The Australia Institute has recently released the discussion paper, Rich Men and Tax Concessions: How certain tax concessions are widening the gender and wealth divide.

The paper, authored by Matt Grudnoff and Eliza Littleton, includes a new economic modelling study commissioned from the ANU Centre for Social Research and Methods, showing that four tax concessions: negative gearing, superannuation tax concessions, capital gain tax discount and refunding excess franking credits, cost the Federal Budget $60 billion per year; and overwhelmingly benefit high-income, high-wealth men.

Key Findings:

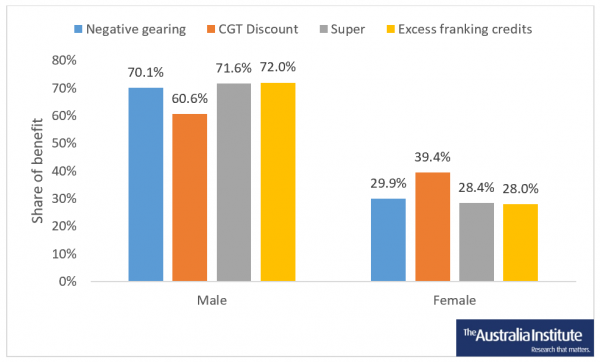

- Analysing the gender distribution of the benefit of these tax concessions find that for three tax concessions: negative gearing, superannuation tax concessions and excess franking credits, for every dollar which goes to women, more than two dollars goes to men. Meanwhile, for every dollar of the capital gains tax discount that goes to women, $1.50 goes to men.

- These four tax concessions: negative gearing, superannuation tax concessions, capital gain tax discount and excess franking credits cost $60.1 billion per year; $42 billion of the benefit goes to men, while $18 billion go to women. Men receive $24 billion more of the benefit than women per year.

- Furthermore, the research shows that even accounting for the increased share in income tax paid by men compared to women due to having higher average incomes than women, that men still receive an oversized benefit of these tax concessions.

- Analysing the income distribution of the benefit of these tax concessions finds that the top 10% most wealthy receive 41% of the benefit ($24.7 billion per year), while the bottom 50% of Australians get only 18% ($11 billion per year).

Figure – Distribution of tax concessions by gender

Recent Comments