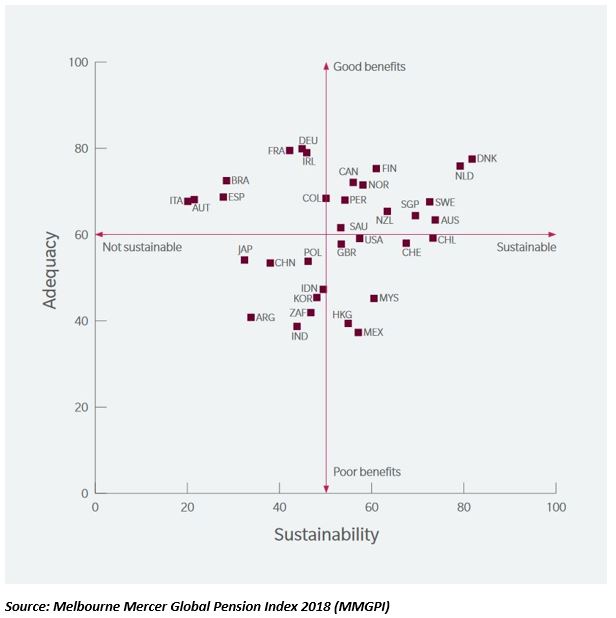

Australia’s index value fell significantly from 77.1 in 2017 to 72.6 in 2018, due to decreasing adequacy, in the latest Melbourne Mercer Global Pension Index . The ranking—which covers 34 retirement systems around the world—is now headed by the Netherlands, Denmark and Finland.

Decreasing score for adequacy of safety net

With its score of 72.6, the report finds that the Australian pensions system has a sound structure, with many good features, but also has some areas for improvement.

While the country gained some ground on sustainability in the last year, going from 73 to 73.8 points (grade B), and remained stable in its integrity sub-index at 85.7 points (grade A), its adequacy sub-index lost almost 12 points since 2017, sliding from 75.3 to 63.4 (grade C+) and leading to the overall decline to a B ranking. The adequacy sub-index considers the base (or safety-net) level of income provided as well as the net replacement rate for an average-income earner; comprising benefits, system design, savings, tax support, home ownership and growth assets.

Among the adverse factors for Australia’s assessment are a change in scoring which now considers the average-income earner as opposed to the lower median-income earner (resulting in a reduction in the net replacement rate), and the country’s high level of household debt as percentage of GDP.

The report suggests that Australia’s overall index value could be increased by:

- Moderating the asset test on the means-tested age pension to increase the net replacement rate for average income earners.

- Raising the level of household saving and reducing the level of household debt.

- Introducing a requirement that part of the retirement benefit must be taken as an income stream.

- Increasing the labour force participation rate at older ages as life expectancies rise.

- Introducing a mechanism to increase the pension age as life expectancy continues to increase.

Melbourne Mercer Global Pension Index

As the Victorian Minister for Industry and Employment notes, the index started in 2009, bringing together government, industry and academia to provide valuable insights on pension systems from around the world.

(Source: Melbourne Mercer Global Pension Index 2018 | Read the report)

Recent Comments