This blog captures some of the ideas from my research published in the Australian Tax Review: Is Unpaid Tax the Canary in the Coalmine? In this article, I propose a range of policy tools that could be used by Inland Revenue in New Zealand to minimise the impact on other stakeholders when businesses enter liquidation with outstanding obligations. In many cases, businesses entering liquidation have substantial tax debts that have accumulated over long periods of time. Note that Inland Revenue initiates over 60% of liquidation applications in New Zealand in most years.

The focus of the article was debt related to goods and services tax (GST), pay-as-you-earn (PAYE) and other employment-related taxes. These are funds that are held on trust for the state, and there are short periods of time between when they are collected and when they should be paid to Inland Revenue.

Tax debt in New Zealand

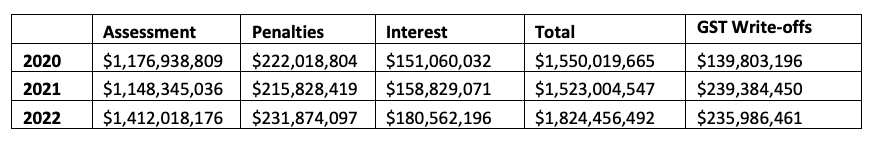

Table 1 shows the balance of outstanding GST in the three most recent years. Most of the debt balance relates to the core tax, which ranges from 75%-77% of the total debt balance. Penalties range from 13%-14%, while interest is stable at 10% of the total in each year.

Table 1: GST debt balances – data at 30 June (New Zealand dollar)

Source: Official Information Act 1982 request, Inland Revenue, 19 September 2022.

Source: Official Information Act 1982 request, Inland Revenue, 19 September 2022.

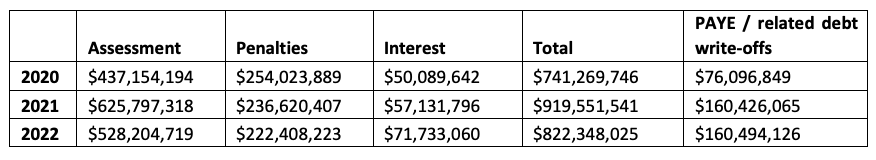

Table 2 shows PAYE and related debt balances. This category includes KiwiSaver Employee Contributions, KiwiSaver Employer Contributions, Employer Superannuation Contribution Tax, Student Loan Employer Deductions and Child Support Employer Deductions.

Table 2: PAYE and related debt balances – data at 30 June (New Zealand dollar)

Source: Official Information Act 1982 request, Inland Revenue, 19 September 2022.

The proportion of core tax for the PAYE and related debt balances ranges from 59%-68% of the total debt balance over the period shown. The proportion of penalties ranges from 26%-34%, while interest ranges from 6%-9% of the balance.

Table 1 and 2 also show amounts that were written off in each of the three years. Amounts written off include all penalty and interest remissions associated with the tax that are permitted under legislation.

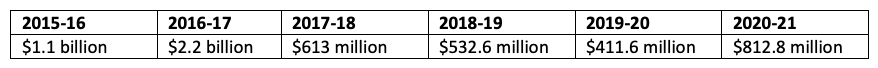

For the purposes of context, Table 3 shows all tax debt that is written off as uncollectable over the past six years. As can be seen in Table 3, there is some volatility in tax debt written off over the period shown, ranging from NZ$2.2 billion in 2016-17 to NZ$411.6 million in 2019-20.

Table 3: Tax debt written off as uncollectable (New Zealand dollar)

Note: Tax is written off for serious hardship, bankruptcy, liquidation or where it is uneconomical to collect. The table shows core tax and excludes debt from child support or student loans. Source: Inland Revenue Annual Reports.

What can be done?

Other countries have been using policy tools to minimise the impact on other parties when businesses become unviable. They could potentially be used by Inland Revenue in New Zealand and are outlined below.

Publishing the details of tax defaulters. Many countries publish the details of tax defaulters. Ireland was the first European country to adopt this approach, in 1997. Irish Tax and Customs publish a quarterly list of tax defaulters. This includes the name, address, and occupation of the tax defaulter, along with details of the tax debt. Names are published when the tax, interest and penalties are greater than €50,000, the penalty is greater than 15% of the total tax, and a qualifying disclosure was not made. Names are also disclosed when a settlement offer has been accepted instead of court proceedings, and the tax debt arises because of careless or deliberate behaviour.

Debt collection agencies. The Australian Tax Office (ATO) has previously used debt collection agencies to assist with collection of certain low value and aged debt, although they have not done so since April 2020. Debts were referred up to the value of A$75,000, with a flat fee per case paid to the debt collection agency. A review of this tool in 2015 reported that from September 2011 to June 2013, 800,000 cases had been referred to external agencies, with a total of A$3.6 billion, of which A$2.4 billion was collected (66%).

Director penalties. The ATO Director Penalty Notice (DPN) regime means that company directors may be personally liable for certain tax liabilities, including pay-as-you-go withholding, GST and the superannuation guarantee charge. Once a DPN is issued it can be remitted by paying the debt, appointing an administrator or a small business restructuring practitioner, or commencing winding up proceedings. There are several defences to a DPN that would result in directors not being liable for the outstanding tax, such as not being actively involved in management of the company during the time the debt occurred, or taking all reasonable steps to ensure payment was made.

Disclosing tax debts to credit rating agencies. The ATO may also disclose business tax debts to credit rating agencies, when a tax debt is above A$100,000 and is overdue by more than 90 days. However, debts will not be disclosed when the taxpayer is engaging with the ATO and attempting to repay the debt. The aim of disclosing tax debts to credit rating agencies is to make the debts more visible and therefore allow other businesses to make more informed decisions about who they enter into commercial arrangements with.

The need for quicker action

In summary, the advantage with taking faster and further actions not only mitigates the impact on other stakeholders, who potentially will not be paid, but can create incentives for timely payment or liquidation. All the tools outlined can assist with this and some would also protect stakeholders through increased transparency. Inland Revenue is the only entity with sufficient information and power to achieve this transparency in a time frame that would be useful for stakeholders.

There is clearly a need for balance between supporting taxpayers to meet their tax obligations and taking action to protect other stakeholders from those engaging in poor business practice. There is nothing to be gained from forcing viable entities into liquidation when they have a short-term trading or cash flow problem. However, allowing business to continue to operate with unpaid tax obligations for long periods is counterproductive. The process is inequitable, as the debtor benefits from non-payment of the tax for an extended period.

Recent Comments