In addition to the preference available to owner-occupiers in the form of the main residence exemption, the Australian tax system offers preferential income tax treatment to taxpayers who invest in housing. In comparison to most other OECD countries Australia operates generous negative gearing provisions. Investors in housing assets also receive the benefit of the 50% capital gains tax (CGT) discount (which applies to CGT assets generally, which have been held for at least 12 months) on the event of the asset’s sale.

Our report models several transitional options for reform to negative gearing provisions and the 50% CGT discount in the context of housing investment by individual taxpayers. The reform options we model may allay concerns about more comprehensive changes to the provisions (for example, the introduction of a full quarantining system for negative gearing or the abolition of the CGT discount), having the potential to lead to a large-scale withdrawal of ‘mum and dad’ investors from the housing investment market.

It has been identified in the literature that the current income tax treatment of housing assets may have negative impacts on housing market stability and housing affordability. The tax concessions available for housing may also have adverse applications for the distribution of housing assets, as well as outcomes in the housing market. It is the case that the benefits of the 50% CGT discount for individuals, as well as negative gearing, are heavily skewed towards high income and high wealth taxpayers. Some commentators have argued that these features of the Australian tax system potentially exacerbate income and wealth inequality in the Australian population.

Progressive rental deduction reforms

As an alternative to the current rules for negative gearing, our report models a progressive rental deduction whereby:

- investors at lower levels of income or rental property wealth (the bottom half in each case) would be entitled to claim 100% of their rental expense deductions in the income year;

- Taxpayers in the 50th to 75th percentiles would be entitled to claim 50% of their rental expense deductions that exceed their investment income, with the remainder to be carried forward;

- Taxpayers in the top quartile of the distribution would be subject to full quarantining of rental deductions; which would require any amount of rental expenses that exceeds net investment income to be carried forward to future tax years.

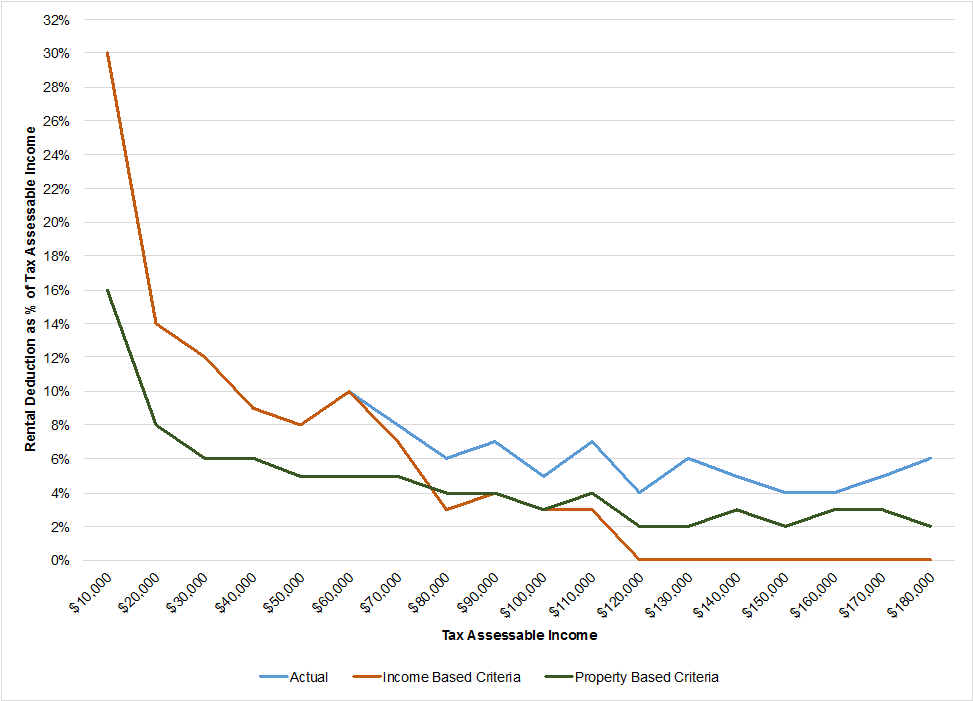

The proposed reform options in our report would have the effect of increasing tax revenue and increasing the progressivity of the personal income tax system. While our modelling is based on percentiles, for administrative ease the three taxpayer groups could be translated into assessable income bands. The distributional impacts of the progressive rental deduction reforms are set out in Figure 1. We modelled the distributional impacts on income and property criteria separately.

Figure 1: Distributional impacts of progressive rental deduction reforms, 2013–14

Source: Authors’ own calculations from the 2013 SIH.

Notes: Estimates are population weighted on a person basis.

If the progressive rental deduction were implemented using the income criteria for separating the taxpayer population into the three groups, it is estimated that it could save the Government approximately $1.7 billion per annum. If the property value criteria were used, the saving would be around $1.5 billion. The design of the proposed reform is such that investors at lower levels of income and wealth would be less likely to withdraw from the rental market.

What about the CGT discount?

Given that our policy audit identified the 50% CGT discount as a significant factor in the growth of negative gearing since 1999, we undertook a distributional analysis to gain a better understanding of who benefits from the CGT discount.

The CGT discount is heavily weighted towards those who have higher levels of income and property ownership. The greatest benefits of tax preferences for capital gains, including the CGT discount, are received by taxpayers who, as well as owning a main residence dwelling, own at least one rental property. Our analysis showed this group had an average property portfolio valued at over $730,000. They also had an average assessable income of $82,000, which was more than 250% of the average assessable income of renters, at $31,000.

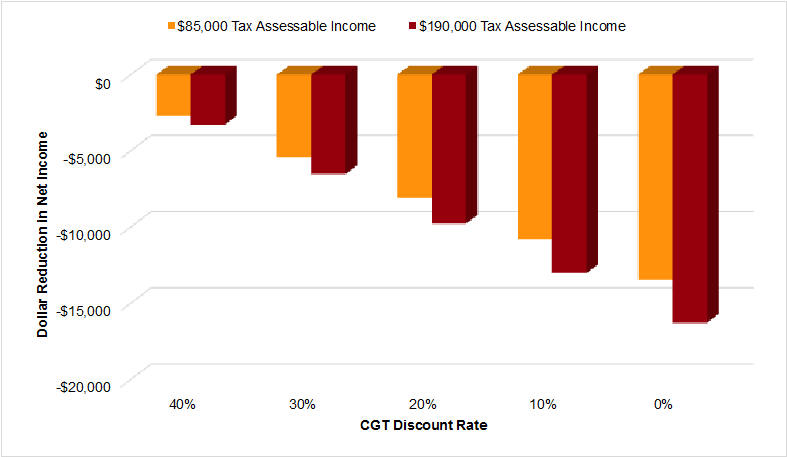

We modelled the effect of a progressive reduction in the CGT discount rate, providing a transitional pathway to a more progressive tax system. Data limitations meant that we could not undertake the same simulations as for negative gearing, however we were able to show the effect of reform across a range of scenarios with decreasing levels of CGT discount.

Our calculations show that a higher income earner will pay more CGT than a lower income earner as the level of the CGT discount rate decreases, as shown in Figure 2. These proposals reduce the difference between the tax payable by higher and lower income rental investors, and therefore reduce inequities in the current system.

Figure 2: Impact of a reduction in CGT discount on the after-tax net income of a typical rental investor with gross annual income of $85,000 and $190,000, assuming capital gains of $70,000, 2013, dollar reduction

Source: Authors’ own calculations from EVITA, 2013 SIH.

Pathways for transition

The policy changes modelled are focussed upon ‘pathways’ which have potential benefits for increased stability and the reduction of inequities in the housing market. Housing reform is complex, involving a range of market factors as well as the tax drivers. Changes to the taxation of housing need to be implemented – and communicated to investors – in a way that limits the risk of a shock to the market if investors exit the housing market. For this reason, policy makers have been reluctant to change the fundamental settings of the tax system.

Transitional pathways, such as those presented in our report, are more likely to be successful in moving to a more equitable tax treatment that will also ensure a sustainable housing market.

Further reading: Duncan, A.S., Hodgson, H., Minas, J., Ong-Viforj, R. and Seymour, R. (2018), The income tax treatment of housing assets: an assessment of proposed reform arrangements, AHURI Final Report No. 295, Australian Housing and Urban Research Institute, Melbourne.

Recent Comments