“Relative to other similar size OECD countries, Australia’s company income tax rate is high … Australia should respond to these developments by reducing the company income tax rate to 25 per cent”.

You could be forgiven for thinking that these words were written in the context of this year’s corporate tax reform debate. However, this is an extract from the decade-old, and aptly named, Australia’s Future Tax System: Report to the Treasurer (2009), also known as the ‘Henry Review’.

It is important to note the quote in context, because in the next breath, the Henry Review calls for a tax on economic rents — specifically, “a broad-based resource rent tax” — to be implemented at the same time as a corporate tax cut. The Henry Review then posits that a lower company income tax rate would reduce incentives for foreign multinational enterprises (MNEs) to shift profits out of Australia.

The central premise of this article is that it is imperative to increase the efficiency of business taxation, where possible. The corporate income tax system has the highest efficiency costs among Australia’s federal taxes, with the efficiency losses resulting from taxing normal returns likely to be above 40%. On the other hand, taxing economic rents gives rise to a zero welfare loss.

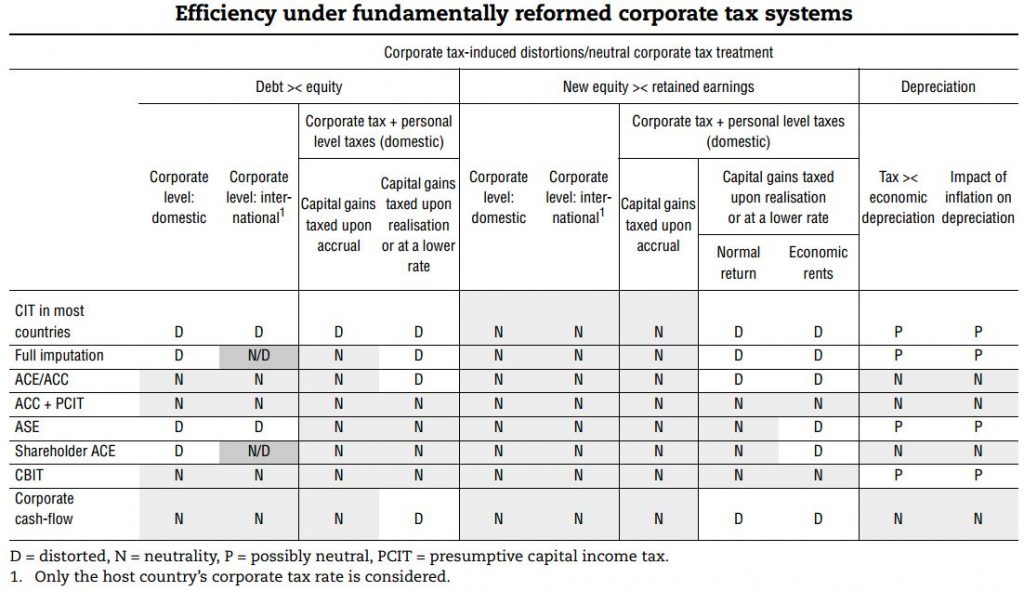

While there are many fundamental reform proposals targeting corporate tax-induced distortions, as show in Table 1, the Allowance for Corporate Equity (ACE) and its variants have been most commonly experimented with in practice. The ACE is a type of source-based economic rent tax providing a deduction for equity capital similar to the interest deduction for debt. There is much economic literature on the theoretical desirability of an ACE, the most widely accepted feature being its ability to attain debt-equity funding neutrality (thereby eliminating the debt bias at the corporate level). However, the ACE has a revenue cost.

Table 1: Comparison of fundamental reforms’ impact on corporate tax-induced distortions

CIT: Corporate Income Tax; ACE: Allowance for Corporate Equity; ACC: Allowance for Corporate Capital; ASE: Allowance for Shareholder Equity; CBIT: Comprehensive Business Income Tax. Source: OECD (2007)

CIT: Corporate Income Tax; ACE: Allowance for Corporate Equity; ACC: Allowance for Corporate Capital; ASE: Allowance for Shareholder Equity; CBIT: Comprehensive Business Income Tax. Source: OECD (2007)

I explore these reform suggestions in the Henry Review through a case study analysis of the ACE in practice, as introduced in Belgium and Italy in the last decade. I then analyse a simulation of the behavioural responses of a hypothetical tax-minimising MNE to existing and proposed tax regimes. This facilitates a comparison of the efficiency and integrity outcomes of implementing corporate tax cuts, as opposed to fundamental reforms such as an ACE, in these jurisdictions.

Why did Belgium and Italy implement an ACE?

As highlighted in my recent paper, the theoretical desirability of an ACE may not have been the determining motivation for implementing the fundamental reform of an ACE in either Belgium or Italy.

In the Belgian experience, two key factors motivated the introduction of the Belgian Allowance for Corporate Equity system in 2005. The first factor was pressure from the European Commission (EC) to abandon the Belgian coordination centre regime, an advantageous tax regime primarily used to finance group companies, which was found to be in violation of the EC rules on state aid. The second factor was pressure resulting from the expansion of the European Union to countries with lower corporate tax rates, including Cyprus, Latvia, Lithuania, and Hungary. Belgium saw a need to strengthen its competitive position on the regional and international tax map.

Italy’s ACE reform provides a unique and interesting case study that demonstrates the policy compromises needed in real life tax reform. Italy implemented two ACE-variants under two different corporate-shareholder tax systems. The first was the Italian ACE-variant operating from 1998-2001, termed the Dual Income Tax, under which companies were liable to pay the statutory corporate income tax rate on above-normal profits, with the normal return on capital subject to a reduced tax rate fixed by the government. The second is the current Italian ACE-variant, implemented in 2012, termed the Aiuto alla Crescita Economica.

Leading commentators observe that the Italian ACE-variant shares the main characteristics of the ACE considered efficient in economic theoretical approaches. However, the Italian corporate tax system is a hybrid in reality. It has elements of a Comprehensive Business Income Tax (CBIT), which has a broad base and denies a deduction for interest expense. This is because of the local business tax and the regional production tax in Italy, and because of an overarching limit on the deductibility of interest by corporations, in force since 2008.

Accordingly, the Italian corporate income tax can be characterised as a combination of a partial ACE and a partial CBIT. This system mitigates the debt-equity distortion for corporate capital raising from both directions, while helping to protect the revenue base.

By conducting a comparative legal analysis of the Belgian and Italian ACE-variants, my paper distills socio-political, legal and policy challenges faced by both jurisdictions’ ACE experiences. The four key trade-offs that emerge are:

- between protecting the corporate revenue base and integrity in an ACE system;

- between implementing an ACE at the expense of tax revenue, as opposed to reducing the headline corporate income tax rate;

- on a domestic level, between perceptions that the ACE benefits MNEs disproportionately more than small to medium enterprises; and

- on an international level, between the desire to make inbound investment more attractive and the risk of base erosion from aggressive tax planning by MNEs.

Simulating the trade-off between a lower corporate tax rate and an ACE

In my simulation, I focus on the fourth trade-off because economic distortions are likely to increase incentives for tax-induced behavioural responses, in particular, aggressive tax planning.

In a global economy with capital mobility, it is difficult to observe how an MNE structures its internal affairs to achieve tax optimisation. Policymakers have little information on the size and scope of the problem, which makes targeting tax-minimisation techniques even more challenging.

To address this challenge, in my paper, I conceptualise the capital funding decisions of multinational enterprises as an optimisation problem, using linear programming. This enables me to simulate the cross-border intercompany tax planning responses to both existing and proposed tax reforms of a hypothetical tax-minimising MNE, using Belgium and Italy as examples.

Do high-tax jurisdictions benefit from corporate tax cuts?

Two key findings emerge from my simulation analysis.

First, simply implementing a corporate tax rate cut will not achieve efficiency and integrity outcomes for either Belgium or Italy. This is because most tax-aggressive MNEs will likely be indifferent to a corporate tax cut by higher taxing jurisdictions. While total tax payable would fall marginally, the most tax-aggressive MNE would never choose to place any profits into its Belgian and Italian subsidiaries. Rather, it would choose to channel profit into the lowest taxing jurisdictions available to it.

In my model of the choices available to MNEs, profit shifting activities are directed almost entirely to Hong Kong which has a 16% tax rate. My simulation finds that even relatively less tax-aggressive MNEs will also likely be indifferent to a unilateral corporate tax cut.

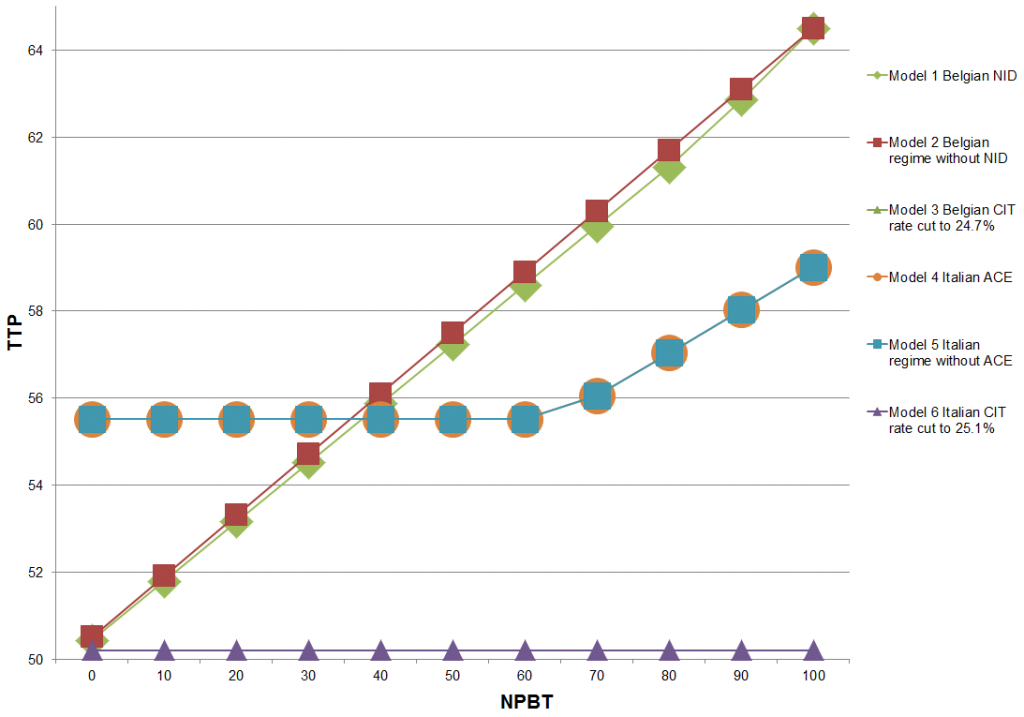

Belgium cut its headline corporate tax rate to 29% and Italy cut its headline rate to 24% in 2017. Unfortunately, my simulation finds that if Belgium and Italy were to reduce their corporate tax rates to the thresholds I model (around 24.7% and 25.1% respectively, as shown in Table 2), they would simply be forfeiting tax revenue from economic rents without impacting multinational enterprises’ profit shifting behaviour.

This unintended consequence is contrary to a key policy objective of implementing corporate tax cuts, namely, to reduce incentives for foreign MNEs to shift profits out of higher taxing jurisdictions.

Table 2: Results of Modelling a Headline Corporate Income Tax (CIT) Rate Cut on the Belgian and Italian Subsidiaries’ Effective Tax Rates (ETRs)

| Net Profit Before Tax (NPBT) | Model 1 Belgian ACE (or ‘NID’) | Model 2 Belgian regime without ACE | Model 3 Belgian CIT rate cut to 24.7% | Model 4 Italian ACE | Model 5 Italian regime without ACE | Model 6 Italian CIT rate cut to 25.1% |

| 0 | 25.2% | 25.3% | 24.7% | 27.8% | 27.8% | 25.1% |

| 10 | 25.9% | 26.0% | 24.7% | 27.8% | 27.8% | 25.1% |

| 20 | 26.6% | 26.7% | 24.7% | 27.8% | 27.8% | 25.1% |

| 30 | 27.3% | 27.4% | 24.7% | 27.8% | 27.8% | 25.1% |

| 40 | 27.9% | 28.1% | 24.7% | 27.8% | 27.8% | 25.1% |

| 50 | 28.6% | 28.8% | 24.7% | 27.8% | 27.8% | 25.1% |

| 60 | 29.3% | 29.5% | 24.7% | 27.8% | 27.8% | 25.1% |

| 70 | 30.0% | 30.2% | 24.7% | 28.0% | 28.0% | 25.1% |

| 80 | 30.7% | 30.9% | 24.7% | 28.5% | 28.5% | 25.1% |

| 90 | 31.4% | 31.6% | 24.7% | 29.0% | 29.0% | 25.1% |

| 100 | 32.3% | 32.3% | 24.7% | 29.5% | 29.5% | 25.1% |

Second, I find that a combination of an ACE-variant system, combined with a mechanism similar to a fixed ratio rule may present a more effective revenue protection measure than simply removing the ACE concession altogether and cutting the corporate tax rate. This behavioural response is illustrated in Figure 1.

Figure 1: Results of Modelling a Headline CIT Rate Cut on the Belgian and Italian Subsidiaries

A fixed ratio rule limits deductions of an MNE for interest expense to a specified ratio of its earnings, assets or equity. A ratio of between 10 to 30% of Earnings before interest, tax, depreciation and amortisation, (EBITDA) is proposed by the OECD BEPS recommendation. I find that using a fixed ratio rule to limit interest deductions enables better protection of a capital importing country’s revenue base.

A fixed ratio rule limits deductions of an MNE for interest expense to a specified ratio of its earnings, assets or equity. A ratio of between 10 to 30% of Earnings before interest, tax, depreciation and amortisation, (EBITDA) is proposed by the OECD BEPS recommendation. I find that using a fixed ratio rule to limit interest deductions enables better protection of a capital importing country’s revenue base.

The wider literature identifies that a fixed ratio rule can reduce distortions between debt and equity, contributing both to combating base erosion and attaining neutrality.

Corporate tax rate cuts, or an Allowance for Corporate Equity?

As we approach the decennial anniversary of the Henry Review, governments and policymakers are increasingly faced with the trade-off of protecting their tax revenue bases while maintaining their international competitiveness.

However, international tax competition issues cannot be eliminated, and so downward pressure on corporate tax rates appears an inevitability. Nonetheless, this article observes that simply implementing unilateral corporate tax cuts will not achieve efficiency and integrity outcomes. Rather, inspired by both the Henry Review and the OECD’s Base erosion and profit shifting (BEPS) project, a better approach may be to adopt an economic rent tax such as an ACE-variant combined with a mechanism similar to a fixed ratio rule.

This article is based on: Kayis-Kumar A (2018), ‘Implementing corporate tax cuts at the expense of neutrality? A legal and optimisation analysis of fundamental reform in practice’, eJournal of Tax Research, vol. 16, no. 1, pp. 201-235.

Recent Comments