The original version of this note was posted on David’s blog at on 13 May 2016

Carbon price compensation was introduced in a range of welfare payments at the time of the Gillard Government’s emission trading scheme in 2012. This scheme had a 2-year fixed carbon price period, which impacted a range of prices including electricity prices. In consequence compensation measures were introduced to protect lower income groups, including Newstart recipients. Newstart had a carbon compensation increase of 1.7%. When the Abbot Government abolished the ‘carbon tax’ in 2014 it didn’t immediately unwind all the compensation measures.

One of the measures announced in the Government’s 2016 budget was the abolition of ‘carbon compensation’ payments for those newly claiming a range of welfare payments, including Newstart allowance. Originally referred to as clean energy supplements, but later renamed energy supplements by the Government, they were brought in by Labor to offset the increase in costs caused by the introduction of carbon pricing. The removal of said pricing makes the supplements redundant and so their abolition has a certain logic.

However, if the removal of this compensation goes ahead as announced, the rate of payments for new applicants will actually be less than if compensation for carbon pricing had never been introduced.

As an example, for a person claiming the (usual) lower single Newstart allowance rate, this will mean their payment is not just $8.80 a fortnight less than current recipients (who get to keep the energy supplement), but $3.60 less than it would have been had there been no carbon tinkering in the first place. Let that sink in for a moment. In spite of seemingly endless calls for the rate of Newstart allowance to be increased – see the current ACOSS campaign, $36 a day is not enough! – the Government is actually proposing to reduce Newstart to less than its pre-carbon price compensation value.

How does this happen? The short answer is that the equivalent of around 41% of the energy supplement has already been taken out of Newstart and other affected payment rates. Consequently, removing the energy supplement in full will end up taking out that 41% twice.

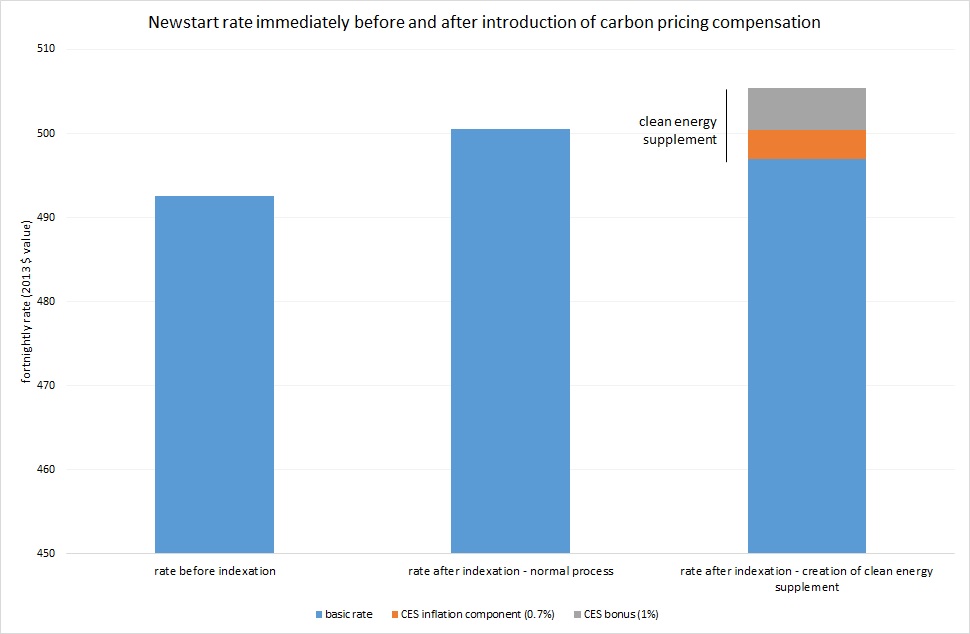

One way to understand this is to consider what would have happened had the Gillard Government not bothered to put in place the carbon price compensation arrangements in the first place, but instead let the normal indexation of income support rates occur. The chart below breaks down the components to illustrate this analysis.

Newstart Rate immediately before and after introduction of carbon pricing compensation

Source: Own calculations

The first column shows the rate of Newstart allowance as at 19 March 2013 – the day before the carbon pricing compensation arrangements were put in place, and also the day before the normal indexation of Newstart allowance would have occurred.

The second (middle) column shows the rate that would have applied from 20 March 2013 under the standard CPI adjustment – a 1.6% increase at that time.

The third column shows what was done instead. Based on Treasury calculations, it was assumed that about half (0.7%) of that 1.6% was attributable to the introduction of carbon pricing. Consequently, the ‘basic’ rate of Newstart was increased by 0.9% and the 0.7% was put into a new rate component. The blue basic rate segment in column 3 reflects this – you can see it has increased compared to the column 1 pre-indexation rate, but not by as much as would have happened ordinarily (column 2). The balance, moved to the clean energy supplement, is shown as the new orange segment in column 3. As you would expect, the blue plus the orange is the same total as column 2.

In addition, the compensation arrangements also included a real increase (i.e., above CPI) of 1%, shown as the grey segment in column 3. The clean energy supplement ended up being this 1% real increase, plus the 0.7% part of the normal CPI adjustment, giving a total payment of 1.7% of the original pre-indexation rate.

So now let’s remove the energy supplement. If it’s taken straight off the rate in column 3 we are left with just the blue ‘base rate’, which is lower than the column 2 indexation. It’s lower because despite the fact that we’ve repainted part of the rate orange, it’s still really part of the base. Getting rid of it is really just chopping into the ‘normal’ base rate. The only segment we can justify removing, if we plan to remove the carbon price compensation as the Government says, , is the grey segment reflecting the 1% real increase introduced under Gillard.

But what about the fact that the orange segment, and also the equivalent amount in column 2’s base rate, is a result of increases in the CPI that are attributable to carbon pricing? Shouldn’t this mean that it’s still appropriate to remove the full energy supplement (orange plus grey), and that there’s actually a problem with the normal arrangement in column 2?

Not at all, and here’s why. Just as the introduction of carbon pricing led to a higher CPI than otherwise, taking it away produced a lower result. The CPI still rose, but not by as much. In turn, income support rates that are adjusted by reference to the CPI also increased by less than would have otherwise occurred. This smaller increase has effectively removed the carbon price effect from income support rates, leaving only the original 1% ‘real increase’ behind.

–Based on my calculations, this problem applies only to payments indexed to the CPI, rather than to wages. Abolishing the energy supplement for pensioners, including sole parents on parenting payment, does not result in the excessive reduction. This is because the different indexation/benchmarking arrangements for these pensions against male total average weekly earnings – has taken the ‘base rate’ past the point at which this issue occurs.

A misunderstanding that will cost poor families

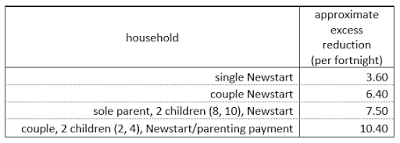

If whichever government is in power after the election decides to continue with the budget proposal to remove the energy supplement it will be reducing rates by too much. Further examples of just how much are in the table below:

That is, a sole parent with 2 children on Newstart will lose $7.50 per fortnight more than they should if we are just trying to undo the carbon price compensation. A couple with 2 children will lose $10.40 per fortnight more than they should.

I’m assuming that the apparent meanness of the budget measure reflects a misunderstanding of how the carbon pricing compensation was constructed originally, rather than malicious intent. Whatever the reason, to those at the bottom of the income distribution, every dollar counts – and this should at a minimum be fixed.

Recent Comments