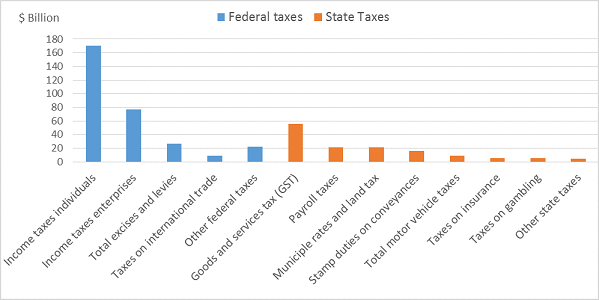

The Australian Goods and Services Tax (GST) is a tax levied on the supply of goods and services in Australia. The GST is charged at a rate of 10 per cent of the final price of goods and services. In the fiscal year ended 30 June 2014, the GST raised $51.4 billion. This is about 3.3 per cent of GDP or 12.5 per cent of total tax revenue collected in Australia. The following chart shows the relative importance of the GST in Australia’s tax mix.

Figure 1: The relative Importance of Australia’s Taxes (2013-14)

Source: Taxation Revenue, ABS Cat No. 5506

The GST began operating in Australia in 2000, and it has changed little in the last 15 years. The GST was introduced under the Howard-Costello government. However, as explained by Richard Eccleston, it was a “thirty year battle” for the GST to be enacted in Australia.

The GST is levied under the A New Tax System (Goods and Services Tax) Act 1999 and related legislation.

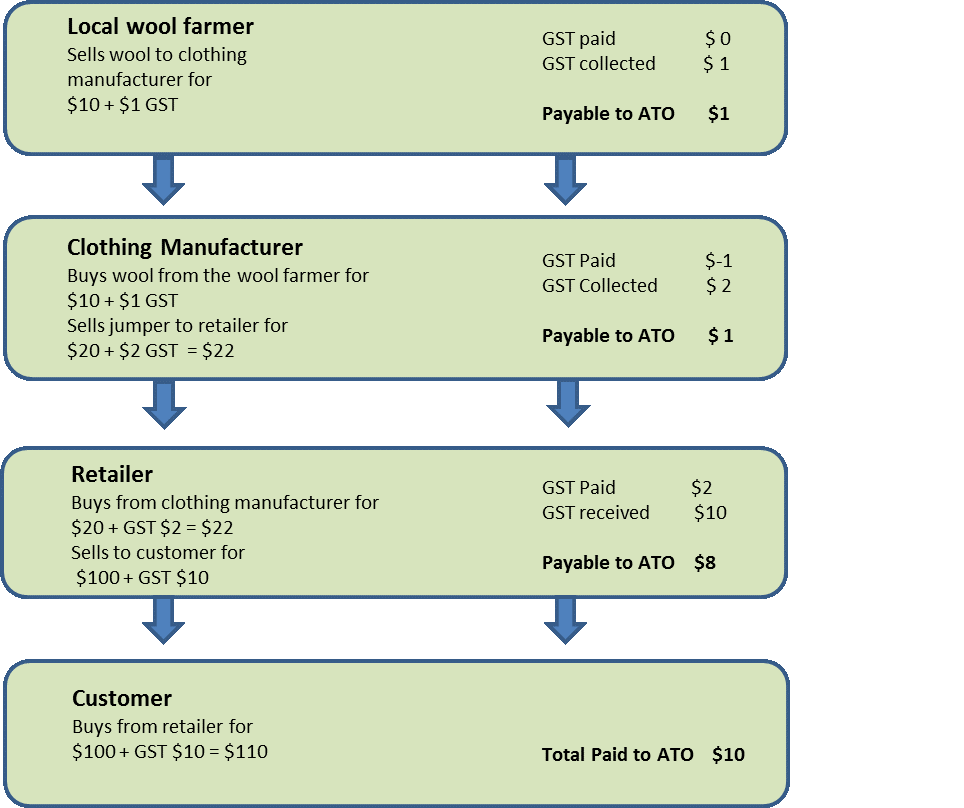

The GST is a type of indirect tax levied on suppliers of goods and services in Australia, called an invoice-credit value added tax. The tax at 10 per cent is levied at the point of sale of a good or service at all points of sale through the supply chain. Each supplier must pay GST to the ATO and receives a tax credit for any GST paid on inputs, on evidence of a tax invoice. As a result, each supplier pays the net GST only on the amount of value added by that supplier. Ultimately, the GST is borne by the consumer. The following example shows how this works.

Figure 2: How the GST is collected through the supply chain

Source: This example from the ATO.

GST exemptions

Not all goods and services are subject to GST. In fact, it is estimated that as a result of exemptions, Australia only collects 48 per cent of the revenue that would be collected if all elements of final consumption were taxed at the full rate. This proportion has declined over time from a peak of 56 per cent in 2005-06. The downward trend being explained by higher savings rates, and consumption patterns that have trended towards untaxed items (such as health care and education).

There are two ways an item can be exempted from paying the full rate of GST:

- A GST-exempt item has no GST on the final supply of the good or service, and any GST paid on inputs can be claimed as a tax credit. GST exempt items include fresh food, health, education, childcare, water, sewerage and drainage services, imported goods valued at less than $1000 and most imported services and intangibles.

- An input-taxed item has no GST on the final supply of the good or service, but producers are unable to claim refunds for any GST that is paid on inputs. This means that there is some GST levied on the item through the production and distribution chain. Input taxed items include residential rent and financial services, as well as products from businesses with turnover of less than $75,000 (or charities with turnover of less than $150000).

The Treasury estimates tax expenditures using a revenue foregone approach, which asks how much tax would be collected if the 10 per cent GST was applied to all goods and services. This estimate also assumes no behavioural response to the tax.

Table 1: Cost to Government Revenue of the Biggest GST Exemptions in 2014

| Fresh Food | $6400 million |

| Education | $3950 million |

| Financial Supplies | $3550 million |

| Medical and Health Services | $3550 million |

| Residential Care, Community Care and Other Care Services | $1110 million |

| Child Care Services | $1090 million |

| Water, Sewerage and Drainage | $1050 million |

| Imported Goods Valued at Less than $1000 | $460 million |

Source: 2014 Tax Expenditures Statement, The Treasury.

Is the GST an efficient tax?

In general, taxes impose a larger cost on the community than is collected in revenue. This is because taxes change the relative prices of various goods and services that in turn change people’s consumption patterns, as well as the choice of inputs firms use in the production process. When economists refer to the efficiency of different taxes, they define an efficient tax to be one that collects revenue in a way that limits these distortions.

There are various ways to measure the efficiency effects of taxes in the economy, but the GST generally performs well compared to most other taxes used in Australia. In the recent Treasury Re:think Discussion Paper on tax reform, it is estimated that the GST is a more efficient tax than the company income tax, roughly equivalent to a labour income tax, and less efficient than a broad based land tax.

The GST also performs well in terms of the difficulty of tax evasion, in large part because it collects information from firms on both sales and purchases. As one firm’s sales (tax liability) are another firm’s costs (tax deductible expense), there is less scope to mislead the tax office about your tax liability. Joel Slemrod and Christian Gillitzer argue that this self-enforcement mechanism is the main reason that value added taxes are an increasingly popular part of the global tax mix, while retail sales taxes (an identical tax in a textbook setting) are rarely used.

Is the GST regressive?

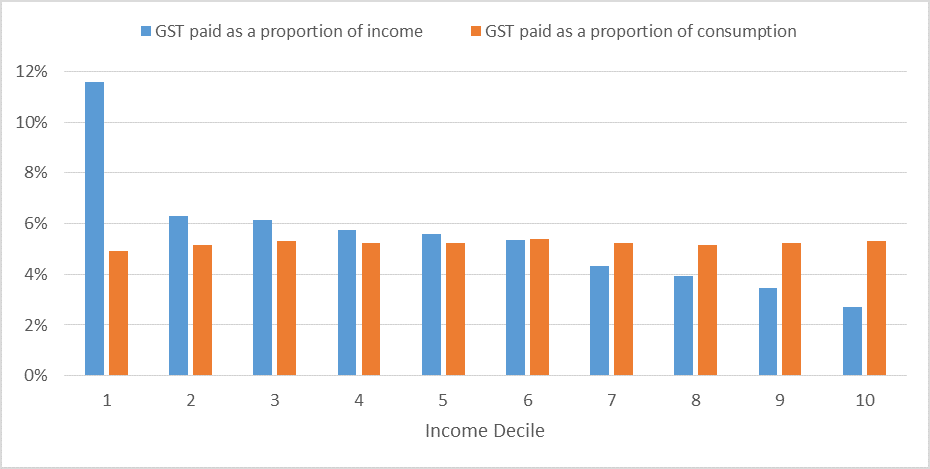

Concerns are often raised that the GST is a regressive tax, meaning that those who earn less pay more tax as a proportion of their income. To test this proposition, it is necessary to access data from the Household Expenditure Survey. This survey is only conducted every six years, so the data below is from 2009.

The chart shows that GST paid as a proportion of income (the blue columns) is highest for low incomes, so the GST is in fact regressive with respect to income. However, the chart also shows that GST paid as a proportion of consumption (the orange columns) is fairly constant throughout the income distribution. The difference between these two patterns is explained by the fact that wealthier people save a greater proportion of their income, and therefore spend a smaller proportion of their income. If people with higher incomes are saving to finance future spending, then the GST will be less regressive when comparing the tax paid across a lifetime.

Figure 3: Burden of GST Across the Income Distribution

Source: Author’s Calculations using the Household Expenditure Survey. ABS Cat. No. 6503.

The data in the chart come from the Fiscal Incidence Study that is calculated by the ABS along with the Household Expenditure Survey. Income deciles are based on equivalised total income from all sources of income.

ACOSS and NATSEM have released modelling showing the distributional impact of a variety of GST reform options.

The GST and the States

The GST is levied by the Australian Government on behalf of the States and Territories. All GST revenues are distributed to the States and Territories, and the States and Territories also pay the administrative costs of the tax to the Australian Taxation Office.

Payment of GST revenue to the States and Territories occurs pursuant to section 96 of the Constitution as a general revenue grant. This is done under an Intergovernmental Agreement signed by the Commonwealth and all State and Territory governments in 1999. The Intergovernmental Agreement is in a Schedule to A New Tax System (Commonwealth-State Financial Arrangements) Act 1999 (Cth), which was a part of the suite of legislation that enacted the GST. Section 10 of this Act states that it is the “intention” of the federal government to abide by the Agreement. Section 11 requires changes to the GST rate to have the unanimous agreement of all States and that changes to the GST base should be consistent with: (a) maintaining the integrity of the GST base; (b) administrative simplicity; and (c) minimising compliance costs for taxpayers.

This intergovernmental agreement cannot bind the federal Parliament, and is unenforceable as a matter of constitutional law. However, in spite of its lack of legal force, and a change in government, the 1999 Intergovernmental Agreement has endured for 15 years.

GST is distributed to the states following the principle of horizontal fiscal equalization so that each of Australia’s States and Territories has the same fiscal capacity, under average policies, to provide general government infrastructure and services. The complicated calculation required to estimate the fiscal capacity of each State and Territory is performed by the Commonwealth Grants Commission. In practice, GST distribution is used to transfer funds from wealthier states (such as Western Australia) to poorer states (NT and Tasmania). This mechanism has proved particularly controversial in recent years as the mining led investment boom in Western Australia has led to significantly lower GST distributions to that state.

Reform of the GST

As the GST is based on an agreement between the Commonwealth and the States, changing any aspect of the GST would require the agreement of all States and Territories, along with the Federal government. Second, the GST is a famously political topic. This political sensitivity led to the exclusion of the GST from the Henry Tax Review. Nevertheless, there are good reasons to consider GST reform. The two obvious option for reform are to increase the rate of GST, or expand the base.

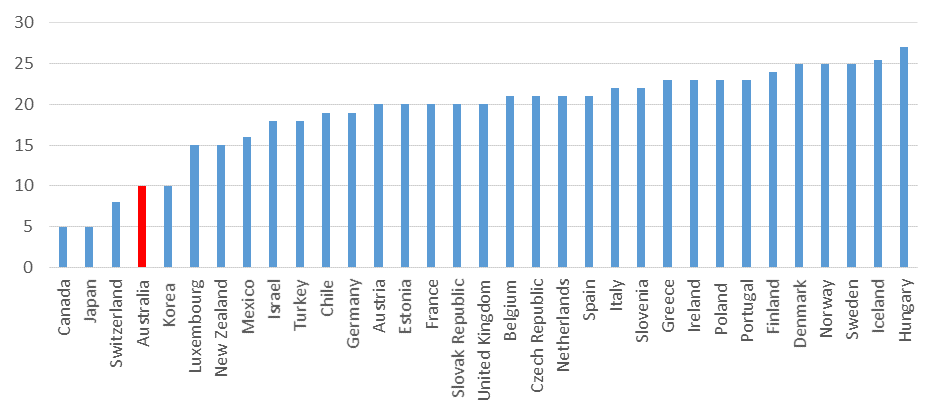

At 10 per cent, the Australian rate of GST is relatively low compared to other OECD countries. The following chart shows the rate of taxation in all OECD countries with the exception of the US, which is the only OECD member without a GST/VAT. This suggests that Australia could increase the GST rate and stay well within the international experience.

Figure 4: GST Rates in OECD Countries in 2014 (per cent)

Source: OECD Consumption Tax Trends 2014.

Another potential area for reform is to expand the GST base to cover more goods and services. In some ways, this is attractive as a consistent rate of taxation eliminates some compliance issues, such as the current need to distinguish between GST exempt food (such as pizza rolls) and food that is not GST exempt (such as pizza, or pizza pockets).

However, it is important to be specific when referring to expanding the GST base, as there are a variety of exemptions made for a range of different reasons. For instance, according to the Re:think Discussion Paper, health and education were made GST exempt to ensure tax neutrality between public and private providers of these services. Imported goods valued at less than $1000 and intangible products were exempted due to the difficulty of enforcing taxes on these goods, while the fresh food exemption was based on a deal with the Australian Democrats, and was based primarily on equity issues. As the different exemptions are based on such different rationales, expanding the base of the GST should be considered on a case by case basis, and needs to consider whether the original case for exemption is still valid.

One area that has been identified by the Liberal Government as a priority to expand the GST base is the sale of digital products. The so-called Netflix Tax was included in the 2015 budget and would extend the current tax to digital content from overseas providers.

Further reading on the GST

Main GST page at the Australian Tax Office

Re:think the Federal Government Tax White Paper

VAT explanation from the Tax Policy Centre

The rise of the Value Added Tax, by Kathryn James

The Allure of the Value-Added Tax, from the IMF Finance and Development Magazine

CPA modelling of GST reform in Australia

Is the GST as efficient but less equitable than income tax? A Factcheck article by Flavio Menezes

John Freebairn explains the Commonwealth Grants Commission process.

The “Netflix tax” – coming to a country near you, by Rebecca Millar

Recent Comments