The International Monetary Fund (IMF) has published its 2018 ‘G20 Report on Strong, Sustainable, Balanced, and Inclusive Growth’, with inputs from the Organisation for Economic Co-operation and Development (OECD).

Relative to last year’s report, the authors summarise, output gaps have been closing—with actual output closer to potential—and fewer people are unemployed, although risks have increased. At the same time, progress toward more sustainable and balanced growth has been slow, as external excess imbalances persist, debt levels remain high, and productivity growth remains low.

Inclusion remains a challenge

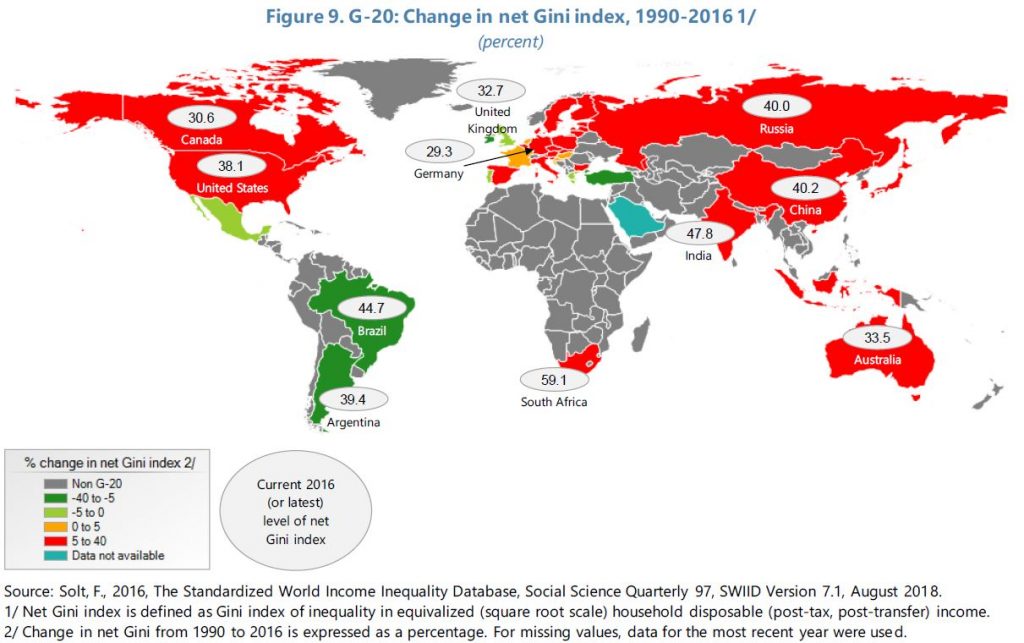

The report finds that inequality has risen since 1990 in almost all G20 advanced economies, such as Australia, and in many emerging economies. Across the G20, earners in the bottom 10 percent of the income distribution, on average, earn only 8 percent of what earners in the top 10 percent make. These persistent inequalities reflect and reinforce uneven access to economic opportunities, such as education, health care, and financial services.

Source: G20 Report on Strong, Sustainable, Balanced, and Inclusive Growth

Source: G20 Report on Strong, Sustainable, Balanced, and Inclusive Growth

Australia amongst three countries with substantial fiscal space

In relation to fiscal policy, the IMF finds that across the G20 economies, policy space is more limited now than it was before the global financial crisis. Constraints on fiscal policy have increased due to the rapid accumulation of public debt since 2007, with the most recent IMF assessments indicating substantial fiscal space for only three countries: Australia, Germany and South Korea.

Due to the urgency of rebuilding policy space for the next downturn, the report calls for policymakers to accelerate fiscal consolidation and step up their efforts to rebuild fiscal buffers, noting that while this will have an impact on short-term growth, it can help sustain growth over the medium term. Procyclical policies should be avoided or rolled back, while prudent use of fiscal space can raise potential growth, advance external rebalancing, and enhance inclusiveness. Current expansionary spending and tax plans in the United States, for instance, worsen the prospects for debt sustainability and external imbalances, since the economy is already at full employment.

Fiscal adjustment should be as growth-friendly as possible, with measures that help reduce inequality and protect the most vulnerable, the report concludes.

Redistributive fiscal policies are a key instrument

Noting that tax and benefit systems are already widely used to mitigate unwanted inequality of market outcomes, the report recommends improving their effectiveness through the design of more progressive tax systems and lower tax expenditures, and through targeted policies to improve access to economic opportunities; in particular, education, health, financial inclusion and the removal of gender barriers.

Leaders’ Summit

This year’s G20 Leaders’ Summit—marking the ten-year anniversary since the inaugural summit in Washington, in the wake of the global financial crisis—will take place in Buenos Aires, Argentina, on 30 November and 1 December.

(Source: IMF Report | IMF Blog)

More from the blog:

Tax and Fiscal Policy Take Centre Stage at the G20

Recent Comments