Progress continues on implementing the BEPS Action 5 minimum standard, with a further 22 jurisdictions changing their laws to address harmful tax practices. On 19 July 2019, the Inclusive Framework on BEPS approved the latest results of reviews of jurisdictions’ domestic laws conducted by the OECD Forum on Harmful Tax Practices (FHTP). The review covered not only preferential tax regimes, but the results of the review of the substantial activities factor for no or only nominal jurisdictions.

Review of substantial activities factor for no or only nominal tax jurisdictions

After agreeing the new substantial activities standard for no or only nominal tax jurisdiction in November 2018, the 12 “no or only nominal tax jurisdictions” identified by the FHTP introduced the necessary domestic legal framework to meet the standard. The standard requires that for certain highly mobile sectors of business activity, the core income generating activities must be conducted with qualified employees and operating expenditure in the jurisdiction.

The FHTP has now reviewed the new domestic laws of the 12 no or only nominal tax jurisdictions. For 11 of these jurisdictions (Anguilla, the Bahamas, Bahrain, Barbados, Bermuda, British Virgin Islands, Cayman Islands, Guernsey, Isle of Man, Jersey, Turks and Caicos Islands), the FHTP concluded that the domestic legal framework is in line with the standard and therefore “not harmful”. Regarding the remaining jurisdiction reviewed by the FHTP (United Arab Emirates), the FHTP concluded that the legal framework was in line with the standard but with one technical point outstanding. In this respect, the United Arab Emirates committed to make further legislative changes and the law is now “in the process of being amended.”

From 2020, the FHTP will start an annual monitoring process for the effectiveness of jurisdictions’ mechanisms to ensure compliance with the standard in practice.

Review of preferential tax regimes

During its June 2019 meeting, the FHTP made new and updated decisions on 56 regimes, some of which were reviewed for the first time, as follows:

- 13 regimes were abolished (Cabo Verde, Malaysia, Mongolia, Montserrat, Morocco, Switzerland, Thailand).

- Three regimes were amended to remove the potentially harmful features (Cabo Verde, Malaysia, Mauritius) and four new regimes were classified as “not harmful”, as they were specifically designed to meet the Action 5 standard (Malta, Poland, Thailand).

- Four regimes are in the process of being amended (Aruba, Greece, Kazakhstan).

- Eight regimes were found to be out of scope for the FHTP (Cabo Verde, Nigeria, Paraguay and Vietnam).

- Two regimes have been found potentially harmful but not actually harmful (Aruba, Vietnam) and one regime is not operational (Paraguay).

- One regime has been found actually harmful (Jordan).

- 21 additional regimes have now been placed under review (Cook Islands, Dominica, Dominican Republic, Jamaica, Morocco, North Macedonia, Qatar).

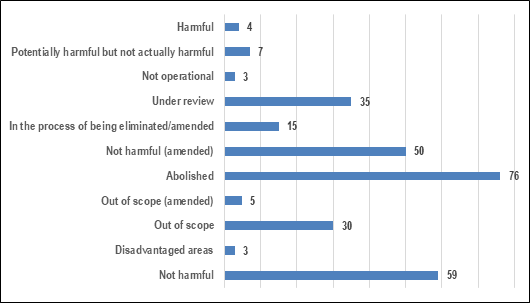

The FHTP has reviewed 287 regimes since the start of the BEPS Project. The results of these reviews can be depicted as follows:

The FHTP will continue its reviews in December 2019, and in 2020 will continue to monitor the implementation of the new laws in practice.

More information on the BEPS Action 5 peer review and monitoring process

(Source: OECD Tax)

Recent Comments