Timing is an important aspect of policy design that is often overlooked by policymakers. Prompting people at different times can have drastically different levels of success. In particular, policies that rely on people to take action at a certain point in time are affected by present bias and imperfect memory.

Reminders have been linked to improved individual behaviour in various contexts, including savings and loan repayments. Less is known about the extent to which the timing of reminders affects policy outcomes, although the effectiveness of early and late reminders may differ considerably. While early reminders are more likely to be forgotten or cause people to overestimate the frequency of reminders, late reminders may be less effective because they reduce the time available to take action.

The aim of our research is to provide evidence on the implications of the timing of reminders, by studying how varying the timing of reminder letters to taxpayers affect their tax payment behaviour. There is now a large body of experimental research investigating how deterrence and non-deterrence methods affect taxpayers’ income reports, but there is comparatively little research on the timely payment of tax debts.

We present results from a field experiment that was conducted in collaboration with the Australian Taxation Office (ATO) to learn about the payment behaviour of small business taxpayers. Such an analysis is important because the volume of outstanding tax debts is non-trivial. For the United States, Internal Revenue Service (IRS) tax gap estimates for the 2008-2010 tax years show average underpayment of $39bn, which is about 10 percent of the gross tax gap. The bulk of unpaid debt is owed by individual taxpayers and unincorporated businesses. In Australia, 30 percent of small businesses did not pay their tax liabilities on time in the 2017 financial year and together owed around 67 percent of total collectible tax debt.

The taxpayer’s problem

In our paper, we construct a simple theoretical model to examine the channels through which the timing of reminders affects the payment behaviour of taxpayers. We show that varying the time at which a reminder letter is sent to taxpayers has a theoretically ambiguous effect on payment behaviour.

In our theoretical model, taxpayers trade off the benefit of paying their tax debt immediately with waiting until a time in the future when the opportunity cost of payment is lower. The disadvantages of delaying payment include interest penalties on the outstanding debt and the possibility that the debt is forgotten. If the debt is forgotten, it remains out of memory until a reminder is received from the tax authority.

Sending reminder letters early alerts taxpayers who have forgotten about their debts. However, an early reminder may also cause taxpayers to believe they will receive frequent reminders from the tax authority, reducing the cost of delay to the taxpayer, and lowering the likelihood of payment. In this case, the probability of payment can be greater when the reminder letter is sent with some delay after the missed payment deadline.

Varying the timing of reminder

While some taxpayers with overdue debts are willfully non-compliant, many have simply forgotten about their debt. The ATO seeks to resolve outstanding tax debts among compliant taxpayers by sending a reminder letter soon after the tax debt becomes overdue. Our field experiment is novel because it varies the time elapsed between the tax payment deadline and the reminder letter being sent.

Deciding when to send reminders is an issue facing all debt collectors. Despite its importance, we provide the first scientific evidence on this choice in a large-scale real-world setting. The target population of taxpayers was restricted to business taxpayers with a history of compliant payment behaviour who had missed their 26 May 2017 tax deadline. Debt cases were randomly allocated to receive a reminder letter either one, two, or three weeks following their missed tax debt due date; a control group did not receive a letter for the seven week duration of the trial.

Findings

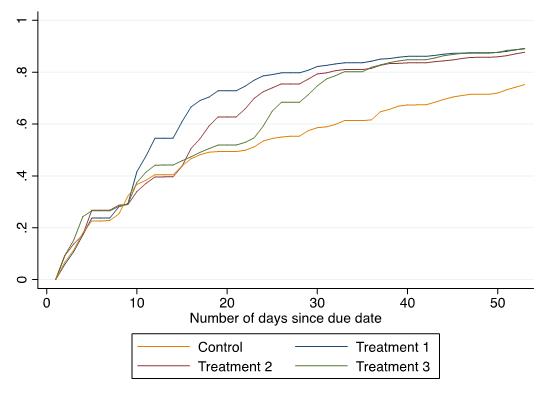

Figure 1 below shows the share of cases that could be resolved over time in the control group and in each of the treatment groups. Each line depicts the share of cases resolved by group and by day since the beginning of the trial.

The solid line in Figure 1 reveals that the share of resolved cases in the control group remains relatively low over the entire study period. Almost 50% of the cases in the control group remain unresolved 52 days after the due date.

In contrast, more than 75% of the cases in the three treatment groups could be resolved within 52 days (less than 25% of the cases remain unresolved). The difference between the treatment groups and the control group constitutes the causal effect of the reminder letter. Differences between the three treatment groups and the control group are statistically significant.

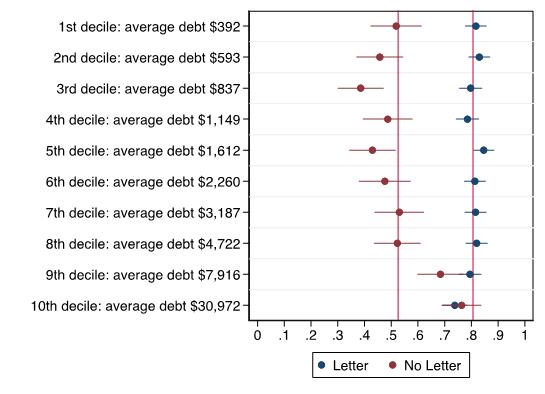

Figure 2 provides information about the share of debt that was paid over time. We observe that taxpayers in the control group repaid about 75% of their debt by the end of the trial period. In contrast, taxpayers in the three treatment groups repaid close to 90% of their debt. The share of debt paid in each group is larger than the share of cases resolved (see Figure 1) because high value debts are more likely to be repaid than low value debts.

While the difference between the treatment groups and the control group are considerable towards the end of the trial period, the three treatment groups converge to about the same share of debt paid over time. Moreover, we observe that taxpayers who receive their reminder letter earlier also repay their debt earlier than taxpayers who receive their reminder letter later on.

A more detailed analysis of payment rates reveals that, although the reminder letters could increase payment rates, the effects are driven entirely by relatively low initial debt levels (below AUS$7,500). This finding suggests that reminder letters are ineffective if initial debt levels are too high.

To determine the “tipping point” beyond which the reminder letters are no longer effective, we examine the effect of receiving a letter (i.e. the effect of being in one of the three treatment groups) on debt payments by the initial debt level of the taxpayer. Figure 3 shows the difference between businesses that do and do not receive a reminder letter within each decile of the initial debt level.

We find that the letters were highly effective for initial debt levels of about AUS$8,000 or less. Beyond that threshold, the effect of the letter on debt payments is not significant, suggesting that reminder letters are ineffective if the initial amount of debt is larger than AUS$8,000. However, it is worth noting that high value debt cases not receiving a reminder letter resolved at a similar rate to low value debt cases that did receive a reminder letter.

Figure 3: Treatment Effect by Initial Debt Level

Figure 3: Treatment Effect by Initial Debt Level

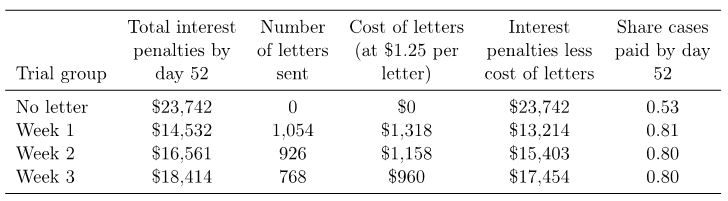

Cost-benefit analysis

It is interesting to compare the revenue implications of varying the letter send date. For each day a tax debt is outstanding the ATO levies interest penalties at the rate of 8 percent per annum, compounded daily. Thus, delaying the date at which a debt is paid raises more revenue from penalties. Delaying the reminder letter send date also reduces cost, because some debts will be paid in the intervening period and fewer letters need to be sent. However, compared with interest penalties the cost of sending the reminder letters is low, at about AUS$1.25 per letter, including postage. Table 1 summarizes these costs and benefits for each group.

A private debt collector would prefer sending letters in week three, rather than week one or week two, because this maximises net revenue and has no cost in terms of the share or amount of debt paid by the end of the trial. However, net revenue is only around AUS$4,200 higher when the letters are sent in week three rather than week one. For comparison, around AUS$1m of debt was outstanding in each experimental group at the beginning of the trial.

From a social welfare perspective, exploiting taxpayer’s imperfect memory to raise revenue seems problematic. On one hand, there is no behavioural response available to taxpayers to reduce the amount of tax owed, and penalties raise lump-sum revenue. However, if taxpayers were to become aware of the fact the tax authority was deliberately not alerting taxpayers about overdue debts to raise revenue, such a policy could adversely affect taxpayer behaviour in the future. We discussed this trade-off with staff at the ATO and they were of the view that sending reminder letters early was best from a taxpayer compliance and engagement perspective.

In sum, we find that the probability of payment at the end of the seven-week field experiment was 25 percentage points greater for each group that received a reminder letter relative to the control group. However, there was no difference in the probability of payment between treatment groups at the end of the seven-week trial period, regardless of whether the reminder letter was sent one, two or three weeks after the due date.

Our results imply that sending reminder letters early accelerates the collection of tax debts and has no effect on the ultimate probability of payment. The only meaningful heterogeneity in payment behaviour is related to the size of debts. Reminder letters did not increase the probability of payment for high value debts (above AUS$7,500). This could indicate that inability to pay is a more important barrier to payment than imperfect memory for taxpayers with high value debts.

This blog post is based on TTPI Working Paper 13/2018, ‘Nudging business to pay their taxes: Does timing matter?’, by Christian Gillitzer and Mathias Sinning. The paper was recently presented at the TTPI Conference on Behavioural Economics and Public Policy (TTPI-BEPP2018) by Christian Gillitzer. Speaker slides and audio recording can be downloaded from the event page.

Recent Comments