The Australian economic context is characterised by persistent unemployment, growing under-employment, wage stagnation and growth in inequality. As good-quality, skilled, full-time work opportunities shrink, more people are reliant on casual, poorly paid, intermittent and precarious work. Will the current social security system be ‘fit for purpose’ if work intermittency increases and demand for human labour decreases further? Although falling demand for human labour will not happen immediately, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and others predict a ‘perfect storm’ where a ‘unique combination of forces… will lead to much more rapid transition and restructuring of labour markets in the near future than previously experienced’ (Hajkowicz et al. 2016).

The revival of the idea of a Basic Income – a floor payment to all citizens, regardless of engagement in the labour market or job-seeking activities – is prefigurative of a future where automation, artificial intelligence and further productivity gains may reduce demand for human labour in many sectors. In such a future, the expectation that swathes of the population must subsist on below-poverty level payments due to being unable to find enough paid work to support themselves is unjust.

Yet, there are increasingly punitive measures directed against the unemployed such as income management, ‘breaching’ for non-compliance and algorithm-detected ‘overpayments’. Are these measures an attempt to deflect attention from a disjunction between what is occurring in labour markets by using the perennial tactic of blaming the unemployed? Are there alternatives to the ‘reinforcement and extension of the punitive apparatus’ (Wacqant 2009) and US-style ‘workfare’?

Current approaches to the management of the unemployed involve a combination of job search requirements and sanctions. These have effects on individual outcomes but weaker effects on the overall unemployment rate. There are surprisingly few Australian studies that measure net individual outcomes (that is, whether job search assistance resulted in a person exiting from unemployment). Overall, the biggest predictor of exit is length of time unemployed (van der Berg et al. 2004), and impacts of sanctions and job search assistance may be minimal for the most disadvantaged, the long-term unemployed (Eardley et al. 2005). This can lead to anger, hopelessness and humiliation without any tangible outcomes (Marston & McDonald 2008).

The overall unemployment rate is influenced by a number of factors such as monetary policy, macroeconomic conditions, globalisation and the offshoring of jobs, technological substitution of human labour, and shocks such as the Global Financial Crisis of 2008. Unemployment fluctuations are mainly driven by aggregate demand shocks rather than by labour supply factors (Michaillat and Saez 2014). The evidence is quite weak that sanctioning and activation strategies have much effect on the overall unemployment rate (if this was so, then the more stringent the job search requirements, the lower the unemployment rate would be), however activation strategies and ‘threat effects’ do have effects on particular individuals (in particular, newly-unemployed, relatively skilled persons rather than lower skilled, long-term unemployed persons (Davidson 2015)).

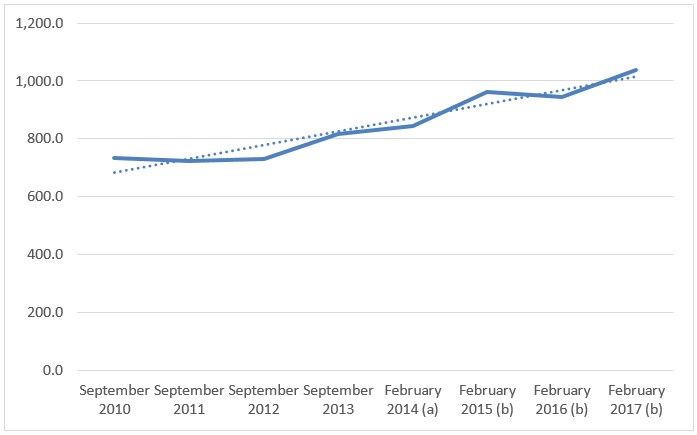

In Australia, the trend underutilisation rate, which includes both unemployment and underemployment, shows that over one million people were considered to be ‘underutilised’, equivalent to 14.4 per cent of the labour force in May 2017 (ABS 2017), or about one in seven work-capable people. Figure 1 shows an increasing number of people who were employed part time or casually desired more than 20 hours of extra work a week.

Figure 1: Part-time workers who would prefer more hours, 2010 – 2017, Persons (‘000)

Source: ABS 2017

The unemployment rate and monetary policy

Governments make choices about unemployment rates (Mitchell & Watts 1997). Full employment (2 per cent or thereabouts) was actively pursued until about 1974, and there have only been brief and partial efforts to guarantee employment since (via the ‘Jobs Compact’ policy of 1994-1996). After 1997, the focus shifted towards job search assistance (Davidson 2011).

A certain rate of unemployment is encouraged, illustrated in the concept of the Non-Accelerating Inflation Rate of Unemployment (NAIRU). If unemployment reduces below the NAIRU, this leads to greater competition for labour by employers, thus wage and inflation pressures may build as labour strengthens its position. Therefore, the logic of monetarist orthodoxy is that a certain level of unemployment (the NAIRU) is optimum and part of the ‘counter-inflationary consensus’ (Beggs 2015).

The Reserve Bank of Australia (RBA) employs the NAIRU concept but that the NAIRU is between 4-6 per cent (RBA 2017). This suggests that there is no desire amongst the RBA and Government to see unemployment drop below 4-6 per cent. However, within the media and popular discourse, there is a pretence of deficient labour supply, rather than insufficient labour demand (Whiteford 2016).

The punishing welfare regime

The spectre of the unemployment haunts an increasing number of employed people, and the unemployed are a disturbing and disciplining reminder of precarity. The range of performative and controlling measures applied to the unemployed is extensive, increasingly paternalistic and punitive.

This includes: a very low income of $267.80 a week (Newstart, single person), removal of all or part of payment if the person does not comply with prescribed activities, moves to a place with an unemployment rate of 2% higher, or has a partner who earns a wage; restrictions on access to cash payment (the BASICS card); requirement to work for an extra $4 an hour (‘internship’); high effective marginal tax rates on extra money earned; and no guarantee of getting access to enough paid work allowing a minimum standard of living.

The unemployed are virtually treated as ‘civic felons’ (Wacquant 2009). It is apposite that a private company that manages some of Australia’s gaols has been mooted as a provider of some customer service functions of Centrelink.

The ‘work as a virtue’ morality is harshly applied to the unemployed and poor, while wealthy rentiers (persons of independent income derived from asset ownership) are, conveniently, free from requirements to work.

At what point can we concede that it may be better to stop punishing people with diminished opportunity to do paid work and, rather, allow them a decent standard of living so they can contribute to the community in other ways?

The idea of a Basic Income

Basic Income is the idea that all persons are citizens and all citizens have a right to a share of societal wealth. If there is insufficient waged work for all citizens, then a means of living or a ‘floor payment’ must be provided. A societal dividend or ‘rent’ – originally conceived as compensation for exclusion from land as means of subsistence; a share in the common wealth – has long been an idea (see van Parijs & Vanderborght 2017 for a history of the concept). The key elements and variations are as follows:

- Enough to modestly live on.

- Unconditional – not associated with having to meet any requirements.

- Individual payment (not household).

Basic Income would allow anyone not engaged in paid employment to live modestly. It could also allow the performance of paid work without high effective marginal tax rates.

Three options

If we accept that a certain level of un- and underemployment seems to be entrenched in our economy, we have three broad policy options:

1. The ‘business as usual’ approach would see the continuation of the current highly means-tested, conditional series of payments. The current cost of social security is $159.654 million (which includes $3.671 million administration cost) (Parliament of Australia 2015), projected to slowly increase by 2018 to $186.869 million.

2. A ‘Jobs Guarantee’ model, championed by Mitchell (2013) and former Treasurer, Wayne Swan: Government would offer everyone a job who wants it (paying at least the minimum wage). Cost can roughly be calculated by multiplying the number of unemployed by a minimum wage job – for instance, 470,400 unemployed persons x $640.15 (a 35-hour week) on $18.29 an hour = $301,126,560. Some argue that this is superior to a Universal Basic Income (UBI), as it is more politically palatable and would produce less inflationary pressure (Hail 2017).

3. The Basic Income approach is not conditional on performing certain actions and activities. A Basic Income may be payable to all citizens (hence Universal) or only payable to citizens where their income falls below a certain threshold (a targeted Basic Income). It has been estimated that a modest UBI of $20,000 a year for all adults would cost $380 billion (Foster 2016). Spies-Butcher and Henderson (in Dunlop 2017), advocating a gradualist approach, have suggested paying the equivalent of the pension to designated eligible persons would cost $78.5 billion.

Conclusion

Governments disingenuously blame the unemployed even though structural joblessness is a permanent feature of capitalist economies. A Basic Income approach would break with the past – including the nostalgia for a return to full employment – and respond to a future where paid work seems set to become scarcer, more intermittent and self-directed. A Universal Basic Income could free us from over-work and poverty and provoke a reorientation of identity based not only on our roles as paid workers, but also as engaged citizens, carers, and autonomous individuals.

Recent Comments