The ATO has published the corporate tax transparency report for 2015-16 which includes some tax information of more than 2,000 large companies operating in Australia.

The findings include:

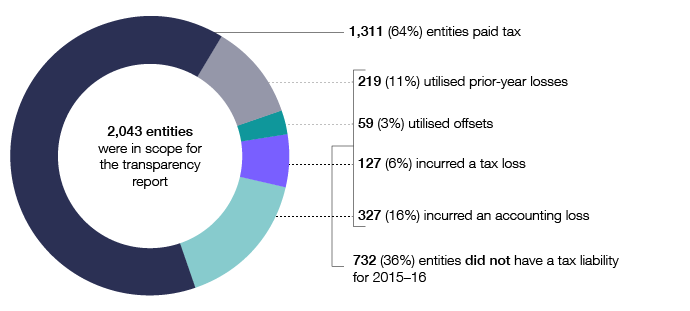

- There are 2,043 corporate entities in the 2015–16 corporate transparency population, with total income tax payable of $38.2 billion. This represents almost 60 per cent of total company tax payable.

- Of the 2,043 entities in scope, 64% paid tax; however, due to features of the tax system, the remainder did not.

- The proportion of companies paying tax at an economic group level is significantly higher at 76%. This is because entities without a tax liability for a given year may have been part of a broader economic group that did have a tax liability.

The report explains why a company might not have to pay tax in the income year:

- 219 entities reported a taxable income but prior-year losses were available to deduct against that profit, so no tax was payable

- 59 entities reported a taxable income but were also entitled to offsets (such as the research and development incentive) at least equal to the tax otherwise payable

- 127 entities reported an accounting profit but reconciliation items (for example, tax deductions allowed at higher rates than accounting permits) resulted in a tax loss

- 327 entities reported an accounting loss.

(Source: ATO)

The report also has a breakdown of those didn’t pay tax by ownership and industry segment.

The report covers the petroleum resource rent tax (PRRT) as well. There are 9 corporate entities in the 2015–16 PRRT transparency population, with total PRRT payable of $845 million. The number of entities paying PRRT decreased from 12 in the previous year, while PRRT payable decreased from $1.2 billion.

Read the report here.

Read the press release by the ATO here.

Entity tax information is available here.

Recent Comments