One of the most significant trends in the evolution of global tax systems has been the rise from relative obscurity of thin capitalisation rules. These rules target ‘excessive’ debt deductions arising in the cross-border context by reference to prescribed gearing ratios.

However, just as the rise of thin capitalisation rules can be attributed to the convergence – mostly of tax systems in Western democracies – so too can their possibly impending decline. As observed in the OECD’s BEPS Final Report on Action 4, there is currently a trend away from thin capitalisation rules’ fixed debt-to-equity ratios to instead applying fixed net interest-to-EBITDA ratios. Indeed, the latter regime was proposed by the OECD in its Final Report on Action 4 (‘OECD’s Fixed Ratio Rule’), released in October 2015.

The position of the Australian Treasurer is that this reform need not be adopted. However, it is unclear whether tightening thin capitalisation by narrowing the prescribed gearing ratios is as effective at protecting the tax revenue base as the approach recommended by the OECD.

Accordingly, in what is a novel contribution to the thin capitalisation rules’ debate, this article models a tax-minimising multinational enterprise’s (‘MNE’s’) behavioural response to both types of thin capitalisation regimes. This ‘makes the invisible visible’, and shows that the OECD’s Fixed Ratio Rule is more effective than the current regime of thin capitalisation rules at protecting the tax revenue base from the most tax-aggressive MNEs.

Modelling tax-minimising behavioural responses

Despite a rich and growing theoretical literature utilising general equilibrium modelling, substantially less developed is the literature on optimisation modelling as a framework to anticipate MNEs’ behavioural responses to changing tax laws.

This is surprising because mathematical optimisation is one of the most powerful and widely-used quantitative techniques for making optimal business decisions. Yet, this technique remains largely unexplored in the context of anticipating MNEs’ behavioural responses to changes in tax rules. This is a particularly significant gap because some literature does exist suggesting that international tax planning decisions can be approximated as optimisation problems.

By expressing the ‘objective function’ as ‘minimising the total tax payable for the MNE’, this paper makes observable a tax-minimising MNE’s behavioural responses to changing tax rules. This facilitates a formal analysis of one of the most significant challenges presented by the mobility and fungibility of capital. The hypothetical MNE modelled by this paper has entities in 4 jurisdictions; two high-tax jurisdictions (one capital-exporter and one capital-importer; specifically, a US parent and Australian subsidiary) and two lower-tax jurisdictions (one non-treaty country and one treaty country, in Hong Kong and Singapore, respectively).

Assuming that the OECD’s Fixed Ratio Rule was adopted by Australia in place of the existing thin capitalisation rules, this reform would result in an increase in total tax payable (‘TTP’) for the most tax aggressive MNEs – albeit nominally.

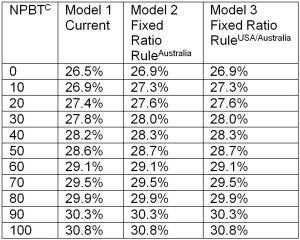

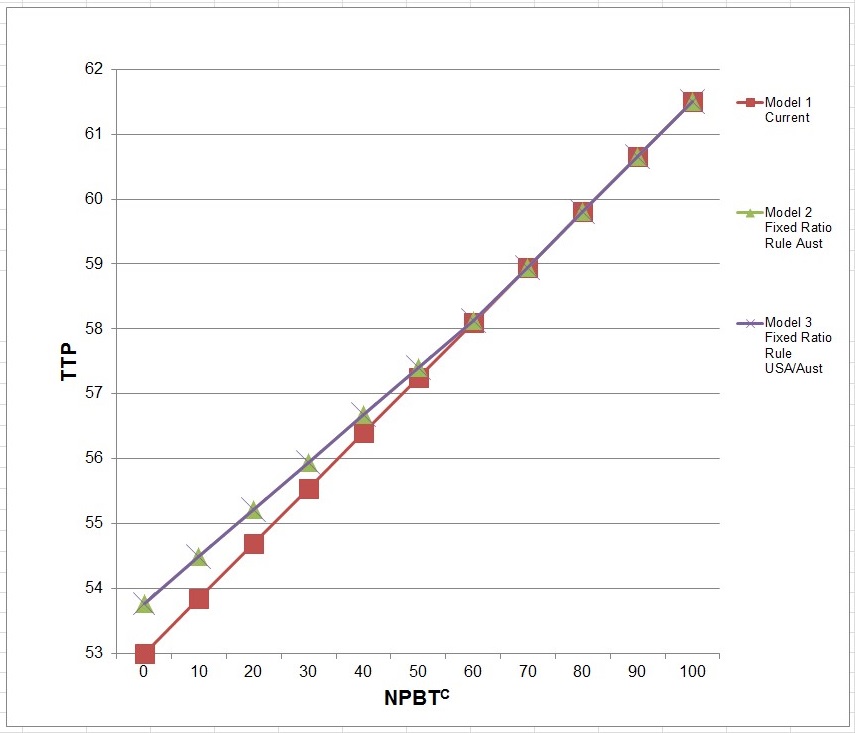

Specifically, the average effective tax rate would increase from 26.5% to 26.9% for the most tax-aggressive MNE (that is, where Net Profit Before Tax has been reduced to nil in Australia (‘NPBTC=0’)). This is reflected in the below Table 1 and Figure 1, which show a maximum 1.45% increase in TTP (that is, from 53 to 53.77).

Table 1

Figure 1

If Australia were to unilaterally adopt the OECD’s Fixed Ratio Rule (Model 2), the Australian entity would see no change to the magnitude of outflows. Rather, the MNE would simply switch the funding mix utilised in Australia from finance lease payments to a combination of royalty and interest payments to attain the same tax payable result in Australia. Also, under Model 2, the MNE needs to ‘work harder’ to obtain an additional deduction by making royalty payments from its Australian entity to its Singaporean entity.

On the other hand, if Australia and the US were to multilaterally adopt the OECD’s Fixed Ratio Rule (Model 3), the tax-minimising MNE would behave in the same way as Model 2. While at first blush this result may appear unusual, the basis for this replication is logical. Under the minimisation problem solved in Model 2 above, the MNE ensured that its US profits (NPBTA) remained at zero throughout. Accordingly, upon the multilateral implementation of the OECD’s Fixed Ratio Rule, there was no need for any further changes to the magnitude or direction of financial flows, because the US entity’s tax liability had already been minimised.

So, should Australia adopt the OECD’s Fixed Ratio Rule?

The bottom line is that if governments and policymakers plan to change key features of their jurisdictions’ tax regimes, it is practical and meaningful to anticipate how a tax-minimising MNE might react to those changes. This is particularly significant in the intercompany context, where both policymakers and academics have noted the difficulty in finding publicly available ‘real world’ examples of aggressive tax minimisation using debt-related deductions in an Australian context.

By simulating a tax-minimising MNE’s response to potential changes in thin capitalisation rules, this paper confirms that the existing design of these rules is not as effective at protecting the tax revenue base as the approach recommended by the OECD – particularly for the most tax-aggressive MNEs.

Having said that, this research does not suggest that an overwhelming benefit arises from implementing the OECD’s recommendation. As such, subsequent research by the author explores whether a fundamental reform would better protect the tax revenue base compared to both the existing and proposed thin capitalisation regimes explored in this article. Further research also examines how a tax-minimising MNE would respond to reductions in Australia’s corporate income tax rate.

This article is based on: Kayis-Kumar A, ‘International tax planning by multinationals: Simulating a tax-minimising intercompany response to the OECD’s recommendation on BEPS Action 4’ (2016) 31(2) Australian Tax Forum 363-394.

Further Reading

Australian Government, The Senate Economics References Committee, ‘Corporate tax avoidance: Part I – You cannot tax what you cannot see’ (18 August 2015), 18

Bucovetsky S and Haufler A, ‘Tax competition when firms choose their organizational form: Should tax loopholes for multinationals be closed?’ (Technical Report 1625, CESifo, 2005)

Grubert H and Slemrod J, ‘The effect of taxes on investment and income shifting to Puerto Rico’ (1998) 80 Review of Economics and Statistics, 365–373

Haufler A and Schjelderup G, ‘Corporate Tax Systems and Cross-country Profit Shifting’ (2000) 52 Oxford Economic Papers, 306–325

Markle KS and Shakelford DA, ‘Cross-Country Comparisons of the Effects of Leverage, Intangible Assets, and Tax Havens on Corporate Income Taxes’ (2012) 65 Tax Law Review 415, 417-432.

Mintz J and Smart M, ‘Income shifting, investment, and tax competition: Theory and evidence from provincial taxation in Canada’ (2004) 88 Journal of Public Economics 1149–1168

Slemrod J and Wilson JD, ‘Tax competition with parasitic tax havens’ (Technical Report, University of Michigan 2006).

Recent Comments