Modernising VAT/GST systems to reduce the compliance burden for all could benefit tax administrators, businesses and society at large, suggests new research conducted by UNSW Sydney, with support from KPMG International.

A new study has been released that yields significant global findings as to the relative compliance burden of Value Added Tax (VAT) and Goods and Services Tax (GST) around the world. The research was conducted by a team at the UNSW Business School, along with colleagues at various universities around the world and had support from KPMG International.

Using an exclusive VAT/GST Diagnostic tool, this study provides a new comparative assessment, which considers the compliance requirements and related administrative burden associated with adhering to local VAT and GST rules across 47 different jurisdictions.

The diagnostic tool

Using the specialised diagnostic tool, built for the purpose of this project, UNSW applied 27 different compliance burden indicators to assess the VAT/GST compliance burden on taxpayers in a comparative and relative sense across the countries, including indicators such as

- The use of multiple rate structures

- The ease of registration

- The ability to deal electronically with tax authorities for registration, filing, payment and information services

- The complexity of the return forms

- The speed of refunds

- The availability of simplified processes for small businesses

The tool focused not only on the VAT/GST policy settings in place in any given country, but also on how the VAT/GST system is administered. The compliance burden indicators were objectively rated and weighted, in consultation with tax authorities, academics and/or professionals. Collectively, the 27 different compliance burden indicators reflect four factors that are perceived to be the main drivers of the aggregate VAT/GST compliance burden at the individual country level: tax law complexity, the number and frequency of administrative obligations, revenue body capabilities to support taxpayers, and monetary costs and benefits.

Taking all of the indicators applied at the individual country level into account, the tool computes an overall ‘compliance burden index’ rating on a scale of 1 to 10, with 1 representing a VAT/GST system with a very low/minimal compliance burden.

Compliance burden varies across surveyed countries

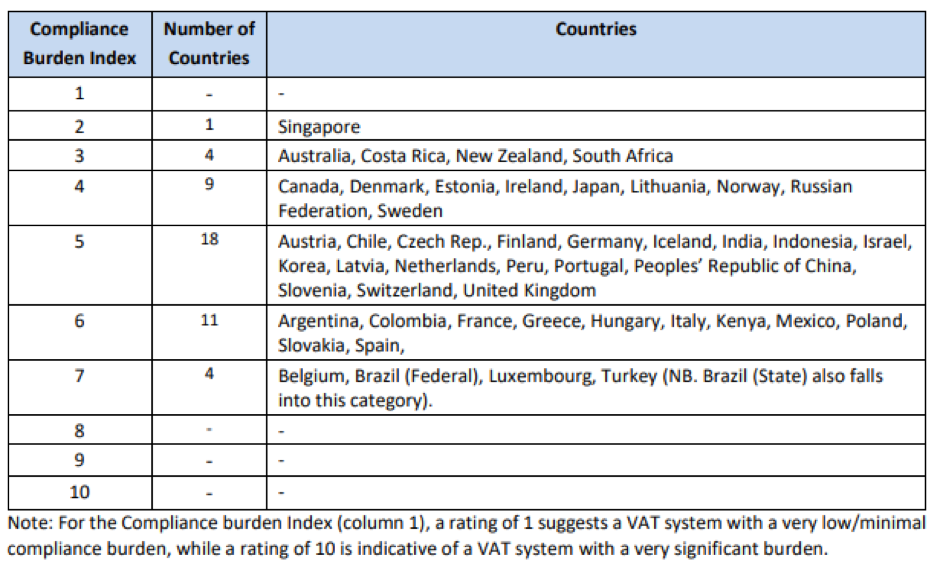

The research concluded that 14 countries around the world score favorably overall, including Singapore, Australia, New Zealand and South Africa, with a compliance burden index of 4 or less. However, 15 countries were rated with a score of 6 or more, suggesting the need for policy and/or administrative reforms in those locations in order to help reduce the compliance burden — for taxpayers and for tax administrators. A summary of the VAT/GST compliance burden findings is provided in Table 1.

Table 1: VAT/GST Compliance Burden Index for Surveyed Countries (2017 Fiscal Year)

The study also suggests that governments and their tax administrations can learn from those jurisdictions where the compliance burden is rated more favorably. For example, by implementing technology solutions in order to help streamline processes.

KPMG’s Global Head of Indirect Taxes, Lachlan Wolfers, says, of the study, “The findings highlight the importance not only of countries having the right VAT or GST policies in place, but also the call to modernise the delivery of tax administration to support businesses in efficiently managing VAT/GST compliance costs. Businesses are telling us that, as their compliance obligations are globalising through the digitalisation of business models, the ability to deal with tax authorities electronically in registering, invoicing and filing is becoming increasingly important.”

The UNSW research team intends for the diagnostic tool to be used by governments and tax authorities around the world to help them see variances and identify best practices that can help to reduce compliance costs and improve compliance. For example, recent initiatives such as Making Tax Digital (MTD) in the UK, Singapore’s Assisted Compliance Assurance Program (ACAP), as well as electronic invoicing, filing and registration systems all support taxpayers in efficiently managing VAT/GST compliance costs, while at the same time enhancing the integrity of countries’ tax systems.

Key drivers of compliance burden

The tool focuses not only on the VAT/GST policy settings in place in any given country, but also on how the VAT/GST system is administered. Looking across all countries, the research finds that features of tax policy design, including reduced rates, exemptions, and registration thresholds, had a negative impact on taxpayers’ compliance burden in over two thirds of the countries studied. However, part of the compliance burden is sometimes an inevitable consequence of policy decisions, such as measures to make the system more progressive.

The results of the tool also show that, as a VAT/GST regime grows older, the relative compliance burden tends to be higher, and that, from a macroeconomic perspective, the VAT/GST compliance burden is generally higher in less developed countries. Both higher levels of exports as a percentage of GDP, as well as the higher the ratio of tax to GDP in a country, are also associated with a higher compliance burden.

In addition, the diagnostic tool can be used to highlight the importance of best practice VAT/GST policy settings to assist in managing compliance costs, with countries like China and India both recently recognising the value of having fewer VAT rates which operate off a broad base.

Potential expansion to other business taxes

The UNSW diagnostic tool has initially been deployed to assess VAT/GST compliance costs but is expected to be expanded to cater for other business taxes. The UNSW team considers that, at this stage, it has sufficient proof of concept to be able to undertake, in collaboration with stakeholders, the development of a broader suite of diagnostic tools designed to measure and evaluate the tax compliance burden of other business taxes. In particular, the corporate income tax; tax regimes applicable to the provision of labor (for example PAYG and social security taxes); and customs duties and excises.

Read the report:

Highfield, R, Evans, C, Tran-Nam, B & Walpole, M 2019, Diagnosing the VAT compliance burden: a cross-country assessment, Final report, UNSW Business School, available at: https://www.business.unsw.edu.au/Our-People-Site/Documents/Joint%20Report%20on%20VAT%20compliance%20costs%20tool.pdf.

Recent Comments