It has been long established in the social science literature that geographical location affects individual decision making, leading to uneven distributions of economic and social outcomes such as innovations, health, crime and violence, as well as pro- and anti-social behaviour. While social scientists often use location as a common unit of analysis to study individual behaviour, recent business studies have just begun to explore the spatial variations in corporate behaviour. This stream of research is quite important because studying the relation between location and corporate behaviour has important implications for various corporate regulators in identifying misbehaviour “hot spots”.

In our study, we examine whether there are spatial variations in American firms’ corporate tax avoidance; in other words, whether firms’ geographical locations have explanatory power regarding why some firms are more likely to engage in tax avoidance activities than others. Our main goals involve quantifying the fixed effects that firm locations have on corporate tax avoidance, and investigating the extent to which the estimated location fixed effects can be explained by a range of observable regional characteristics.

The effects of firm location on corporate tax avoidance

We believe that there are at least three possible reasons why we may observe geographic variations in corporate tax decisions. First, firm locations may be correlated with advantages in information and resources. Firms located in the same area are likely to share similar information, hence making similar decisions, and firms located in different areas may have access to different levels of resources, therefore leading to observed spatial differences in corporate behaviours and strategies.

Second, firms that are closely located to one another are exposed to similar regional risks, including regulatory risks, as well as those related to overall economic wellbeing and weather-induced psychological wellbeing in a particular region, and all of that can alter the incentives and behaviour of managers when making corporate decisions.

Third, firm locations may be correlated with the cultural and ethical norms of local communities, which may differ widely across space. As corporate tax avoidance is a contentious issue that affects a firm and its top-level managers’ reputations in their surrounding community, managers are likely to take account of local social norms in making tax decisions. Taking those arguments together, we predict that the level of tax avoidance activities undertaken by a given firm will depend on where the firm is located. Therefore, our stated hypothesis is that firms’ locations have significant fixed effects on corporate tax avoidance.

We estimate location fixed effects on four measures of corporate tax avoidance to encompass an entire continuum of tax planning strategies that reduce tax payments. This includes two standard measures that capture tax avoidance broadly: firms’ effective tax rate (ETR) and cash effective tax rate (CETR). Our third proxy is the unrecognised tax benefits (UTB). Scholars suggest that the UTB is the most robust proxy for tax shelters. Last, we employ the long-run CETR measure to capture firms’ ability to maintain aggressive tax positions for a much longer term of five years (CETR5) as we conjecture that the long-run CETR reflects persistent tax avoidance properties that are closely related to our objective of identifying time-invariant location fixed effects.

Our study focuses primarily on the US Metropolitan Statistical Area (MSA) in which firms’ headquarters are located. We focus on the location of headquarters since the overall tax strategy of a firm is typically formulated and executed by the top management team. We examine the effect of sample firms’ ETR, CETR, UTB, and CETR5 respectively on location fixed effects after controlling for year and firm fixed effects as well as a set of time-varying firm-level characteristics and state corporate income tax rates. We obtain the location fixed effects by estimating the MSA-specific coefficients.

There are two important features of our empirical design. First, we specifically control for firm fixed effects, thereby testing whether the within-firm variation in tax avoidance is systematically associated with the locations of firms’ headquarters. Thus, our primary identification relies on observed changes of firm headquarters locations. Second, we specifically control for state-level corporate tax rates. Therefore, we only estimate tax-code unrelated variation in location effects on corporate tax behaviour.

Our empirical results show that the location of firm headquarters has a statistically and economically significant effect on the level of tax avoidance of firms. The estimated MSA fixed effects on ETR, CETR, UTB, and CETR5 are all jointly significant, regardless of whether tested individually or in the presence of other fixed effects. We find that the explanatory power of models including MSA fixed effects is in between that of those including year fixed effects and those including industry fixed effects. Moreover, the distribution of the MSA fixed effect coefficients reveals large and significant differences in tax avoidance behaviour across locations. In particular, moving between the top and bottom quartiles of MSAs results in an approximately 14% swing in ETRs. We observe similarly sizable swings for CETR, UTB, and CETR5.

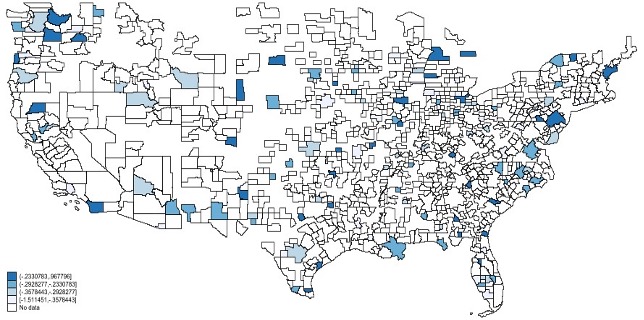

A visual depiction of the distribution of location fixed effects for the ETR across the United States is provided in Figure 1. A darker shade indicates greater tax avoidance in the area.

Figure 1: spatial distribution of the location fixed effect coefficients for the ETR sample

Location-based characteristics and location fixed effects

After establishing significant location fixed effects, we investigate whether these effects are associated with observable regional characteristics. Specifically, we regress the vectors of estimated MSA fixed effect coefficients obtained from the ETR, CETR, UTB, and CETR5 models on that particular MSAs’: (1) information and resource factors (proxied by workforce population, education level, external accounting and finance expertise from audit firms, and geographic proximity to Internal Revenue Service (IRS) local office); (2) economic, regulatory, and behavioural risk attitudes (as captured by average personal wage, GDP per capita, proximity to IRS, and weather pattern); and (3) social and cultural environment (including crime rates and religiosity).

We find evidence suggesting that locations with higher average education level and longer average daily sunlight are associated with higher corporate cash effective tax rates and lower reported tax reserves. Thus, the geographic variation in corporate tax avoidance is associated with information/resource and risk factors, while cultural factors exhibit little explanatory power. Furthermore, the low explanatory power of these regressions suggests that most of the common factors that would be able to explain location-specific tax avoidance are yet to be identified.

Conclusion

As a summary of our findings, the location of firm headquarters has a statistically and economically significant effect on the level of tax avoidance that firms undertake. Additional analyses also show that location fixed effects are more pronounced for firms that have been located in an area for a longer period and that have lower geographic diversification. While some observable location factors are correlated with differences in tax avoidance across MSAs to a certain extent, much of this variation remains unexplained. Since the MSA characteristics that we examine constitute only the observable factors subject to data availability, there may be a set of unobservable factors that are relevant to tax avoidance decisions and tax planning activities but not captured in our models. This suggests that future studies are needed to further explore factors associated with the geographic differences in corporate tax avoidance.

This study makes several contributions. First, it underscores the importance of firm location to corporate tax decisions. Second, this research adds to the literature investigating the effects of corporate location on corporate decisions. Third, this study has important practical implications for tax authorities. The findings of our study suggest that tax authorities could place greater reliance on location-based analysis to identify aggressive corporate taxpayers headquartered in high-risk locations. Tax enforcement, education, and inspections should happen disproportionally across space.

Recent Comments