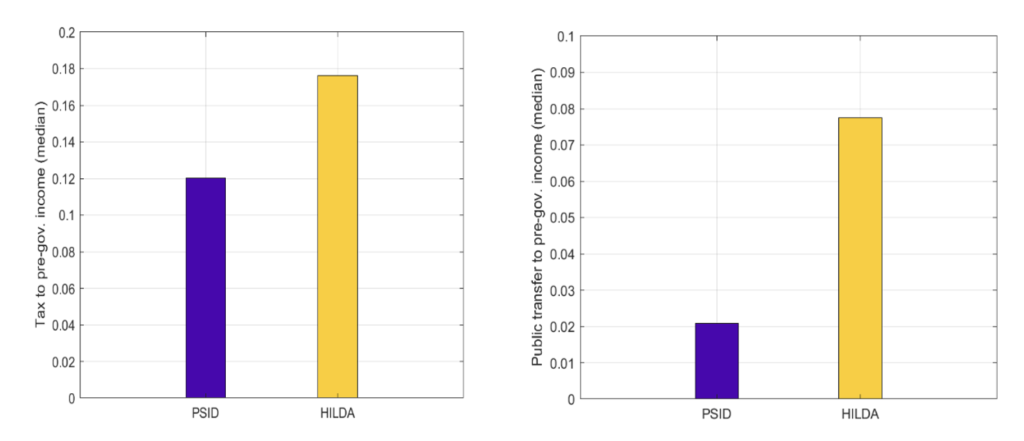

Australian households pay more taxes and receive more government transfers relative to their incomes than US households (see Figure 1). While these differences suggest that progressive taxes and transfers might offer more insurance for Australian households, our study reveals a more complex picture.

Figure 1. Median tax-to-income ratio (left); Median transfer-to-income ratio (right)

Quantifying the insurance value

To quantify the insurance value of the competing tax systems, we develop a semi-structural econometric model of idiosyncratic household incomes, consumption, and tax-and-transfer dynamics. Specifically, we estimate the extent to which unexpected changes in household income lead to changes in consumption and how taxes and transfers mitigate this transmission.

We find that taxes and transfers reduce the volatility of disposable incomes by 28 per cent in Australia and 12 per cent in the US, suggesting a potential role as consumption insurance. However, a key advantage of our study over previous ones is that our econometric framework assesses whether such reductions in income volatility actually translate into a smoother household consumption, an essential indicator of household well-being from an economic perspective.

Surprisingly, when it comes to consumption effects, taxes and transfers reduce the impact of a change in income on consumption by a comparable amount: 4.8 percentage points in Australia versus 5.4 percentage points in the US. In other words, taxes and transfers provide similar levels of consumption insurance for households in both countries.

Exploring the paradox

Why do taxes and transfers provide similar levels of consumption insurance in Australia and the US, despite their differences in tax progressivity and public transfers? To understand this, we consider an economic model that captures how household savings and labour supply behaviour vary with wealth and income.

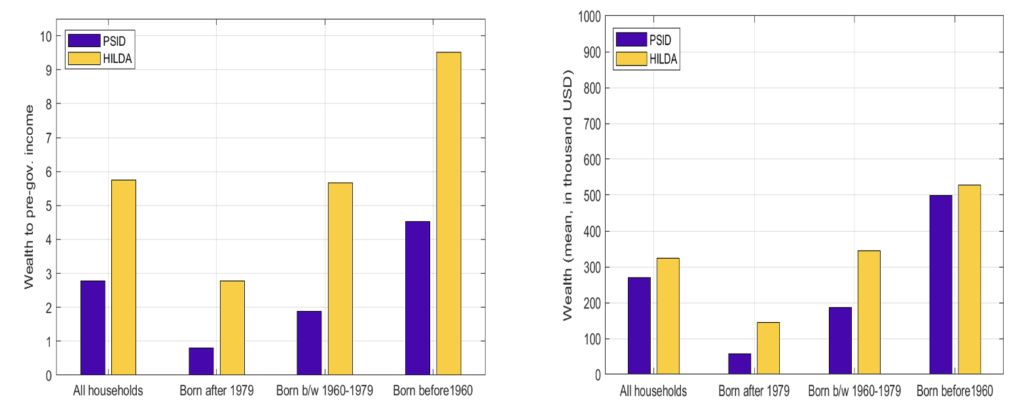

The model suggests that, in wealthier economies like Australia (see Figure 2 for wealth comparisons), progressive taxes and transfers are less effective at providing additional insurance. This is because wealthier households tend to have more savings and investments as a private safety net, reducing the impact of income changes on consumption, even before accounting for taxes and transfers.

Figure 2. Average wealth-to-income ratio (left); average wealth (right)

Our analysis shows the importance of household wealth in shaping the effectiveness of progressive taxes and transfers. In fact, differences in wealth levels help explain why consumption insurance effects are similar in Australia and the US.

While Australia has higher tax progressivity and larger transfers, the country’s relatively high levels of household wealth, especially in terms of housing and retirement savings, mean that the social insurance from taxes and transfers are less effective than intended at providing consumption insurance.

Policy implications

Our analysis raises the question of whether Australia’s highly progressive tax and transfer system is the most efficient way to provide economic security.

Policymakers might consider a slightly less progressive tax structure combined with targeted social programs for households lacking savings and wealth. This approach could achieve similar or better outcomes, while reducing the need for higher tax burdens and minimising disincentives for additional labour supply that come with high progressivity and higher marginal tax rates.

A decidedly perverse redistribution effect is taxing young people looking to buy homes in which to nest in order to pay age pensions to wealthier older people squatting in those assets test free homes. The buyer is forced to help the wealthier seller hold out against him!

What’s progressive about that?