A paradox one may encounter in the debate surrounding the competitiveness of Australia’s tax system in attracting corporate investment is that Australia has continued to attract large amounts of foreign investment, despite its high corporate tax rate in comparison to other countries. This seems to contradict the common view that high corporate tax rates are detrimental to corporate investment.

In a newly published research report, we address this paradox by examining the effect of corporate tax rates, both statutory and effective, on firm location decisions and industry structure. While there is a shortage of Australia-specific studies from which to draw, we use the international literature as an evidence base from which to make inferences about the Australian setting. We then briefly consider options for reforming Australia’s corporate tax system.

What is the evidence in the international literature?

Theory regarding the incidence of corporate taxation has traditionally assumed that in a small open economy such as Australia, capital is internationally mobile. This implies, among other things, that firms already located within the economy are incentivised by corporate taxation to consider relocating, and prospective international investors may decide to invest elsewhere.

In line with this assumption, an extensive body of empirical literature has consistently found a significant and substantial effect of corporate taxation on firm location decisions. The overall consensus of researchers is that the tax elasticity of foreign direct investment (FDI) is around -0.7, corresponding to a semi-elasticity of -3.3 (with respect to statutory and effective tax rates). This means that a 1 percentage point change in the corporate tax rate leads to a 3.3 per cent change in the opposite direction in FDI.

Recent studies have provided further detail about the effects of statutory or effective corporate tax rates on firm location over several dimensions. Some of their main findings can be summarised as follows:

- Statutory and effective average corporate tax rates have negative impacts on both location decisions and FDI.

- The inward foreign investment response to corporate taxes is more important than the effect of corporate taxes on pushing companies to leave a country.

- The effect of high corporate tax rates in deterring investment is larger than the effect of low corporate tax rates in encouraging investment. Both effects are larger when the gap between a country’s corporate tax rate and its peers is larger.

- The effect of high corporate tax rates on investment is particularly large in financial services and smaller in manufacturing.

- The effect of corporate tax rates is larger in deterring greenfield investment (namely where firms build their foreign production capacity from scratch) than in deterring mergers and acquisition-type investment.

So, what are the implications for Australia?

As mentioned, there are two seemingly contradictory trends in Australia: a high corporate tax rate, yet foreign investment continues to flow in. We delve into this further here.

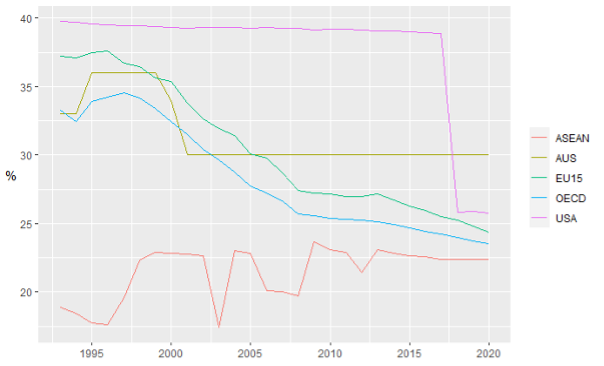

Australia’s statutory corporate tax rate, which was at the OECD average 25 years ago, is now high when compared to other countries. This is due to Australia having maintained its statutory corporate tax rate at a constant level (30 per cent since 2001), while other countries have cut their corporate tax rates over the last three decades (see Figure 1).

Figure 1: Combined statutory corporate tax rates, 1993-2020 (Source: Tax Foundation 2020)

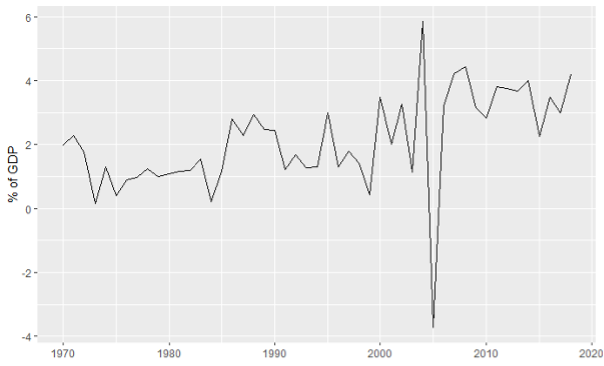

Despite this, FDI into Australia has been on an increasing though volatile trend at least since the 1980s, averaging around 3.5 per cent of gross domestic product (GDP) in the 2010s (see Figure 2).

Figure 2: Flow of inward FDI in Australia, 1970-2018 (Source: UNCTADStat 2020)

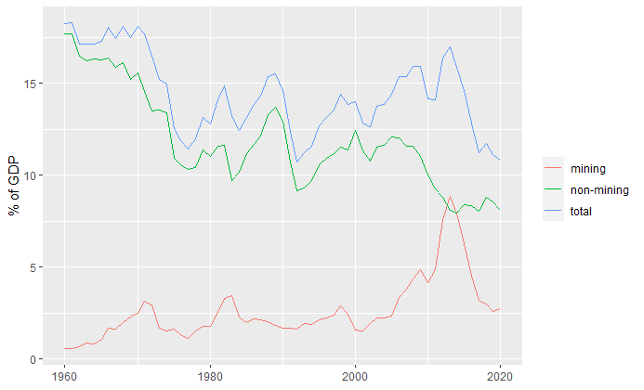

Much of the increase in investment is likely due to the mining and resources boom. Non-mining investment has been declining since the 1960s, while mining investment has increased significantly, particularly during the main period of the mining boom, around 2001-2013 (See Figure 3).

Figure 3: Business investment in Australia (% of GDP), 1960 to 2020 (Sources: ABS 2020a, 2020b)

This has been reflected in Australia’s industry composition over time. Australia’s industry structure has become increasingly focused on mining as well as financial services from 2003 to 2019, with mining more than doubling its share of total gross value added in that period, from 5 per cent to 12 per cent. These two industries are highly profitable and collect particular location-specific rents, and therefore they may be less sensitive to changes in the corporate tax rate. Further, in the case of banks, many shareholders are domestic and they benefit from the imputation system. For them, the corporate tax rate is somewhat irrelevant.

Thus, the aggregate FDI statistics do not tell the whole story. Foreign interests appear largely not to be investing in Australia with any tax favourability benefits in mind, but instead they are concentrating on parts of the economy which are already highly profitable, regardless of tax implications. Further, a large portion of FDI actually comes out of retained earnings of foreign shareholders in Australian-based mining companies. When we look at the non-mining sector, we see a much less positive view of investment and these poor outcomes are, at least in part, attributable to high corporate tax rates. It is then not surprising that Australia lags behind comparable countries in terms of measures of innovation and technology and its propagation through the economy as a result of FDI.

Pulling together our descriptive analysis of foreign investment and industry structure in Australia and the above-mentioned international empirical evidence, we can draw the following lessons for Australia:

- A lower statutory corporate tax rate in Australia would lead to increased investment in Australia and to overseas firms relocating in Australia. Increased investment will happen through a variety of channels including overseas firms located in Australia choosing to retain and re-invest earnings rather than taking earnings out of Australia.

- The high statutory corporate tax rate deters firms from locating in Australia.

- Not lowering the corporate tax rate will likely lead to existing firms in Australia investing outside of Australia rather than in their Australia operations.

- The push factor for companies to leave Australia and investment to leave Australia grows as the gap between Australia’s corporate tax rate and those of its neighbours increases. This is of concern for Australia as the gap between its corporate tax rate and that of its peers has grown over the last 30 years.

- Despite its high corporate tax rate, Australia continues to attract large amounts of foreign investment. This investment, however, is increasingly volatile and is concentrated in a small number of highly profitable sectors. Much of it is due to the mining and resources boom.

Options for reform

Lowering the statutory corporate tax rate is one option for corporate tax reform in Australia. There are also alternative policy options if one were to think more broadly about reform of the corporate tax system.

There are clear benefits and some costs to reducing the statutory corporate rate. This reform does not address deeper problems with the overall system such as the negative impact which corporate taxation has on marginal investment and the bias which favours debt over equity investment under the current system. While Australia should consider cutting the corporate rate, it should also consider more comprehensive reforms.

Of these, the Allowance for Corporate Equity (ACE) is promising, offering several advantages. It is easy to implement as a simple, additional deduction in the current system, and other countries have successfully introduced an ACE. The ACE also allows for moving away from taxing all corporate profits to only taxing economic rents and has the advantage of encouraging investment at the margin by removing the tax rate from the consideration of whether or not a firm should invest.

This article is based on: Rose, T, Sinning, M & Breunig, R, How do statutory and effective corporate tax rates affect location decisions of firms and a country’s industry structure?, Report for the Business Council of Australia, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australia National University.

A more detailed discussion of alternative corporate tax reform options will be available in two forthcoming TTPI reports, Corporate income taxation in Australia: Theory, current practice and future policy directions (2021) and Design considerations for an allowance for corporate equity for Australia (2021).

Hi all, very interesting! (And not that surprising). You don’t mention tax planning at all. If it is the case that both Australian and foreign owned MNEs are able to tax plan so that profits are at least partly located in low tax jurisdictions around the world, and base eroding payments are made through interest deductions etc offshore, the relatively high corporate tax rate may not matter – that is, the real investment stays in Australia precisely because a lower global tax rate is achieved through the tax planning. If we close loopholes for tax planning or make it harder: The pressure to shift real investment away from Australia to a lower taxed jurisdiction will increase. Of course, for mining, not so easy – but even more pressure applies for other sectors.

Further to Miranda’s point, tax planning affects a company’s effective tax rate. In theory the marginal effective rate determines how corporate tax affects investment, though that is only one of the moving parts in tax policy. There is an interesting discussion in a recent US CRS paper in the context of the TCJA and President Biden’s tax plan (https://crsreports.congress.gov/product/pdf/R/R45186).

Any increase in investment from dropping the statutory rate would be unlikely to recoup lost revenue, particularly given that the level of mining investment is unlikely to be much affected. So the broader policy discussion should include (in the event of a lower statutory rate) items such as:

– Taxation to pick up lost corporate tax revenue in relation to location-specific economic rents, such as a MRRT (nothing controversial here …)

– Taxing franked dividends derived by non-residents to some extent (the present approach is justified by a relatively high corporate rate: arguments for dropping the corporate rate don’t imply that we should drop the combined entity+shareholder rate).

Before using BEPS reforms to justify a reduction of our corporate rate, we would need a high level of confidence that they will in fact reduce the gap between statutory and effective corporate tax rates. (International factors are not the only ones which affect that gap, but that is a different discussion.)

Unfortunately, this article assumes that overseas evidence of the effects of tax rates on investment are equally applicable to Australia with its franking credit system. Since essentially no Australian taxpayer pays corporate tax, the effects are quite different, as I showed in my December 2019 article in the Economic Record. The authors hint at the possibility that the absence of corporate tax for Australian investors has contributed to the high level of investment in banking and elsewhere. Since I show that franking credits are fully priced in Australia, this shifts the marginal investor from being foreign, in many instances, to being domestic. A Congressional 2012 study showed that US investors into Australia pay one of the lowest rates, effectively about 10%. The study also fails to mention that the massive Trump tax reduction from 35% to 21% has not so far raised investment in the US to any significant extent.