Over the last two decades, tax authorities around the world have introduced cooperative compliance approaches to increase corporate tax compliance. These approaches open the possibility for tax authorities and corporate taxpayers to move away from an adversarial and often costly relationship to a more constructive and cooperative modus operandi. This new way of working may take shape in formal, so-called cooperative compliance programs as introduced, for example, by the tax authorities of Australia, the Netherlands, South Africa, the United Kingdom, and the United States, but may also be established without formal participation in such programs.

Cooperative approaches are based on the idea of Responsive Regulation Theory, that is the notion that the first step towards effective regulation is for the regulator to create a setting in which subjects are stimulated to accept responsibility for regulating themselves in a manner that is consistent with the law. Such a setting is created by building and maintaining a constructive working relationship between regulator and subjects, and by promoting openness, transparency, and fairness in the dealings between the two parties. According to the Organisation for Economic Cooperation and Development (OECD), this should lead to higher levels of voluntary compliance.

For corporate taxpayers, a cooperative working relationship can increase tax certainty because it provides opportunities to discuss the tax treatment of complex transactions with the tax authority at an early stage. However, there is a potential downside for them as well: establishing a working relationship based on mutual trust and transparency may imply the need for corporate taxpayers to refrain from using potentially profitable (but possibly aggressive) tax planning strategies. This may create a barrier for taxpayers to participate in a cooperative approach.

Cooperative approaches have been implemented without a thorough assessment of their effects on tax compliance. We present the results of a study that identifies the essential building blocks of cooperative approaches, as well as the underlying logic that ties these blocks together, and subsequently tests the resulting model. A better understanding of how cooperative approaches work and how effective they are in promoting corporate tax compliance can help tax authorities to improve the quality of their interactions with corporate taxpayers and to better target their cooperative approaches to specific types of corporate non-compliance.

The building blocks of the cooperative approach

The starting point of this approach is that compliance requires a consistent, objective, and fair treatment of taxpayers by the tax authority; that is, the tax authority should ensure a sufficient level of perceived procedural fairness. The OECD sees this as a prerequisite for the development of a trust-based working relationship between tax authority and taxpayer, which can be beneficial for both parties due to lower enforcement and compliance costs. In the cooperative approach, the OECD expects taxpayers to contribute to this working relationship by being transparent about relevant tax risks to help overcome information asymmetries. Disclosure of these risks enhances the tax authority’s information position, allowing a more effective risk assessment and better resource allocation. The OECD suggests that transparency requires the presence of a sound tax control framework where an internal control system assures the accuracy, timeliness, and completeness of tax returns and disclosures.

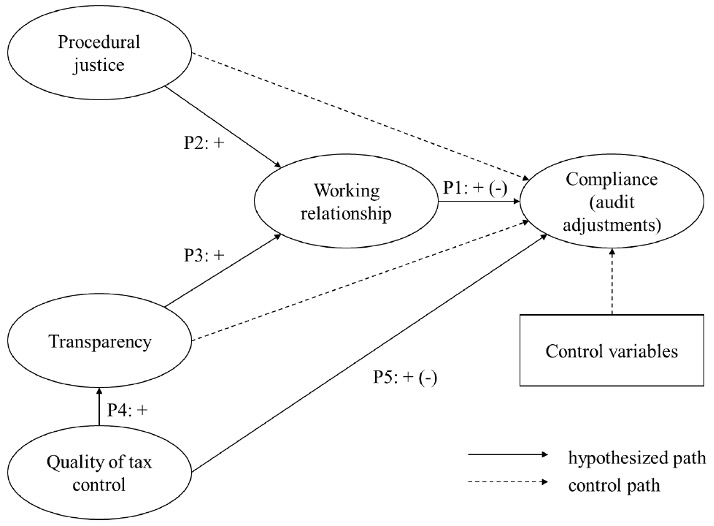

Based on the reports and documents about the cooperative approach, we derived the following theoretical model (see Figure 1):

Figure 1: Theoretical model of the cooperative approach, based on OECD reports

Note: The plus sign behind P1 and P5 indicate a positive effect on compliance, while the minus sign in brackets indicates a negative effect on audit adjustments.

The survey

The data for our study were collected in 2014 through a survey among senior staff responsible for tax matters of selected large organisations in the Netherlands—for instance, tax director, head of tax, chief financial officer or controller – and through a tax audit carried out by Netherlands Tax Administration (NTA) at the same large organisations. This data set was collected as part of a larger research project of the NTA aiming to shed light on the relationship between NTA’s regulatory strategy for large organisations and tax compliance. The research population consists of about 8,500 large organisations in the Netherlands, from which a random sample of 274 profit organisations was drawn. For a total of 169 organisations the survey was completed and audit data was collected.

Our dependent variable is corporate tax compliance. Following DeBacker et al., we use the scaled amount of audit adjustments as a proxy for the level of compliance (or rather: noncompliance), using the materiality threshold used in the NTA audit process as the denominator. Additionally, we also use the number of audit adjustments as an additional proxy for noncompliance. We calculate these proxies separately for Value Added Tax (VAT) and Corporate Income Tax (CIT), based on the results of the tax audits. All other variables are measured with data collected through the survey among those sampled large organisations.

Findings

In line with the theoretical model based on OECD reports, we find that increased procedural justice (namely, treating taxpayers in a consistent, objective, and fair way) and increased transparency from large organisations appear to improve the working relationship between tax authorities and taxpayers. Furthermore, we find the expected positive relationship between the quality of tax control and the degree of transparency from large organisations. Overall, our results suggest that the key tenets of the cooperative approach contribute to the quality of the working relationship between taxpayer and tax authority.

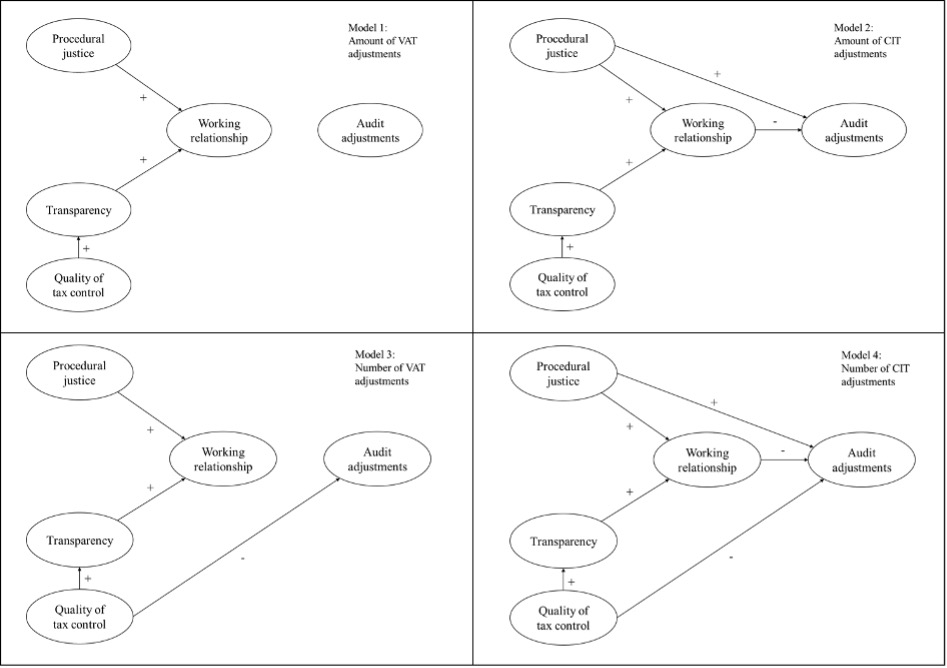

However, the relationships between the quality of the working relationship and the quality of tax control on the one side and tax compliance on the other side are less straightforward. Irrespective of whether we use the amount or the number of audit adjustments to measure (non-)compliance, we find that the working relationship only affects CIT compliance (Models 2 and 4 in Figure 2) but not VAT compliance (Models 1 and 3 in Figure 2). Furthermore, the positive and significant relationship between the quality of tax control and tax compliance only holds for the number of VAT and CIT adjustments (Models 3 and 4 in Figure 2), but not for their amount (Models 1 and 2 in Figure 2).

Figure 2: Significant results

– = significant negative effect, p<.10

+ = significant positive effect, p<.10

A more complex picture

Our findings on the relationships between the quality of the working relationship and the quality of tax control on the one side and tax compliance on the other side suggest a more complex picture than suggested by reports from the OECD and tax authorities. This complexity might be caused by the underlying differences between VAT and CIT compliance. CIT matters are usually dealt with at relatively high staff levels in the organisational hierarchy; the same level that is involved in the development of the working relationship. For VAT, settlement is much more routinised in impersonal administrative processes, managed by operational personnel that do not directly interact with the tax authorities. This difference might explain why we find that the working relationship is more important in the context of CIT compliance. This complexity might also be caused by the underlying differences between the number and scaled amount of audit adjustments as proxies for (non-)compliance.

We argue that the number of adjustments is a better proxy for unintentional errors in the tax filings, whereas the amount of the adjustment more likely picks up on intentional non-compliance, that is, tax aggressiveness. The tax control framework is especially useful to prevent unintentional mistakes, and our results seem to reflect this since the quality of tax control was significantly associated with the number of adjustments.

We conclude that these results could be interpreted as supporting the change by tax authorities worldwide towards cooperative relationships with large businesses. How such a cooperative relationship can contribute to corporate tax compliance is, however, a more nuanced problem. Our findings provide building blocks for a more mature theoretical framework on the effect of both internal tax control and the working relationship on different types of corporate tax compliance.

This blog post is based on our paper: ‘The cooperative approach to corporate tax compliance: An empirical assessment’, Journal of International Accounting, Auditing and Taxation, in print.

Recent Comments