The International Monetary Fund has released the Fiscal Monitor for October 2018, ‘Managing Public Wealth’, highlighting the importance of public sector balance sheets, which offer a broader fiscal picture beyond debt and deficits by bringing together the entirety of what the state owns and owes. The Fiscal Monitor provides governments a framework to analyse the resilience of public finances, noting that, once governments understand the size and nature of public assets, they can start managing them more effectively, raising considerable additional revenue: about 3 percent of GDP, equivalent to the revenue governments make from corporate income tax receipts in advanced economies.

Key highlights

- Few governments know how much they own, or how they use those assets for the public’s well-being. Apart from additional revenue towards better public services, a better understanding of their assets can also reduce risks, improving resilience and acting as a buffer, allowing governments with high public wealth to weather recessions better than those with low public wealth –for instance, by boosting spending in a downturn.

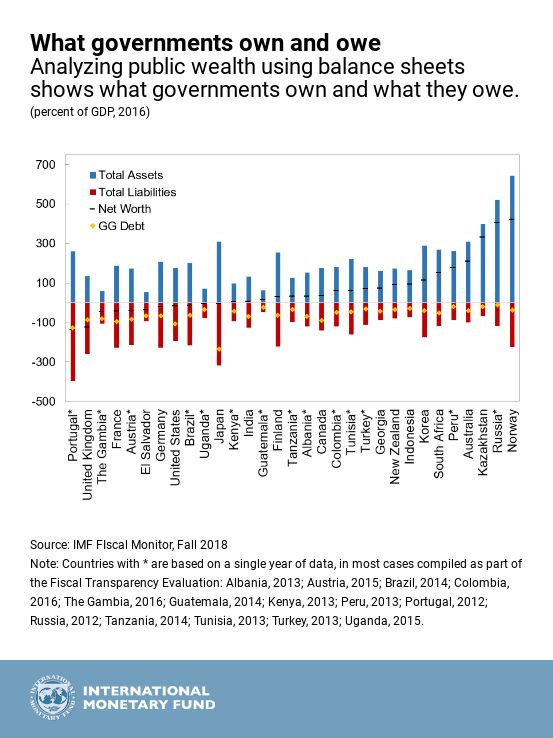

- An analysis of 31 countries—covering 61 percent of the global economy—shows that their assets amount to $101 trillion, or 219 percent of GDP. Assets range from infrastructure to money in the bank, financial investments, and payments owed to them. They also include natural resource reserves and state-owned enterprises.

- It is not just what governments owe, it is what they own: Total liabilities are larger than debt alone, at around 198 percent of GDP. Less than half is general government public debt (94 percent of GDP); the figure also includes pension obligations to civil servants (46 percent of GDP) and debt owed by public corporations.

The report introduces tools that can be used to comprehensively analyse the resilience of public finances, allowing governments to examine both sides of the balance sheet to identify imbalances or mismatches and use fiscal stress tests to gauge the resilience of public finances against tail-risk shocks such as the global financial crisis. These tests should ideally be done on the full public sector balance sheet and, as such, the report advises governments to bring their data together, estimating their public sector assets, liabilities and wealth, and to gradually learn and improve their accounting and statistical collections.

Australia

Source: IMF Fiscal Monitor, Fall 2018

Source: IMF Fiscal Monitor, Fall 2018

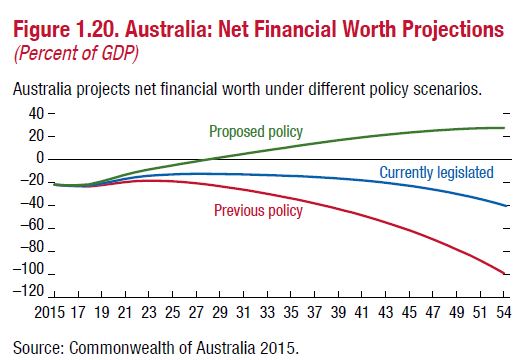

The Fiscal Monitor notes that practical experience from Australia (along with New Zealand, the United Kingdom, and Uruguay) can guide countries on how to increase the effectiveness and returns on assets, while reducing risk across both sides of the balance sheet. This practical experience includes forward projections of balance sheets to demonstrate policy alignment with fiscal objectives, such as the impact of pension reforms, tax changes, and increases in public investment.

(Source: IMF Fiscal Monitor | IMF Blog)

Recent Comments