The principle of subsidiarity, when applied to taxation, suggests that the incidence of taxation should be at the level where they are most salient, and their use is easily monitored.

Thus, one important public finance question relates to the level at which taxes should be raised. In addressing such an issue, it becomes necessary to take into account the structure of government and tax administration in a country, as well as other socio-political factors that could affect revenue-raising decisions.

The literature has argued that the provision of public goods will be efficient through the levy of a benefits tax or user fee. For example, providing drinking water can be cost-effective for a local government if it charges users for accessing the water. The price of such access will necessarily reflect its demand at the local level, and thus raising these revenues at the local level will also help make local governments (the providers) more accountable for efficient delivery.

Challenge of multi-level governance in India

Such a problem is particularly pressing in developing countries, such as India, where there exists a three-tiered structure of governance – a Union government, State governments, and Panchayati Raj Institutions at the block, district, and village levels.

The 73rd amendment to the Constitution of India in 1993 brought into effect several reforms relating to local governance, devolution of powers to elected local governments (Panchayats) and village councils (Gram Sabhas), political reservations for women, and sharing of revenues collected by the States with Panchayats. There have been various policy proposals arguing for greater fiscal decentralization and autonomy to Panchayats, but they largely remained on paper.

Evidence suggested that Panchayats were raising 0.15-0.2% of aggregate village incomes, compared to their urban counterparts who raised around 0.38% of aggregate city/town incomes. However, it remains unclear whether such low levels of revenue raising can be attributed to a lack of willingness to tax, poverty, or a system of intergovernmental transfers that does not adequately incentivize local governments to raise taxes in India.

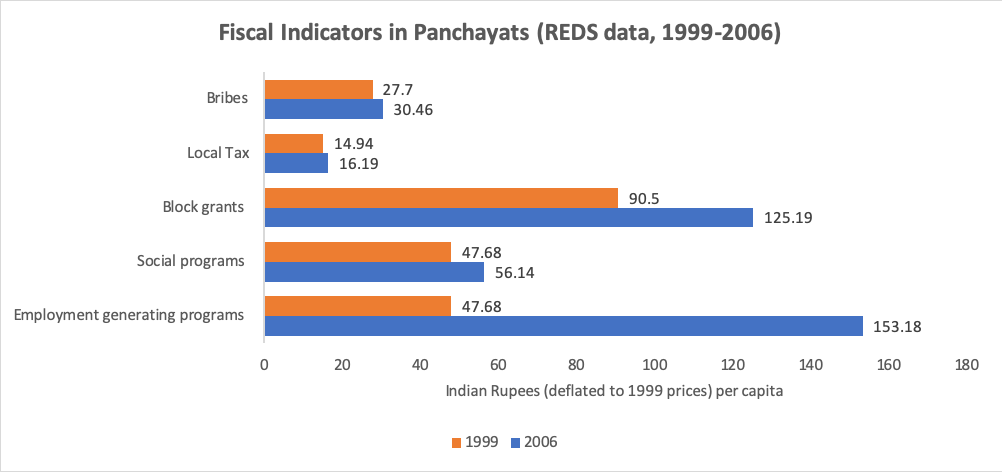

Figures below indicate the state of fiscal autonomy at the Panchayat level in India.

Restricted and Unrestricted Fiscal Grants and Tax Effort of Panchayats

In our recent paper, we argue that the system of intergovernmental transfers in particular is dampening local tax efforts.

Our theoretical framework distinguishes between restricted and unrestricted transfers: the former are grants tied to specific expenditures (for example, employment generation schemes, such as the Mahatma Gandhi National Rural Employment Guarantee Scheme), whereas the latter do not have any such restrictions and decisions are taken by the Panchayats on their timing and use.

How do such grants ultimately affect households? Consider a local government receiving transfers to fund an employment generation program that guarantees fixed wages to participants. This causes a distortion in the local labour market, as the market wage will be influenced by the wage offered by this scheme. Our model shows that the impact of such transfers are complicated, and under specific conditions, will result in a reduced tax base and a decline in the economic welfare of households.

Our model contends that there are three costs of raising taxes:

(a) a wage effect (an increase in wages could depress agricultural profits, and therefore shrink tax revenue);

(b) a profit or productivity effect (for example, grants for better roads can improve market access, and therefore improve profits); and

(c) an incentive effect (for example, a transfer for education may crowd out revenues raised for local schools, or unrestricted block grants may provide incentives to utilize these funds efficiently, as the public expenditure pattern can now conform more closely to the preferences of the village community).

Data

Panchayat-level data on taxes raised are not easily available, and given the diverse state-level variations in taxable items, there are many challenges in finding appropriate data.

The Rural Economic and Demographic Survey (REDS), collected in 1999 and 2006 by the National Council for Applied Economic Research (NCAER), New Delhi is illuminating in this regard. We use village-level panel data on revenues raised, tied and untied grants received, and other characteristics such as presence of functionaries, village wages, and agricultural incomes.

We combine this with state-level data on fiscal autonomy granted to Panchayats compiled in the State of Panchayati Raj Report (by the Ministry of Rural Development, Government of India). Our resulting dataset contains information on 193 villages in 15 states (we exclude Kerala and Jharkhand since fiscal autonomy data was aggregated or unavailable).

Figure 1 below presents growth in key fiscal indicators and bribes paid based on this data.

Source: Authors own calculations using Rural Economic and Demographic Survey (2006) Village and Household Questionnaires

Findings

The proportion of devolved functions increases earmarked grants for social programs and own taxes significantly, but reduces untied grants significantly with no clear effect on employment-generating grants. The proportion of actually devolved functions that require own revenue collection for their finance has no clear impact on own revenues. It is therefore not very apparent if simply asking local governments to pay more for the functions devolved to them is effective in getting them to do so. Devolving more block grants has a positive effect on taxes raised, potentially indicating that it may not be paucity of tax bases that holds revenue raising back, but lack of willingness to tax.

The paper shows that crowding out is caused by a combination of wage and incentive effects. In particular, a per capita rupee increase in restricted grants reduced the per capita revenues raised by 0.6 rupees. In contrast, a per capita rupee increase in unrestricted transfers increased the taxes raised by 0.24 rupees per capita. Although the effect is small, an increase in employment-generating grants reduced agricultural profits, whereas both untied grants and taxes raised boosted overall profits marginally.

Thus, our results indicate that if state governments devolve more functions and require them to be funded locally, Panchayats raise more taxes, and also receive more social grants. In terms of fiscal decentralization, this means that the revenue base of the Panchayats has to be broadened and deepened as recommended by the Second Administrative Reforms Commission (SARC). Incentives for own revenue collection should be provided by the states by devolving additional functions to local governments, by increasing the amount of untied grants, and by shifting resources from restricted grants to untied block grants.

Local level effects matter

Our study has implications not just for design of fiscal decentralization in India, but also more generally with an eye for the future.

For example, the decades-old tax code was recently replaced with a single Goods and Services Tax (GST). In deciding the raising of revenues on specific items and their divisions between the union and subnational, it also becomes important to consider the role of Panchayats.

The 15th Finance Commission, a constitutional body set up to provide recommendations to the Union government regarding fiscal matters, must therefore be aware of the incentive effects at play at the local level.

Further reading

Jha, R, Nagarajan, HK & Tagat, A 2019, ‘Restricted and Unrestricted Fiscal Grants and Tax Efforts of Panchayats in India’, Economic and Political Weekly, vol. 54, no.32, 2019, pp. 68-75.

Recent Comments