Beer, Klemm & Matheson 2018, Tax Spillovers from US Corporate Income Tax Reform, IMF Working Paper No. 18/166

Summary

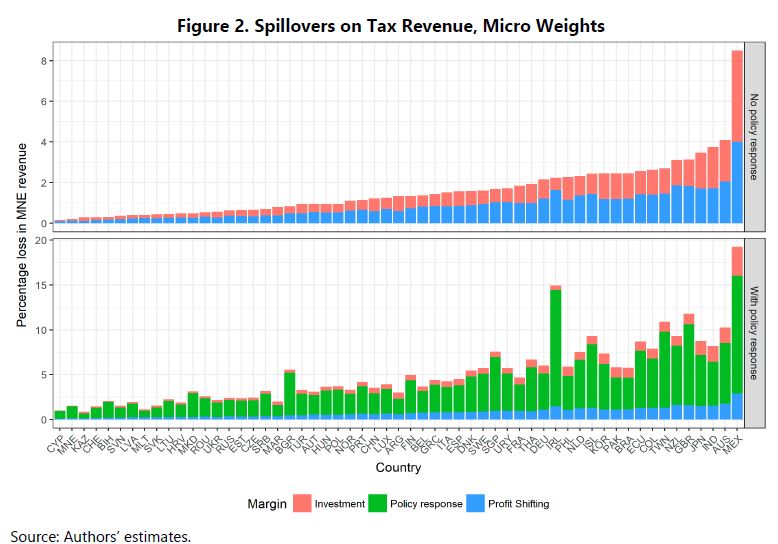

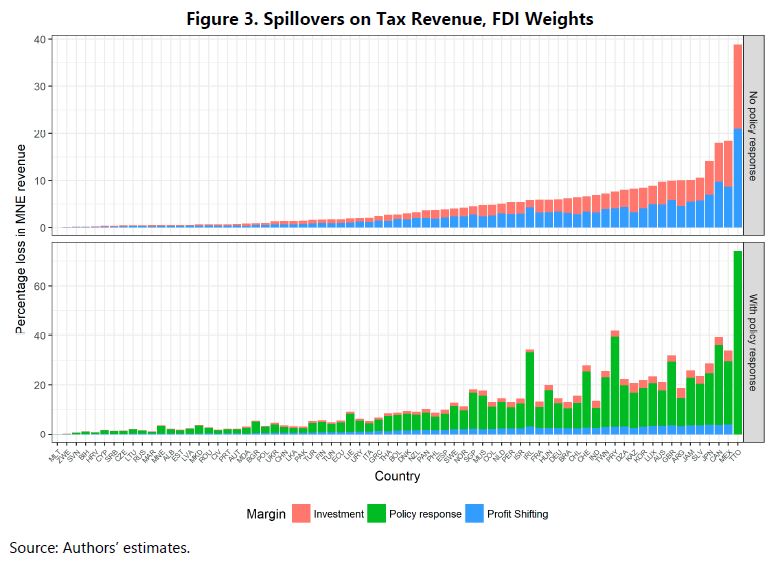

The paper describes, and where possible tentatively quantifies, likely tax spillovers from the United States corporate income tax reform that was part of the broader 2017 tax reform. It calculates effective tax rates under various assumptions, showing among other findings, how the interest limitation and the Foreign Derived Intangible Income provision can raise or reduce rates. It tentatively estimates that under constant policies elsewhere, the rate cut will reduce tax revenue from multinationals in other countries by on average 1.6 to 5.2 percent. If other countries react in line with historical reaction functions, the revenue loss from multinationals rises to an average of 4.5 to 13.5 percent. The paper also discusses profit-shifting, real location, and policy reactions from the more complex features of the reform.

Findings on Australia

Changes to relative tax levels affect the attractiveness of the United States and, in response, other countries may react by adjusting their tax systems, the authors note, leading to renewed incentives to reduce rates and to potential losses of tax revenues.

In its analysis and quantification of the likely spillovers from the change in US corporate income tax rate on other countries, the study places Australia as the country with the second largest percentage loss in multinational enterprise (MNE) revenue, just behind Mexico. The paper estimates a 4 percent loss if Australia maintained its corporate income tax levels, and a loss of 10 percent if there is a policy response, when the micro weights simulation is used.

When using bilateral FDI weights, which ascribe more importance to the US market, the estimates for total revenue spillovers increase substantially, with almost 10 percent loss of revenue if Australia maintained its CIT levels, and a 20 percent loss if there is a policy response to the US cuts.

When using bilateral FDI weights, which ascribe more importance to the US market, the estimates for total revenue spillovers increase substantially, with almost 10 percent loss of revenue if Australia maintained its CIT levels, and a 20 percent loss if there is a policy response to the US cuts.

Given the broad range of elasticities found in the literature, however, the authors warn that the figures should be interpreted with a healthy amount of caution, since the reaction could be larger or smaller.

Given the broad range of elasticities found in the literature, however, the authors warn that the figures should be interpreted with a healthy amount of caution, since the reaction could be larger or smaller.

(Source: IMF WP/18/166)

Beer, de Mooij & Liu 2018, International Corporate Tax Avoidance: A Review of the Channels, Magnitudes, and Blind Spots, IMF Working Paper No. 18/168

Summary

The paper reviews the rapidly growing empirical literature on international tax avoidance by multinational corporations. It surveys evidence on main channels of corporate tax avoidance including transfer mispricing, international debt shifting, treaty shopping, tax deferral and corporate inversions. Moreover, it performs a meta analysis of the extensive literature that estimates the overall size of profit shifting. The authors find that the literature suggests that, on average, a 1 percentage-point lower corporate tax rate will expand before-tax income by 1 percent—an effect that is larger than reported as the consensus estimate in previous surveys and tends to be increasing over time. The literature on tax avoidance still has several unresolved puzzles and blind spots that require further research.

Findings on Australia

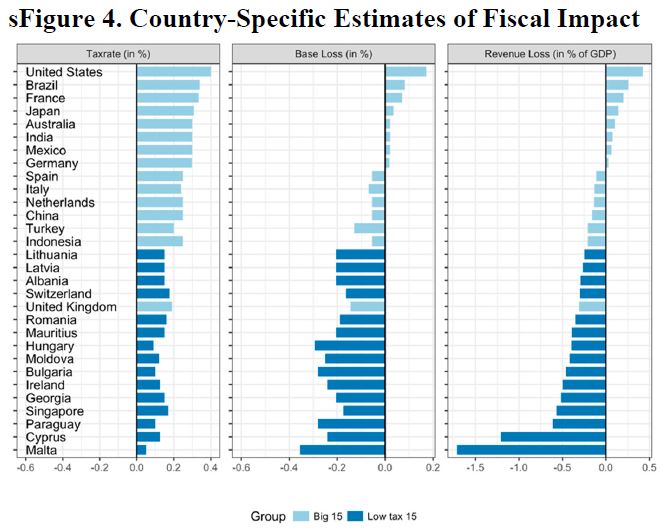

Country-specific results for a selection of simulated variables estimating fiscal impact show Australia as one of the large economies with losses from profit shifting, due to the lower rates in other economies (negative base and revenue losses are gains).

(Source: IMF WP/18/168)

(Source: IMF WP/18/168)

Klemm, Liu, Mylonas & Wingender 2018, Are Elasticities of Taxable Income Rising? IMF Working Paper No. 18/132

Summary

The paper assesses a possible explanation for the global downward trend in top personal income tax rates over the last decades: globalization and the related tax evasion and avoidance opportunities could have raised elasticities of taxable income, which would imply lower optimal tax rates. The paper estimates elasticities of taxable income for top income earners using a large sample of economies and years with a common method, allowing an analysis of trends in such elasticities. The paper finds that elasticities do not appear to exhibit any clear pattern over the years. The downward trend in tax rates must have other possible explanations, which are briefly discussed.

Findings on Australia

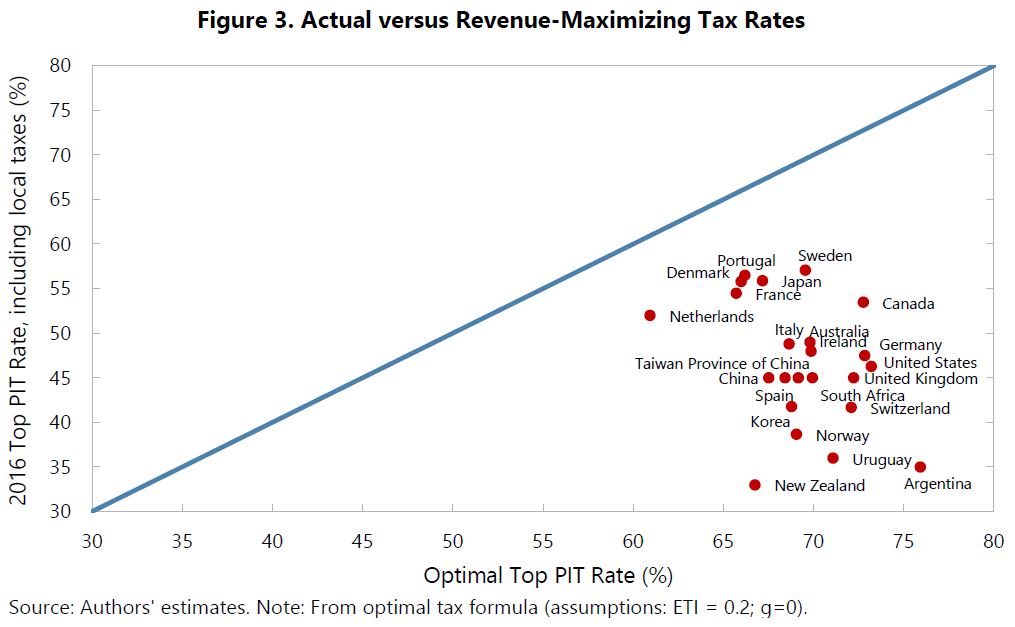

Based on an average elasticity of taxable income of around 0.2, and using each economy’s Pareto index, the authors calculate optimal top tax rates and compare them to actual rates. The study reveals that all economies are below the revenue-maximizing optimal tax rates.

However, the authors note that the finding of actual tax rates being below estimates of revenue-maximizing rates does not necessarily mean that tax rates are not optimal, as the actual welfare weight for rich people could exceed zero or governments may know that the elasticity in their particular economy is higher than average for some structural reason. Nevertheless, the authors assert that this finding provides indicative evidence that revenue-maximizing governments could raise tax rates. A counter-argument to this would be that consumption taxes, such as VAT should be added. Indeed, adding these to the combined (central and regional/local) personal income tax rate, would bring many economies very close to optimal rates. It is, however, questionable whether this should be done. As consumption taxes are also raised from spending of earnings that evade income taxes, they are likely to have a different elasticity. Moreover, the authors conclude, if the marginal propensity to consume is low for rich individuals, those taxes will impose a lower burden on them, meaning that they cannot simply be summed.

(Source: IMF WP/18/132)

Recent Comments