Any commodity tax system must specify whether firms or consumers remit taxes. For e-commerce, historically, consumers in the United States were responsible for remitting taxes. But over time, due to court rulings and evolving business practices, the remitting party has shifted toward vendors.

A commonly held view is that who remits the tax is irrelevant. However, I show that remittance rules for online vendors have important implications for commodity tax rates. E-commerce has two offsetting effects on tax rates. First, when governments cannot easily enforce taxes on many individual consumers, an increase in e-commerce lowers tax rates as governments compete with online sales as a ‘tax haven’. Second, when firms remit taxes, increases in e-commerce possibly allow jurisdictions to raise tax rates via an enforcement channel.

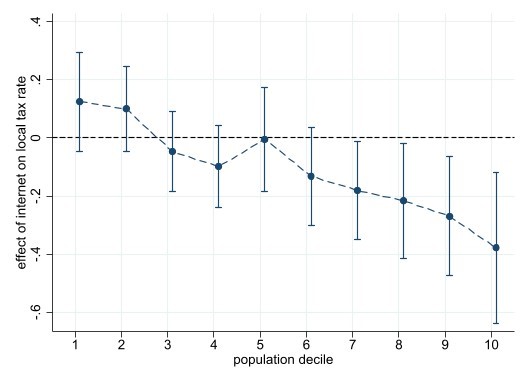

I find that a one standard deviation increase in internet penetration lowers local sales tax rates in the largest population jurisdictions by about 0.15 percentage points or 16% of the average rate. However, increases in internet penetration raise tax rates in smaller jurisdictions and jurisdictions in states where many large online vendors remit taxes.

Background

In the United States, sales taxes are decentralised. States allow counties and towns to levy sales tax rates in addition to the state sales tax rate. Municipal sales tax rates are approximately 1%.

With respect to online transactions, under prior law, a Supreme Court ruling (Quill Corp. v. North Dakota) in 1992 only allowed states to require firms with a physical presence in the state to remit tax. Sales from firms without such presence were effectively tax-free because the obligation to remit the tax fell on the consumer, which the tax authority could not easily enforce.

Despite this physical presence rule, evolving business practices and aggressive state policies led some online vendors to remit taxes in many states. This gradually shifted the remitting party from the consumer to the vendor, whereby the tax authority could more readily enforce destination-based consumption taxes. In 2017, the US Supreme Court ruled (South Dakota v. Wayfair) that states may require online vendors to remit taxes if they have an economic presence – or a sufficient amount of sales – in the state.

How do increases in internet penetration change sales tax rates?

To answer this question, I combine data on all local sales tax rates with measures of internet penetration available at the municipal and state level. Penetration differences across municipalities may result from exogenous historical differences in infrastructure that result in providers servicing the market. Thus, unlike the amount of e-commerce sales in the jurisdiction, penetration is arguably exogenous to sales tax rates. The data are from 2003 and 2011, a period when fewer online vendors were remitting sales taxes. Amazon was only remitting taxes in a handful of states.

To distinguish between tax haven effects and enforcement effects, I use data on the number of online firms remitting taxes in each state. Enforcement effects are most likely to arise in states where many online vendors remit taxes.

On average, higher internet penetration results in lower local tax rates. The effect is most pronounced in large jurisdictions, which see their tax base eroded as large shopping malls decline in importance. But smaller jurisdictions increase their tax rates because sales tax revenue from online purchases now accrues to the consumer’s hometown (see Figure 1).

Figure 1: The effect of a one standard deviation increase in internet penetration on tax rates by population decile

Note: The largest jurisdictions are in decile 10 and the smallest jurisdiction are in decile 1. The dependent variable is the town tax rate. The effect on the town tax rate is for a one standard deviation increase in internet penetration.

Intuitively, absent the internet, a consumer in a small town in Kansas might drive thirty minutes to the state capital Topeka to shop at Walmart, which contributes to the tax revenue of Topeka. However, she can order from Walmart online and pay a similar sales tax via the internet, but the tax revenue accrues to the hometown. Topeka, on the other hand, sees its retail agglomerations erode as its tax base shrinks. In response, the large jurisdiction lowers its tax rate, while the small town raises its tax rate.

I also find large negative effects for border towns in low-state-tax states. These towns set higher tax rates in the pre-internet era when interstate cross-border shopping was the dominant mode of tax avoidance.

Despite using pre-Wayfair data, I identify positive effects of internet penetration in smaller jurisdictions and jurisdictions where many online vendors remit taxes.

Policy implications

Following appropriate changes to remittance rules, such as the recent South Dakota v. Wayfair ruling, (some) governments can exploit technological change to increase tax rates. The mechanisms highlighted apply more generally beyond the retail sales tax. Although technology makes factors footloose, the technological change allows tax administrators to exploit electronic banking, accounting records, credit cards, and IP address as means of enforcement.

The recent South Dakota v. Wayfair decision applies equally to both remote sellers on interstate and international cross-border sales. However, the practical ability of states to enforce these rules internationally is debatable. This could present large compliance costs for foreign vendors seeking to comply with destination-sourcing rules in the United States.

Specific policy implications for VAT or GST

Numerous countries around the world have struggled with compliance on digital transactions, most especially concerning digital services. But several countries have reformed value-added tax (VAT) rules, so platform marketplaces must remit taxes on behalf of many small vendors. Further, recent reforms have shifted the taxation of digital services and products to the standard destination basis.

Historically, many countries had de minimis rules that exempted some cross-border online purchases. In Australia, before 2018, foreign online purchases valued at less than AUD 1000 were not subject to goods and services tax (GST). Thus, like the United States, some online purchases were effectively tax-free. In 2018, GST was due on all goods sold by foreign online sellers, so long as the seller had enough sales in Australia.

When sales escape taxes because of de minimis rules or lack of marketplace facilitator laws, increases in e-commerce erode the VAT base, which may constrain the tax rate as governments worry about consumers shifting purchases to tax-free sites. Following these reforms, increases in e-commerce may allow countries to levy higher tax rates. These effects, of course, might be smaller at the country level than at the state level. Nonetheless, remittance rules provide an important determinant for the level of tax revenues and rates.

This article is based on “The Internet as a Tax Haven?”, which is forthcoming in the American Economic Journal: Economic Policy.

Recent Comments