To what extent do taxes influence foreign direct investment (FDI) in developing countries?

In most of the developing world, tax incentives are employed to attract FDI. While these incentives are typically aimed at promoting investment and generating technological spillovers, they could incur sizable revenue losses. Understanding how foreign investors respond to tax incentives is, thus, crucial for developing countries since they are especially reliant on corporate income tax revenue. In my recent paper (Muthitacharoen 2019), I examine this question using the Association of Southeast Asian Nations (ASEAN) data.

While there are many studies on this issue for advanced economies (see, for example, Devereux and Griffith, 1998; Buettner and Ruf, 2007; Bellak and Leibrecht, 2009; and Egger et al., 2009), the empirical evidence that uses forward-looking tax measures and incorporates international taxation aspects for developing countries is relatively limited. This represents an important gap in the literature since the effect of taxes on FDI in advanced economies may not carry over in a straightforward way for developing economies. A number of studies have shown that the tax sensitivity varies with the income level of host countries (see, for example, Mutti and Grubert 2004; Azemar and Delios, 2008; and Goodspeed et al., 2011).

Tax developments in ASEAN economies

Tax developments in ASEAN economies over the past two decades have provided an excellent opportunity to study the role of taxes on attracting FDI.

The region is one of the largest FDI recipients in the developing world. The FDI in ASEAN accounts for roughly 20 per cent of total stock in developing countries in 2016. On top of that, there are significant variations in the region’s FDI tax treatment over time.

Those variations come from three sources. The first source is changes in the corporate income taxes imposed by the host country, namely those in ASEAN. Examples include Thailand’s aggressive cuts in the statutory tax rate from 30 per cent to 20 per cent over 2011-2013 and Indonesia’s tax rate cuts from 30 per cent to 25 per cent over 2008-2010. The second source is changes in the taxes imposed by the home country. Examples include the switches by Japan and the United Kingdom from worldwide to territorial taxation in 2009. The final source is differences in the effective tax rates across country pairs. Such variations can result from differences in the statutory tax rates and the tax incentives across countries, as well as differences in the double taxation relief methods across country pairs. One example of the latter case is the tax sparing credit which is allowed in the treaties between Thailand and Japan but is forbidden between Thailand and the United States.

Those developments have provided important variations in the tax costs facing foreign investors. My study focuses on bilateral net FDI flows into ASEAN’s middle-income countries (Indonesia, Malaysia, the Philippines, Thailand and Vietnam) from 16 developed countries over 2002-2013.

Taking into account both domestic and international tax provisions

Since the tax costs associated with the decision to choose an investment location depend on domestic as well as international tax, my study captures those costs by computing bilateral effective average tax rates using the methodology proposed by Devereux and Griffith (2003). I also take into account the tax law provisions of both domestic taxation (for example, depreciation deduction and tax holidays) and international taxation (that is, measures to relief double taxation as specified in bilateral tax agreements such as underlying tax credit and tax sparing provisions).

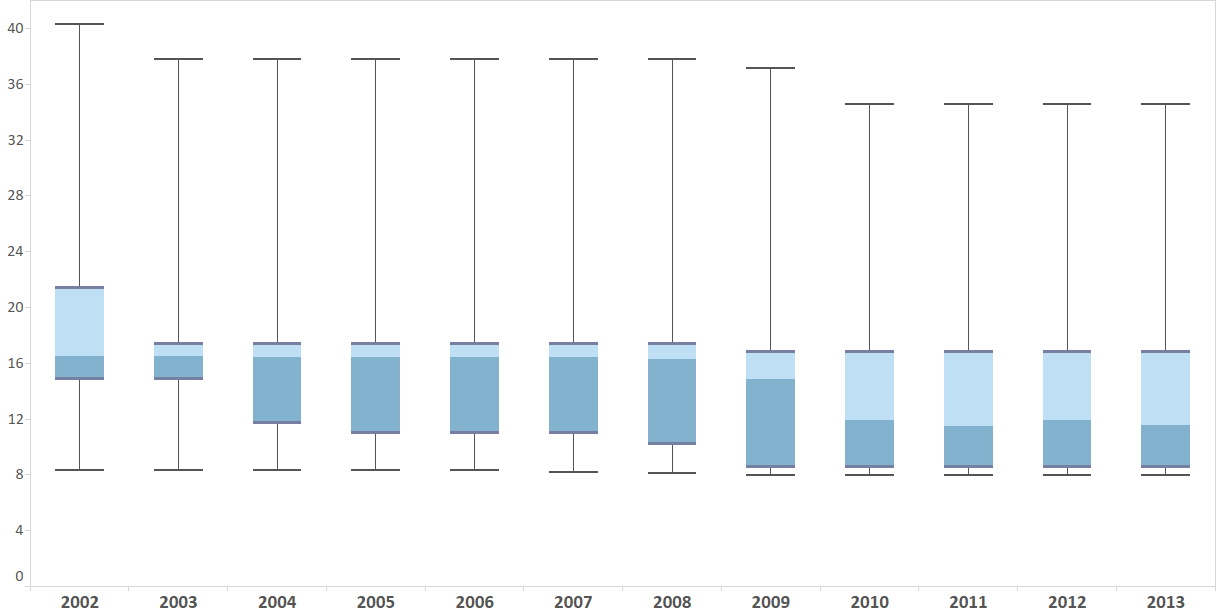

Figure 1 shows the box plot of the bilateral effective average tax rates over the 2002-2013 period. There is a general downward trend in the distribution of the effective tax rates. The median tax rate, for example, falls from 16.5 per cent in 2002 to 11.6 per cent in 2013.

Figure 1: Box plot of the bilateral effective average tax rates (2002-2013)

Note: Whiskers indicate maximum and minimum values. Boxes indicate upper quartile, median and lower quartile.

Source: Muthitacharoen (2019)

Taxes are important but their roles should not be over emphasized

I provide empirical evidence on the effects of taxation on FDI. I estimate a pooled-quantile regression model with fixed effects—describing the net FDI flows as a function of the bilateral effective average tax rates and other control variables. This approach accommodates the skewed distribution of FDI and enables a comprehensive look at the tax sensitivity across the FDI distribution, controlling for unobserved characteristics across country pairs as well as common shocks over time.

I find that taxation plays an important role in attracting FDI into the region. The effect of taxes is negative and statistically significant across the distribution of FDI flows. However, it is not homogeneous across the distribution. My finding indicates that the impact of taxes is relatively smaller for the pairs of countries with large investment flows where investors are already familiar with the host countries (for example, Indonesia-Singapore and Thailand-Japan). This underlines the importance of understanding the effect of taxation across the distribution rather than only at the mean.

I also find that the fundamental factors of host countries such as labor productivity and rule of law are important in FDI. Their economic significance are greater than that of the taxes at the median of the FDI distribution. These findings are generally robust across alternative assumptions and specifications.

Taken together, my findings underline the importance for equipping policymakers with a comprehensive understanding of the effects of tax incentives and other fundamental factors on FDI. Avoiding potential redundancy associated with the tax incentives is key to balance the goals of enhancing competitiveness and maintaining fiscal sustainability.

Further reading

Muthitacharoen, Athiphat (2019) ‘Assessing the Importance of Taxation on FDI: Evidence from South-East Asian Developing Countries’, eJournal of Tax Research, 17 (1): pp. 63-82.

Recent Comments