Since 2018, the Organisation for Economic Co-operation and Development (OECD) has tried to find a way to tax digital companies that is agreeable to most countries. As expected, reaching consensus on a new regime of international taxation has not been easy.

For three years, experts weighed in on many ideas that had value creation at its core. The ill-defined concept of value creation was earlier referred to in the OECD’s work on intellectual assets. Essentially, the concept sought to capture the origins of profit and attribute it to activities. However, with the use of data and intellectual property such separation is often intractable. This article illustrates the key challenges with designing a new tax regime suited for a digitalised economy.

An economic problem

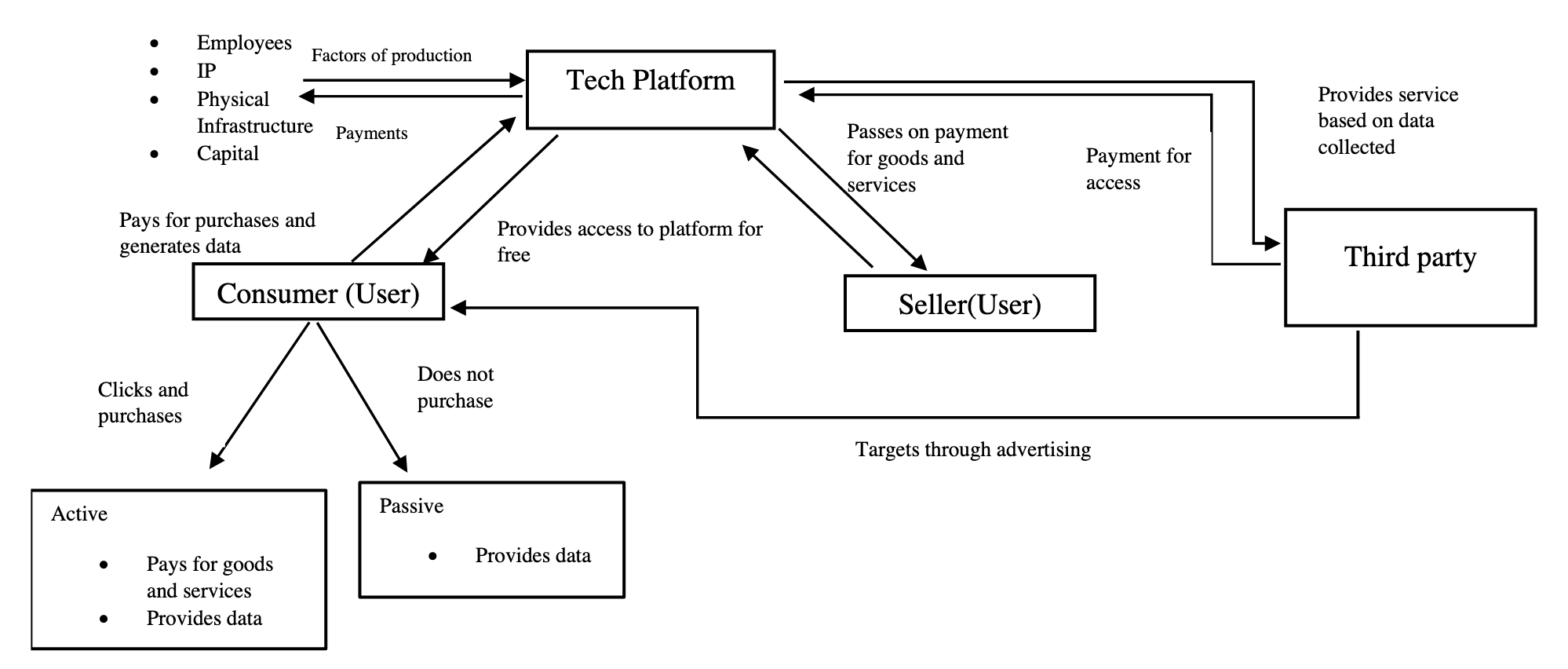

Technology companies can operate at a scale without mass and that they derive value from user markets. For example, active and passive users provide the data which is then used to tailor services to the user base. In spite of the expansion in the user base, these markets do not report commensurate profits on account of inadequate nexus and attribution rules. A fundamental reason for the lack of receipt of fair share of taxes is inseparability of profits from user derived inputs such as data and intellectual property. That is, to isolate the profits from an efficient algorithm and data is difficult. More so, since user participation does not result in a corresponding financial transation, as shown in the figure below.

The problem with taxing digital corporations is often made out to be an issue with pricing of intangibles but this may be overstating the issue. Evidence shows that the share of intellectual property in digital corporations’ assets remains low. For example, as per OECD’s ADIMA database amongst the world’s top 100 multinational enterprises, digital companies owned far lower shares of intangibles than pharmaceutical companies did.

In economic theory, a production function depicts relation between input and output. It represents the labour and capital inputs deployed alongside technology used to generate output. As shown in the above diagram, in addition to the traditional factors of production (which includes physical infrastructure, capital and labour), users are integral to the process.

As a result of this, two key changes have occurred which in turn help generate monopoly rents for digital companies: (1) third degree price discrimination is possible (in other words, the company can customise prices to the consumer); and (2) an added non-rival input to production is user (it means the data generated from user participation can be reused). While it is possible to draw the connection between users and profits, there is lack of clarity on how to divide the profits between market and residence countries.

The prevailing tax rules are largely fit to tax traditional factors such as labour and capital. For example, it is possible that workers in the gig economy are not registered as employees, or capital is deployed more strategically via low tax jurisdictions. To address issues such as the former withholding obligations may be placed on platforms, as has been implemented in India. However, incomes associated with the infrastructure of technology companies such as servers, data processing and user participation remain hard to characterise and value. The root cause for this is the inseparability of revenue and cost associated with digitalised operations. That is, interactions between data and intellectual property as well as the centralised costs, which may not be replicated across countries, are not easily distinguished.

How to tax digital profits?

In 2015, the OECD final report on BEPS Action 1 identified three measures, withholding tax, equalisation levy and new nexus rule, but none were agreed or ultimately recommended.

Over time, different countries sought to implement either one of these measures or a combination of them. For example, in 2016 India was the first country to implement an equalisation levy on digital advertising, later expanding it to e-commerce platforms. Later, India also modified the definition of business connection in its Income Tax Act to include users and revenue thresholds as the minimum requirement for taxable presence. While the equalisation levy bypassed the complications of tax treaty override, the test for significant economic presence remained a cosmetic change without a similar change to double taxation avoidance agreements.

In the years following the release of the final report, four kinds of approach emerged:

- Turnover-based taxes applicable to specific services like digital advertising and electronic commerce (the digital services taxes);

- Modifying the definition of permanent establishment in domestic legislation to introduce users or contracts as the new nexus;

- The consensus-based approach proposed by the OECD via Pillars One and Two solutions; and,

- The UN’s proposal for a withholding tax on automated digital services.

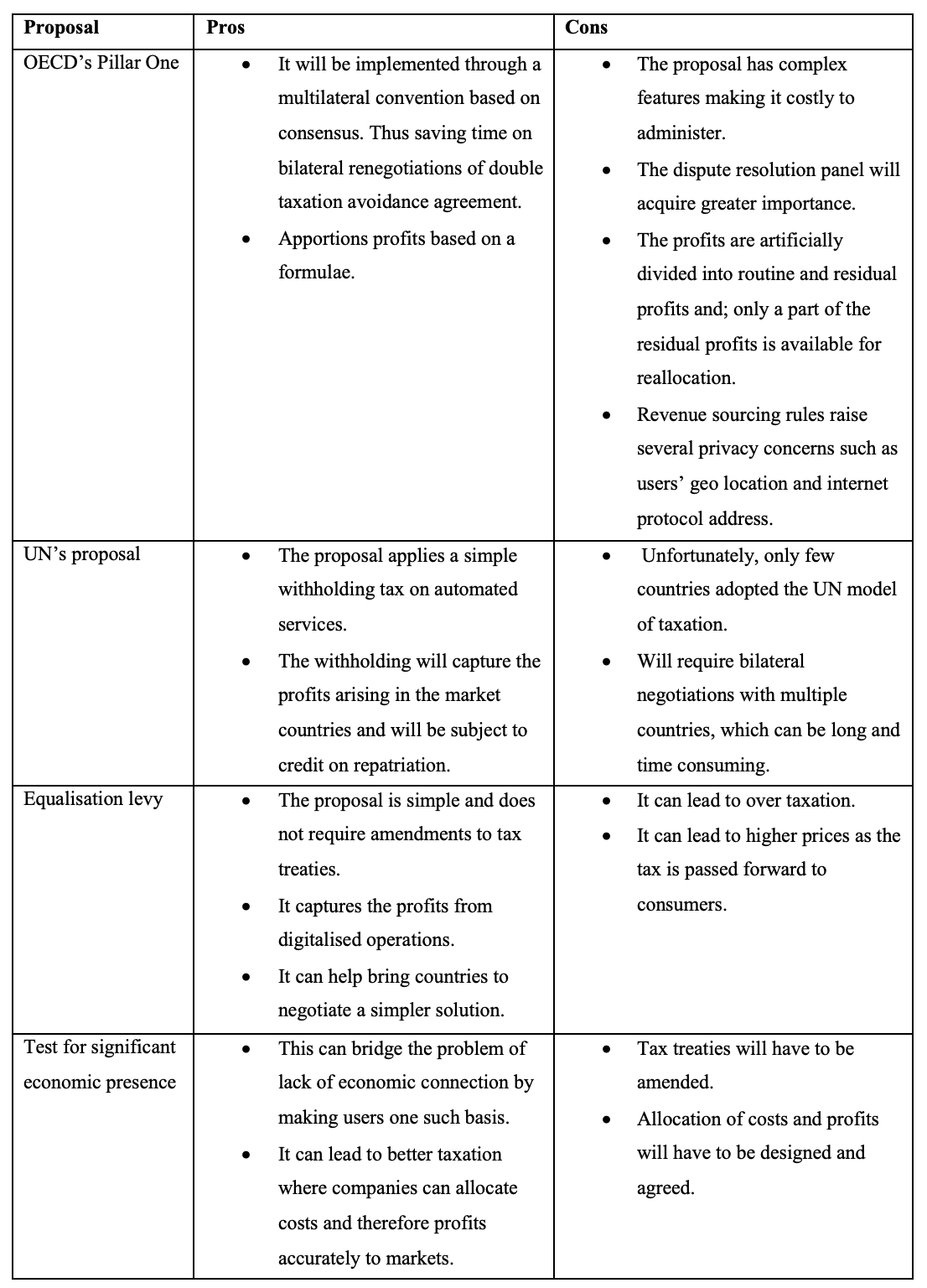

Each of these measures seeks to capture the profits while trying to balance the competing principles of administrability and neutrality in taxation. In recent years, growing number of countries are adopting the digital services tax. This indicates the preference for a simple solution. The United States responded with inquiries, under its Trade Act 1974, into whether these levies are discriminatory to US-based businesses. With fears that digital taxes could culminate into trade war, the OECD hastened the process of finalising its solution while the United Nations affirmed its proposal for a withholding tax on payments made for automated digital services under the proposed Article 12B of the UN Model Tax Convention. A lesson from history of tax policy is that these principles are often difficult to balance and one amongst these may emerge as a decisive factor. The proposals can be evaluated and compared on these principles (see Table 1 below).

While introducing a new nexus test for significant economic presence and functional attribution of profits would be an ideal solution, it is hard to make this administrable without the use of formulae. The OECD’s proposal, on the other hand, claims to tide over this difficulty through the introduction of sales based nexus and attribution of profits based on a politically negotiated formula. However, on close examination it in no way overcomes the inseparability problem and instead applies the formula to a limited notion of profits of companies that aren’t necessarily digital corporations. In addition, it creates two different tax systems, one for firms in scope and another for those outside its scope. On the other hand, a withholding tax on digital services, which over time will include payments for digitalised operations, is simple and neutral.

Solution in sight?

In October 2021, the broad contours of the global tax pact were released, which were almost similar to the G-7 statement in June. In the Pillar One solution, it was agreed that the proposal would apply to all large companies, excluding those in the financial sector, with annual global revenue above 20 billion euros. Thus the proposal was to cover not just digital corporations. A quarter of the profits in excess of a 10% profit level will be shared amongst all qualifying market jurisdictions based on revenue sourcing principles. Disputes relating to the computation and allocation of the amount will be resolved through a dispute resolution panel comprising of tax administrators and independent experts.

The OECD proposal falls severely short of its promise of simplified solution. In fact, it’s application alongside current rules to other companies only further complicate matters where a company migrates between the two systems based on thresholds. One might ask if the challenges in taxing digital corporation will be resolved by the Pillar One solution. The answer is: not entirely, since the same issues will persist for companies outside the scope of Pillar One. Even if the thresholds are revised downwards over time, the benefits must be weighed against the administrative costs.

Another way to weigh the gains from Pillar One is by comparing these with the current revenues from digital services taxes. In my calculation, India can end up losing revenues or gaining insubstantial revenues from the OECD proposal. It is surprising then for its simplicity and potentially similar base as the digital services taxes, why the withholding tax on digital services is not on the table as an option. A multilateral instrument, similar to Pillar One, may then be used to overcome the delay in its adoption caused by bilateral negotiations. The only answer to that is the unwillingness of residence countries to cede their taxing rights.

Table 1: Comparison of all proposals

The blog is based on: Tandon, S 2021, ‘In search of a solution to tax digital economy’, Working Paper no. 354, National Institute of Public Finance and Policy, New Delhi.

Recent Comments